Answered step by step

Verified Expert Solution

Question

1 Approved Answer

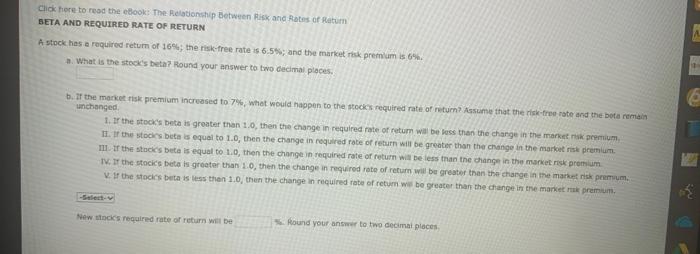

v Click hore to reod the esook: The Relationship Between Risk and Rotes of Returin EETA AND REQUIRED YATE OF RETURN A stock has a

v

Click hore to reod the esook: The Relationship Between Risk and Rotes of Returin EETA AND REQUIRED YATE OF RETURN A stock has a required return of 16%; the risk-free rate is 6:5%; and the market rick premium is 6%. 7. What is the stock's beta? Round your answer to two becimal places. b. If the market fisk premium increased to 7%, whet would happen to the stockn required rate of ritum? Assume that the risk-free rate and the beta remain Hinchanged. 1. If the riteciss beta is groater than 1.0, then the enange in required rate of retum wal be loss than the charige in the market nak premium. II. If the stockin beta is equel to 1.0, then the change in required rate of return will be greater than the change in the market risk premium. 111. If the stackes beta is equal to t.0, then the chnnge in required rate of return will be less tran the change in the manket risk promium V. If the stocics berta is lees then 1.0, then the change in required rate of return will bo greater than the change in ene market ruke premins. New thicics required rate of retirn wit be *h. Round your ansmw to two decimal places

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started