Question

Utilizing the Excel Spreadsheet provided , complete the Horizontal Financial Statement and verify the accuracy of the Financial Statements. There is a tab for each

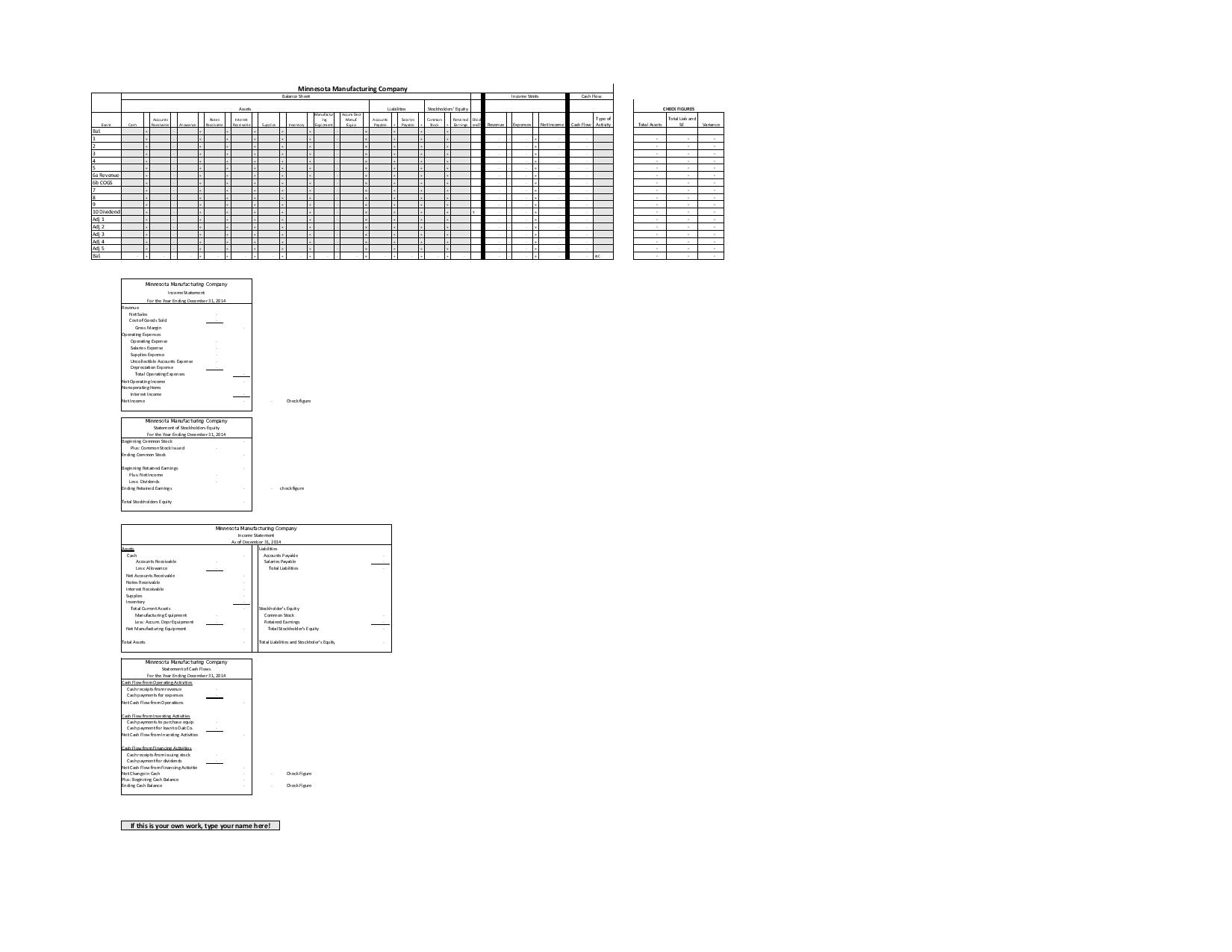

Utilizing the Excel Spreadsheet provided, complete the Horizontal Financial Statement and verify the accuracy of the Financial Statements. There is a tab for each year on the spreadsheet. Each tab includes a Horizontal Financial Statement, an Income Statement, a Statement of Stockholders Equity, a Balance Sheet and a Cash Flow Statement. Assume no taxes are paid.

I have protected the worksheet so you can only enter information in the gray highlighted cells. I have created formulas in the Income Statement and Cash Flow columns so that it automatically puts the correct numbers in the correct columns. Please note that your dividend entry MUST be entered on the line noted dividend. I have added 2 types of check figures for you too. The first is on the right of the Horizontal Financial Statements the variance should be 0.00. These check figures will help you determine if your assets equal your liabilities + S/E. The second set of check figures are next to the financial statements. Make sure your numbers match the check figures. Retained Earnings at the end of 2015 should be $7,740.

You must do your own work please do not copy your fellow students work. You will attest that you completed this work on your own by typing your name in both worksheets in cell C108.

Points: 50 points

Due: Provide a completed and signed Excel Spreadsheet with a file name as follows:

YourLastName_ACC200CompAcctProblem.xlsx

Submit your file through Canvas by Fri. May 6, 2016 at 11:59pm

Minnesota Manufacturing Company was formed on January 1, 2014.

Events Affecting the 2014 Accounting Period:

Acquired cash of $107,000 from the issue of common stock.

Purchased $4,600 of supplies on account.

Purchased a machine press that cost $52,000 cash.

Purchased $98,200 of inventory on account.

Paid $2,500 cash to settle some of the accounts payable created in Event 2.

Sold inventory that cost $78,900 for $141,700. Sales were made on account.

On Oct. 1, Minnesota Manufacturing loaned $7,000 to Oak Co. The note had an 8% interest rate and a one-year term.

Collected $78,450 cash from accounts receivable.

Paid $38,000 cash for other operating expenses.

Paid a cash dividend of $4,200.

Information for Adjusting Entries

Adj. 1.Recognized Salaries of $4,900 on December 31, 2014.

Adj. 2.Had $1,900 of supplies on hand at the end of the accounting period.

Adj. 3.Record $1,320 of Uncollectible Accounts Expense.

Adj. 4.Record the accrued interest for Oak Co. loan as of December 31, 2014.

Adj. 5.Adjust the records to reflect the use of the machine press for 2014. The machine, purchased on January 1, 2014, has an expected useful life of 10 years and an estimated salvage value of $2,000. Use straight-line depreciation.

Events Affecting the 2015 Accounting Period:

Acquired and additional cash of $37,000 from the issue of common stock.

Paid $4,900 cash to settle the salaries payable obligation.

Purchased $50,100 of inventory on account.

On March 1, paid $8,700 cash in advance for a one-year lease on a new facility.

Received $9,900 cash in advance from Pine Co. for services to be performed in the future.

Purchased $2,700 of supplies on account during the year.

Sold inventory that cost $52,450 for $99,100. Sales were made on account.

Oak Company paid off their loan, including the interest, on September 30, 2015. (See pg 174-175 in the text for how to record this).

Paid $28,500 cash for other operating expenses.

Collected $120,000 cash from accounts receivable.

Paid a cash dividend of $1,500.

Paid $100,000 cash for accounts payable.

Information for Adjusting Entries

Adj. 1.Recognized Salaries of $3,500 on December 31, 2015.

Adj. 2.Had $900 of supplies on hand at the end of the accounting period.

Adj. 3.Record the lease accrual for the new facility (See Event 4 above).

Adj. 4.On December 31, 2015, 1/3 of the services for Pine Co. have been performed.

Adj. 5.Adjust the records to reflect the use of the machine press for 2015. The machine, purchased on January 1, 2014, has an expected useful life of 10 years and an estimated salvage value of $2,000. Use straight-line depreciation.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started