Answered step by step

Verified Expert Solution

Question

1 Approved Answer

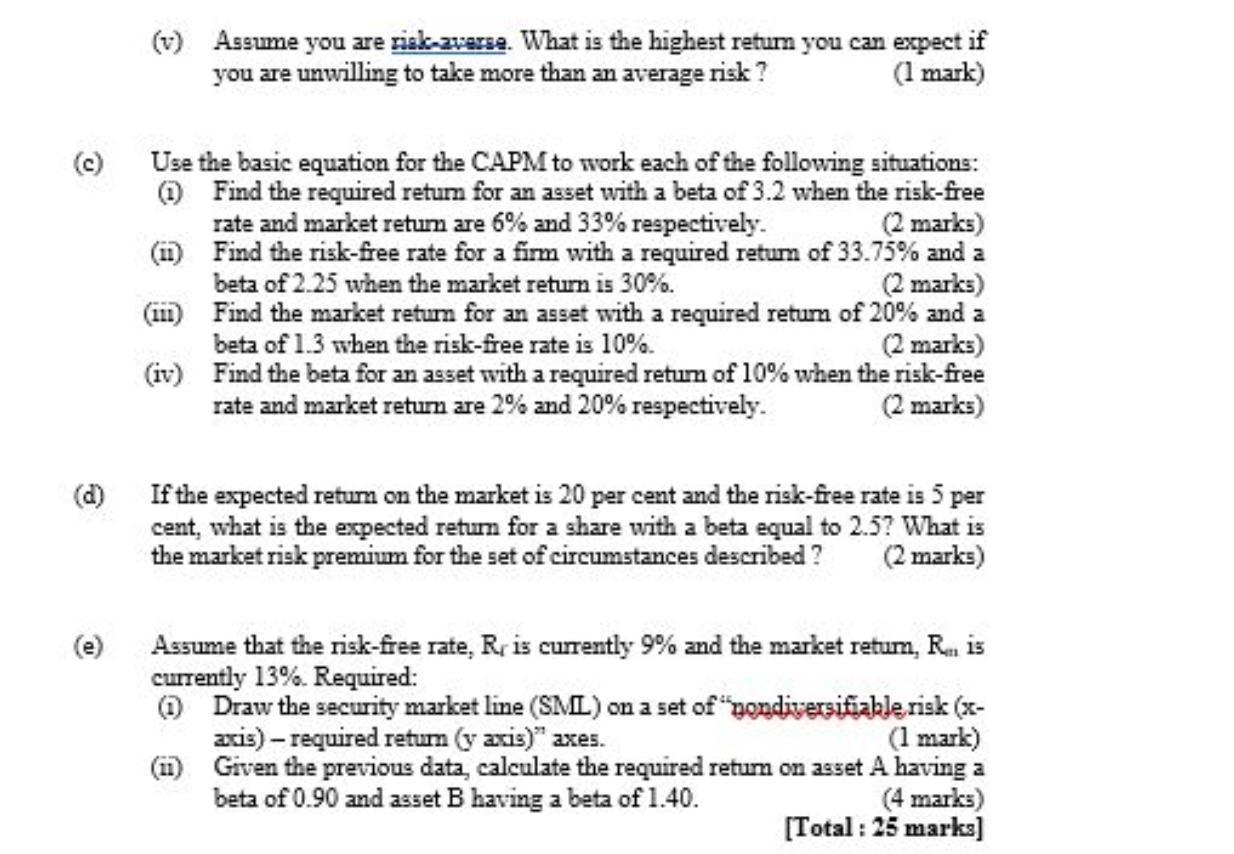

(v) Assume you are risk-averse. What is the highest return you can expect if you are unwilling to take more than an average risk?

(v) Assume you are risk-averse. What is the highest return you can expect if you are unwilling to take more than an average risk? (1 mark) Use the basic equation for the CAPM to work each of the following situations: (1) Find the required return for an asset with a beta of 3.2 when the risk-free rate and market return are 6% and 33% respectively. (2 marks) (ii) Find the risk-free rate for a firm with a required return of 33.75% and a beta of 2.25 when the market return is 30%. (2 marks) (iii) Find the market return for an asset with a required return of 20% and a beta of 1.3 when the risk-free rate is 10%. (2 marks) (iv) Find the beta for an asset with a required return of 10% when the risk-free rate and market return are 2% and 20% respectively. (2 marks) If the expected return on the market is 20 per cent and the risk-free rate is 5 per cent, what is the expected return for a share with a beta equal to 2.5? What is the market risk premium for the set of circumstances described? (2 marks) Assume that the risk-free rate, R, is currently 9% and the market return, R.,, is currently 13%. Required: (1) Draw the security market line (SML) on a set of "pondiversifiable risk (x- axis)-required return (y axis)" axes. (1 mark) (ii) Given the previous data, calculate the required return on asset A having a beta of 0.90 and asset B having a beta of 1.40. (4 marks) [Total: 25 marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started