Answered step by step

Verified Expert Solution

Question

1 Approved Answer

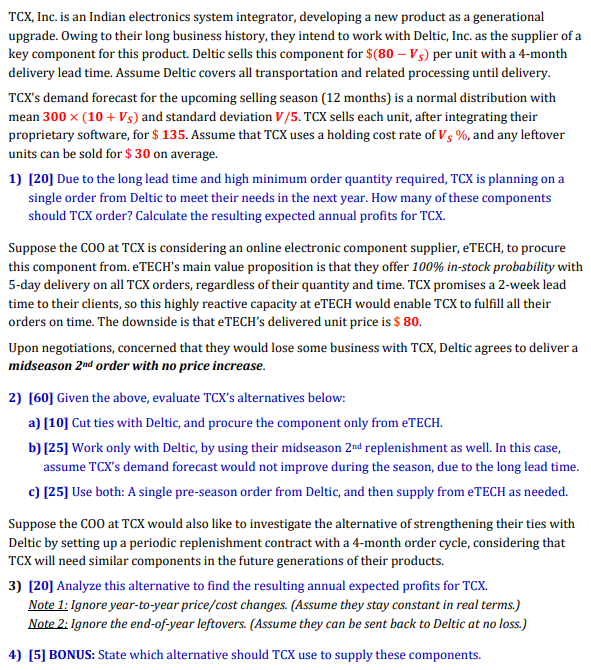

V = 9 7 5 2 Vs = 2 4 TCX , Inc. is an Indian electronics system integrator, developing a new product as a

V VsTCX Inc. is an Indian electronics system integrator, developing a new product as a generational

upgrade. Owing to their long business history, they intend to work with Deltic, Inc. as the supplier of a

key component for this product. Deltic sells this component for $ per unit with a month

delivery lead time. Assume Deltic covers all transportation and related processing until delivery.

TCXs demand forecast for the upcoming selling season months is a normal distribution with

mean and standard deviation TCX sells each unit, after integrating their

proprietary software, for $ Assume that TCX uses a holding cost rate of and any leftover

units can be sold for $ on average.

Due to the long lead time and high minimum order quantity required, TCX is planning on a

single order from Deltic to meet their needs in the next year. How many of these components

should TCX order? Calculate the resulting expected annual profits for TCX

Suppose the COO at TCX is considering an online electronic component supplier, eTECH, to procure

this component from. eTECH's main value proposition is that they offer instock probability with

day delivery on all TCX orders, regardless of their quantity and time. TCX promises a week lead

time to their clients, so this highly reactive capacity at eTECH would enable TCX to fulfill all their

orders on time. The downside is that eTECH's delivered unit price is $

Upon negotiations, concerned that they would lose some business with TCX Deltic agrees to deliver a

midseason order with no price increase.

Given the above, evaluate TCXs alternatives below:

a Cut ties with Deltic, and procure the component only from eTECH.

b Work only with Deltic, by using their midseason replenishment as well. In this case,

assume TCXs demand forecast would not improve during the season, due to the long lead time.

c Use both: A single preseason order from Deltic, and then supply from eTECH as needed.

Suppose the at TCX would also like to investigate the alternative of strengthening their ties with

Deltic by setting up a periodic replenishment contract with a month order cycle, considering that

TCX will need similar components in the future generations of their products.

Analyze this alternative to find the resulting annual expected profits for TCX

Note : Ignore yeartoyear pricecost changes. Assume they stay constant in real terms.

Note : Ignore the endofyear leftovers. Assume they can be sent back to Deltic at no loss.

BONUS: State which alternative should TCX use to supply these components.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started