Answered step by step

Verified Expert Solution

Question

1 Approved Answer

V. Davis Company's June bank reconciliation includes the following data: a. June 30 end-of-month bank statement balance: $7,000. b. June 30 end-of-month Cash account

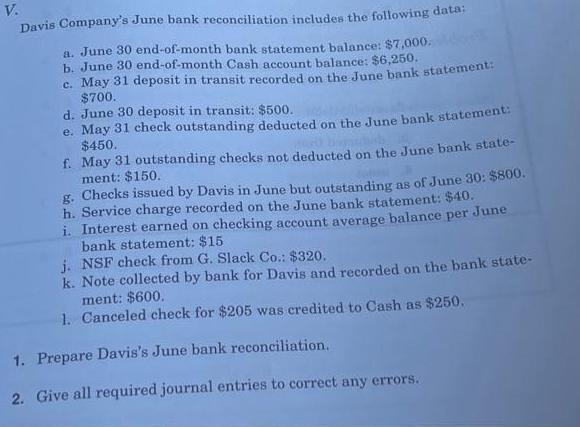

V. Davis Company's June bank reconciliation includes the following data: a. June 30 end-of-month bank statement balance: $7,000. b. June 30 end-of-month Cash account balance: $6,250. c. May 31 deposit in transit recorded on the June bank statement: $700. d. June 30 deposit in transit: $500. e. May 31 check outstanding deducted on the June bank statement: $450. f. May 31 outstanding checks not deducted on the June bank state- ment: $150. g. Checks issued by Davis in June but outstanding as of June 30: $800. h. Service charge recorded on the June bank statement: $40. i. Interest earned on checking account average balance per June bank statement: $15. j. NSF check from G. Slack Co.: $320. k. Note collected by bank for Davis and recorded on the bank state- ment: $600. 1. Canceled check for $205 was credited to Cash as $250. 1. Prepare Davis's June bank reconciliation. 2. Give all required journal entries to correct any errors..

Step by Step Solution

★★★★★

3.57 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 June bank reconciliation for Davis Company Items in Bank StatementAmount Items in Companys BooksAm...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started