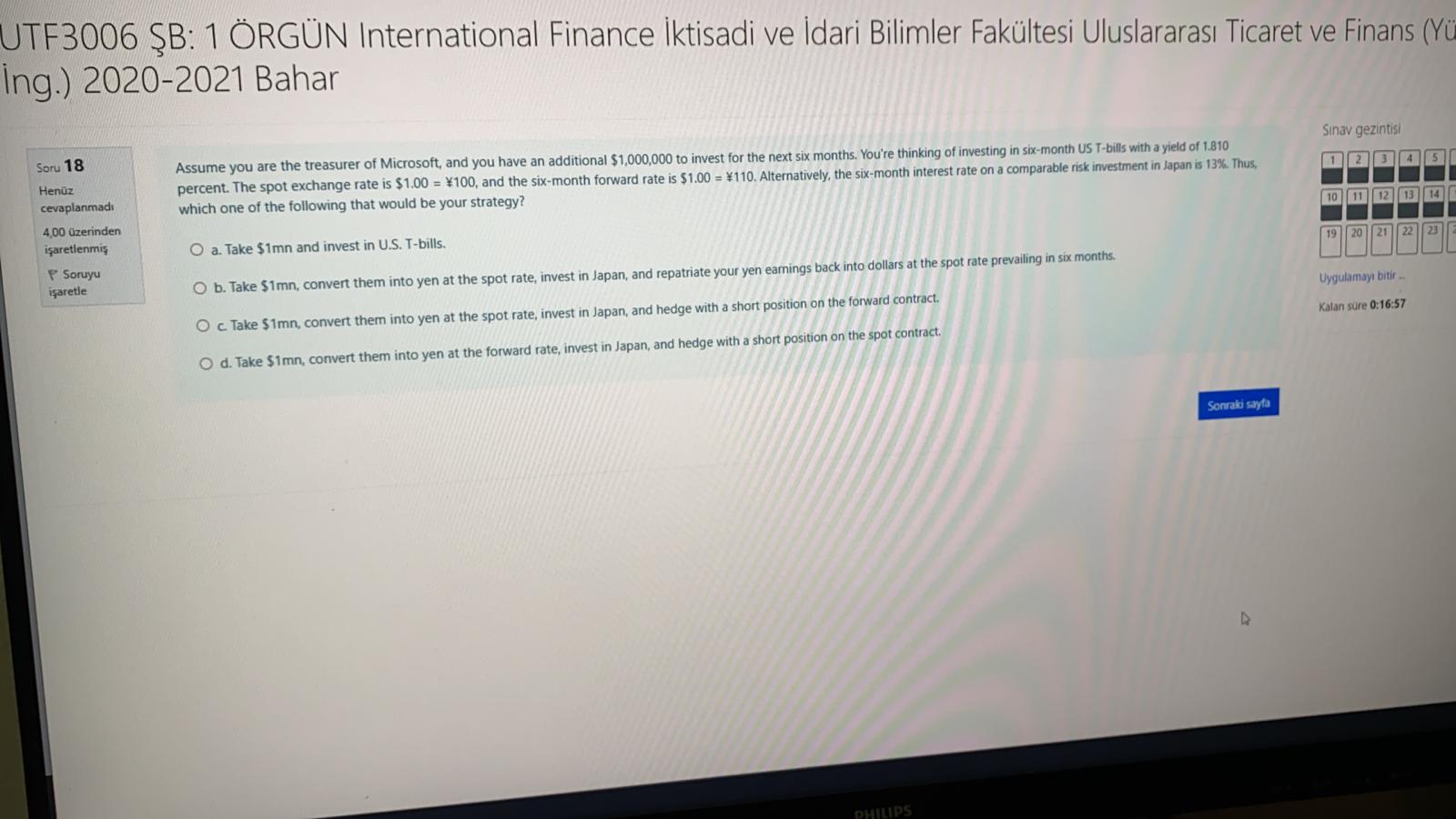

UTF3006 B: 1 RGN International Finance ktisadi ve dari Bilimler Fakltesi Uluslararas Ticaret ve Finans (Y Ing.) 2020-2021 Bahar Sinav gezintisi 1 | 2 | 3 | 45 Soru 18 Assume you are the treasurer of Microsoft, and you have an additional $1,000,000 to invest for the next six months. You're thinking of investing in six-month US T-bills with a yield of 1.810 percent. The spot exchange rate is $1.00 = $100, and the six-month forward rate is $1.00 = $110. Alternatively, the six-month interest rate on a comparable risk investment in Japan is 13%. Thus, which one of the following that would be your strategy? 10 11 12 13 14 Henz cevaplanmadi 400 zerinden iaretlenmi Soruyu iaretle 19 20 21 22 23 O a. Take $1mn and invest in U.S. T-bills. Uygulamay bitir O b. Take $1mn, convert them into yen at the spot rate, invest in Japan, and repatriate your yen earnings back into dollars at the spot rate prevailing in six months. Kalan sure 0:16:57 O c Take $1mn, convert them into yen at the spot rate, invest in Japan, and hedge with a short position on the forward contract. O d. Take $1mn, convert them into yen at the forward rate, invest in Japan, and hedge with a short position on the spot contract. Sonraki sayfa PHILIPS UTF3006 B: 1 RGN International Finance ktisadi ve dari Bilimler Fakltesi Uluslararas Ticaret ve Finans (Y Ing.) 2020-2021 Bahar Sinav gezintisi 1 | 2 | 3 | 45 Soru 18 Assume you are the treasurer of Microsoft, and you have an additional $1,000,000 to invest for the next six months. You're thinking of investing in six-month US T-bills with a yield of 1.810 percent. The spot exchange rate is $1.00 = $100, and the six-month forward rate is $1.00 = $110. Alternatively, the six-month interest rate on a comparable risk investment in Japan is 13%. Thus, which one of the following that would be your strategy? 10 11 12 13 14 Henz cevaplanmadi 400 zerinden iaretlenmi Soruyu iaretle 19 20 21 22 23 O a. Take $1mn and invest in U.S. T-bills. Uygulamay bitir O b. Take $1mn, convert them into yen at the spot rate, invest in Japan, and repatriate your yen earnings back into dollars at the spot rate prevailing in six months. Kalan sure 0:16:57 O c Take $1mn, convert them into yen at the spot rate, invest in Japan, and hedge with a short position on the forward contract. O d. Take $1mn, convert them into yen at the forward rate, invest in Japan, and hedge with a short position on the spot contract. Sonraki sayfa PHILIPS