Answered step by step

Verified Expert Solution

Question

1 Approved Answer

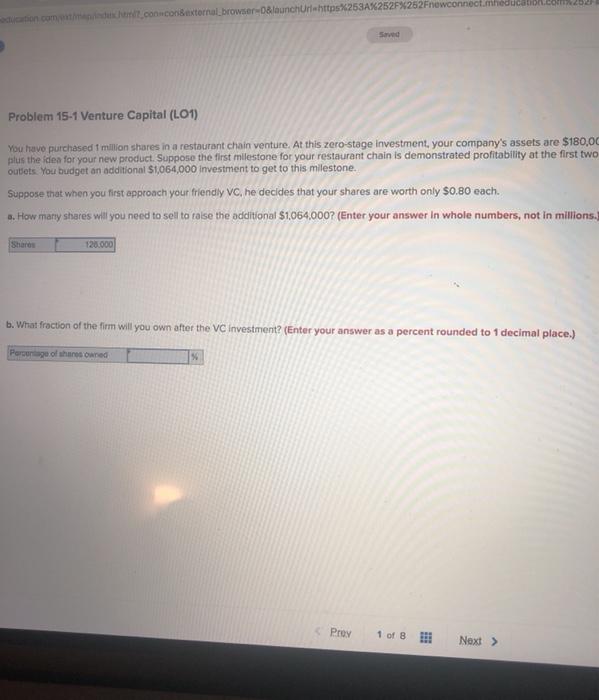

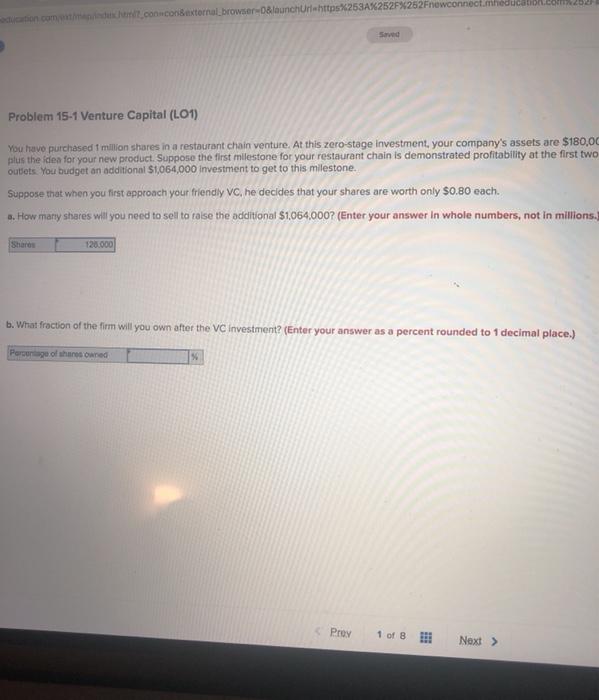

ution commande con conexternal browser launchurahttps%253A%252F%252Fnewconnect.meduca Sowed Problem 15-1 Venture Capital (1.01) You have purchased million shares in a restaurant chain venture. At this zero-stage

ution commande con conexternal browser launchurahttps%253A%252F%252Fnewconnect.meduca Sowed Problem 15-1 Venture Capital (1.01) You have purchased million shares in a restaurant chain venture. At this zero-stage investment, your company's assets are $180,00 palus the idea for your new product. Suppose the first milestone for your restaurant chain is demonstrated profitability at the first two outlets. You budget an additional $1,064,000 investment to get to this milestone. Suppose that when you first approach your friendly vo, he decides that your shares are worth only $0.80 each. .. How many shares will you need to sell to talse the additional $1,064,000? (Enter your answer in whole numbers, not in millions. Share 120.000 b. What fraction of the firm will you own after the VC investment? (Enter your answer as a percent rounded to 1 decimal place.) Personage of shares owned Proy 1 of 8 Next > ution commande con conexternal browser launchurahttps%253A%252F%252Fnewconnect.meduca Sowed Problem 15-1 Venture Capital (1.01) You have purchased million shares in a restaurant chain venture. At this zero-stage investment, your company's assets are $180,00 palus the idea for your new product. Suppose the first milestone for your restaurant chain is demonstrated profitability at the first two outlets. You budget an additional $1,064,000 investment to get to this milestone. Suppose that when you first approach your friendly vo, he decides that your shares are worth only $0.80 each. .. How many shares will you need to sell to talse the additional $1,064,000? (Enter your answer in whole numbers, not in millions. Share 120.000 b. What fraction of the firm will you own after the VC investment? (Enter your answer as a percent rounded to 1 decimal place.) Personage of shares owned Proy 1 of 8 Next >

ution commande con conexternal browser launchurahttps%253A%252F%252Fnewconnect.meduca Sowed Problem 15-1 Venture Capital (1.01) You have purchased million shares in a restaurant chain venture. At this zero-stage investment, your company's assets are $180,00 palus the idea for your new product. Suppose the first milestone for your restaurant chain is demonstrated profitability at the first two outlets. You budget an additional $1,064,000 investment to get to this milestone. Suppose that when you first approach your friendly vo, he decides that your shares are worth only $0.80 each. .. How many shares will you need to sell to talse the additional $1,064,000? (Enter your answer in whole numbers, not in millions. Share 120.000 b. What fraction of the firm will you own after the VC investment? (Enter your answer as a percent rounded to 1 decimal place.) Personage of shares owned Proy 1 of 8 Next > ution commande con conexternal browser launchurahttps%253A%252F%252Fnewconnect.meduca Sowed Problem 15-1 Venture Capital (1.01) You have purchased million shares in a restaurant chain venture. At this zero-stage investment, your company's assets are $180,00 palus the idea for your new product. Suppose the first milestone for your restaurant chain is demonstrated profitability at the first two outlets. You budget an additional $1,064,000 investment to get to this milestone. Suppose that when you first approach your friendly vo, he decides that your shares are worth only $0.80 each. .. How many shares will you need to sell to talse the additional $1,064,000? (Enter your answer in whole numbers, not in millions. Share 120.000 b. What fraction of the firm will you own after the VC investment? (Enter your answer as a percent rounded to 1 decimal place.) Personage of shares owned Proy 1 of 8 Next >

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started