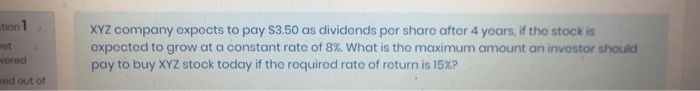

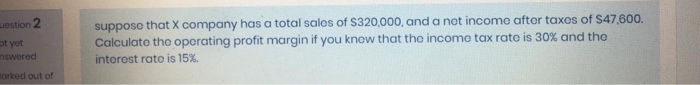

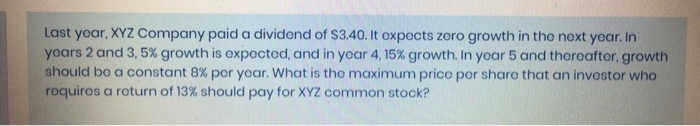

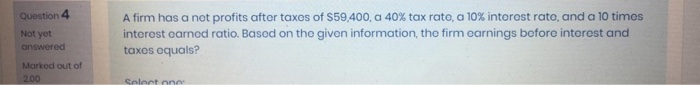

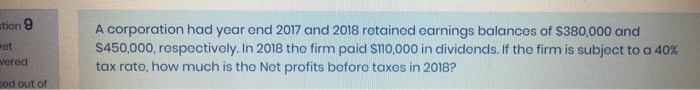

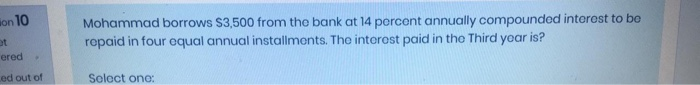

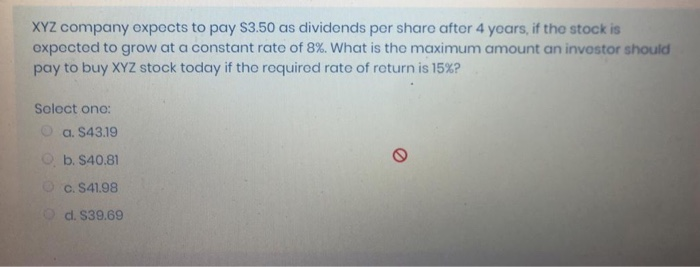

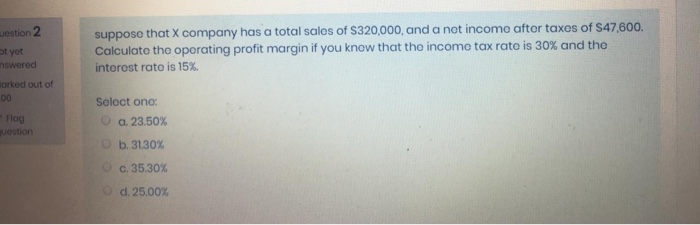

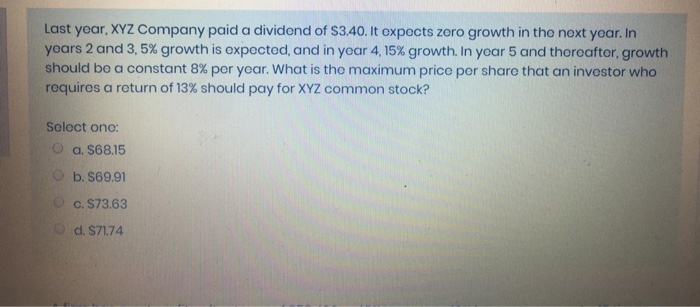

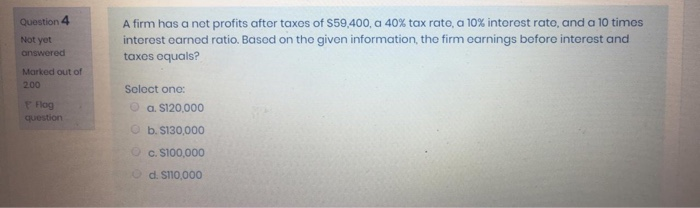

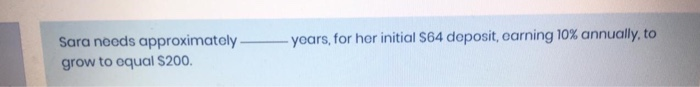

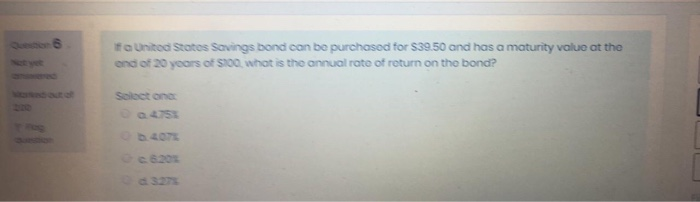

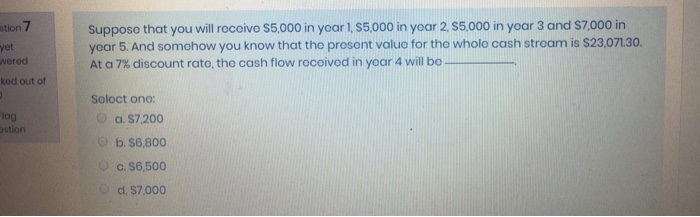

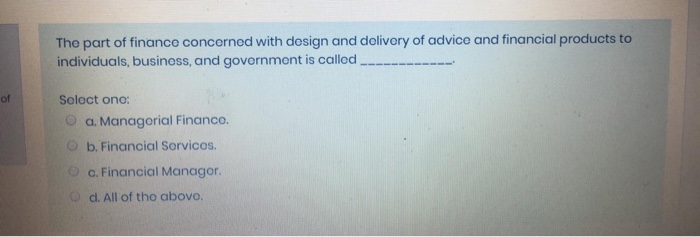

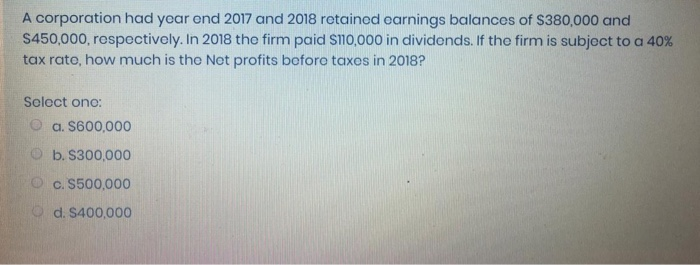

ution1 ot vered XYZ company expects to pay $3.50 as dividends per share after 4 years, if the stock is expected to grow at a constant rate of 8%. What is the maximum amount an investor should pay to buy XYZ stock today if the required rate of return is 15%? Rod out of westion 2 ot yet nswered suppose that X company has a total sales of S320,000, and a net income after taxes of $47,600. Calculate the operating profit margin if you know that the income tax rate is 30% and the interost rate is 15% orked out of Last year, XYZ Company paid a dividend of $3.40. It expects zero growth in the next year. In years 2 and 3,5% growth is expected, and in year 4, 15% growth. In yoar 5 and thereafter, growth should be a constant 8% por yoar. What is the maximum price per share that an investor who requires a return of 13% should pay for XYZ common stock? Question 4 Not yet answered A firm has a not profits after taxes of S59,400, a 40% tax rate, a 10% interest rate, and a 10 times interest earned ratio. Based on the given information, the firm carnings before interest and taxes equals? Marked out of 200 Calent on -years, for her initial $64 deposit, earning 10% annually, to Sara needs approximately grow to equal $200. rot Select one ffa United States Savings bond can be purchased for $39.50 and has a maturity value at the ond of 20 years of $100, what is the annual rate of return on the bond? stion 7 yet wered Suppose that you will receive $5,000 in yoar 1, S5,000 in yoar 2, S5,000 in yoar 3 and $7,000 in year 5. And somehow you know that the prosent value for the whole cash stream is S23,071.30. At a 7% discount rate, the cash flow rocoivod in yoar 4 will be kod out of The part of finance concerned with design and delivery of advice and financial products to individuals, business, and government is called Select one stion 9 ret vered A corporation had year end 2017 and 2018 retained earnings balances of S380,000 and $450,000, respectively. In 2018 the firm paid $110,000 in dividends. If the firm is subject to a 40% tax rato, how much is the Net profits before taxes in 2018? ced out of on 10 Mohammad borrows $3,500 from the bank at 14 percent annually compounded interest to be repaid in four equal annual installments. The interest paid in the Third year is? ot ered ed out of Soloct one: XYZ company expects to pay $3.50 as dividends per share after 4 years, if the stock is expected to grow at a constant rate of 8%. What is the maximum amount an investor should pay to buy XYZ stock today if the required rate of return is 15%? Select one: a. S43.19 b. $40.81 c. S41.98 d. S39.69 westion 2 ot yet nswered suppose that X company has a total sales of $320,000, and a net income after taxes of S47,600. Calculate the operating profit margin if you know that the income tax rate is 30% and the interest rate is 15% orked out of 00 Select one: a. 23.50% Flog question b. 3130% c. 35.30% d. 25.00% Last year, XYZ Company paid a dividend of $3.40. It expects zero growth in the next year. In years 2 and 3,5% growth is expected, and in year 4,15% growth. In year 5 and thereafter, growth should be a constant 8% per year. What is the maximum price per share that an investor who requires a return of 13% should pay for XYZ common stock? Select one: O a. S68.15 b. 569.91 c. S73.63 d. S71.74 Question 4 Not yet answered A firm has a not profits after taxes of $59,400, a 40% tax rato, a 10% interest rate, and a 10 times interest earned ratio. Based on the given information, the firm earnings before interest and taxes equals? Marked out of 200 Select one: a. S120,000 Flag question b. $130,000 c. S100,000 d. S110,000 years, for her initial S64 deposit, earning 10% annually, to Sara needs approximately grow to equal $200 fa United States Savings bond can be purchased for $39.50 and has a maturity value at the end of 20 years of S100what is the annual rate of return on the bond? Soloct on stion 7 yet wered Suppose that you will receive $5,000 in yoar 1, S5,000 in year 2, S5,000 in year 3 and 57,000 in year 5. And somehow you know that the prosent value for the whole cash stream is $23,071.30. At a 7% discount rate, the cash flow roceived in yoar 4 will be ked out of Soloct one: og a. S7200 astion b. 56,800 c. $6,500 d. S7,000 The part of finance concerned with design and delivery of advice and financial products to individuals, business, and government is called of Select one: a. Managerial Financo. Ob Financial Servicos. c. Financial Manager. d. All of the abovo. A corporation had year end 2017 and 2018 retained earnings balances of S380,000 and $450,000, respectively. In 2018 the firm paid $110,000 in dividends. If the firm is subject to a 40% tax rate, how much is the Net profits before taxes in 2018? Select one: a. S600,000 b. S300,000 c. S500,000 d. S400,000 d. $400,000 Mohammad borrows $3,500 from the bank at 14 percent annually compounded interest to be repaid in four equal annual installments. The interest paid in the Third year is