Question

Utease Corporation has several production plants nationwide. A newly opened plant in Dubuque produces and sells one product. The plant is treated, for responsibility accounting

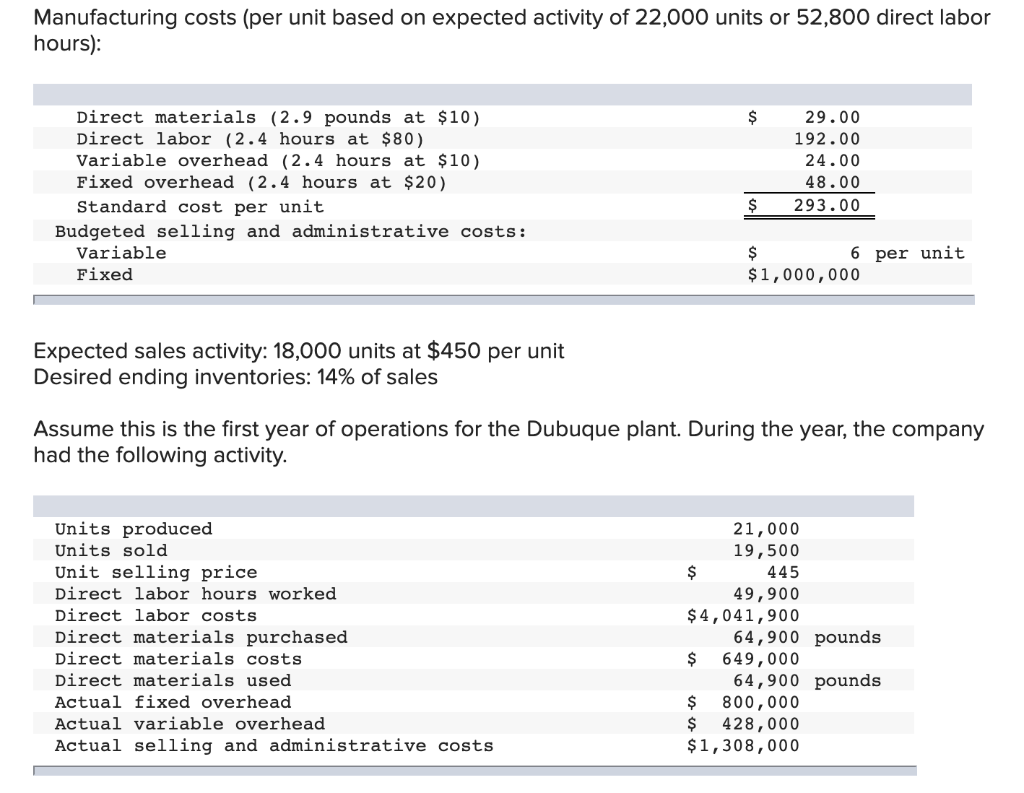

Utease Corporation has several production plants nationwide. A newly opened plant in Dubuque produces and sells one product. The plant is treated, for responsibility accounting purposes, as a profit center. The unit standard costs for a production unit, with overhead applied based on direct labor hours, are as follows.

Manufacturing costs (per unit based on expected activity of 22,000 units or 52,800 direct labor hours):

e-1. Find the total over- or underapplied (both fixed and variable) overhead.

e-2. Would cost of goods sold be a larger or smaller expense item after the adjustment for over- or underapplied overhead?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started