Answered step by step

Verified Expert Solution

Question

1 Approved Answer

v) Camping Plc is a company which operates in the leisure industry and owns a number of fitness centres across the UK. The company

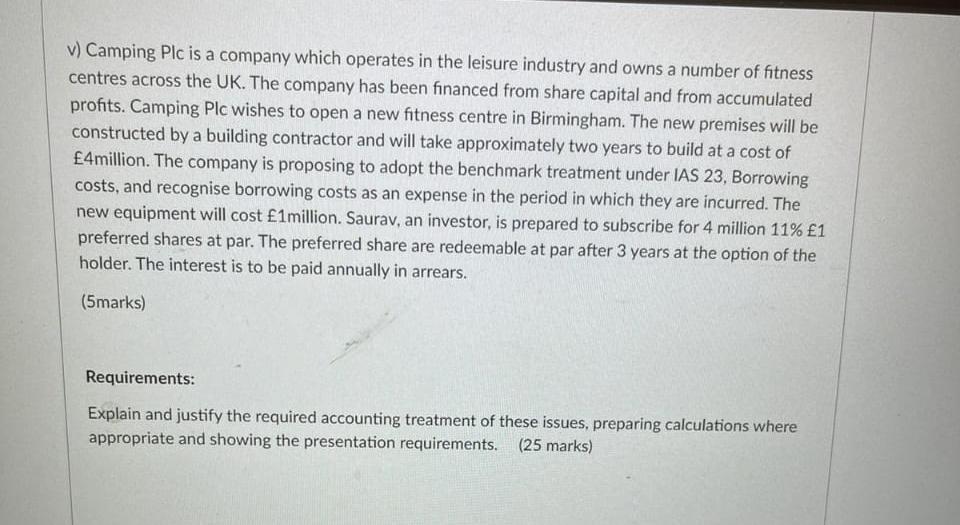

v) Camping Plc is a company which operates in the leisure industry and owns a number of fitness centres across the UK. The company has been financed from share capital and from accumulated profits. Camping Plc wishes to open a new fitness centre in Birmingham. The new premises will be constructed by a building contractor and will take approximately two years to build at a cost of 4million. The company is proposing to adopt the benchmark treatment under IAS 23, Borrowing costs, and recognise borrowing costs as an expense in the period in which they are incurred. The new equipment will cost 1million. Saurav, an investor, is prepared to subscribe for 4 million 11% 1 preferred shares at par. The preferred share are redeemable at par after 3 years at the option of the holder. The interest is to be paid annually in arrears. (5marks) Requirements: Explain and justify the required accounting treatment of these issues, preparing calculations where appropriate and showing the presentation requirements. (25 marks)

Step by Step Solution

★★★★★

3.32 Rating (176 Votes )

There are 3 Steps involved in it

Step: 1

As per IAS 23 Borrowing Costs incurred on the acquisition construction production of a qualifying as...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started