Answered step by step

Verified Expert Solution

Question

1 Approved Answer

V Energy Tech Ltd. has just had a very profitable year as rising energy costs have driven a rapid increase in sales of its solar

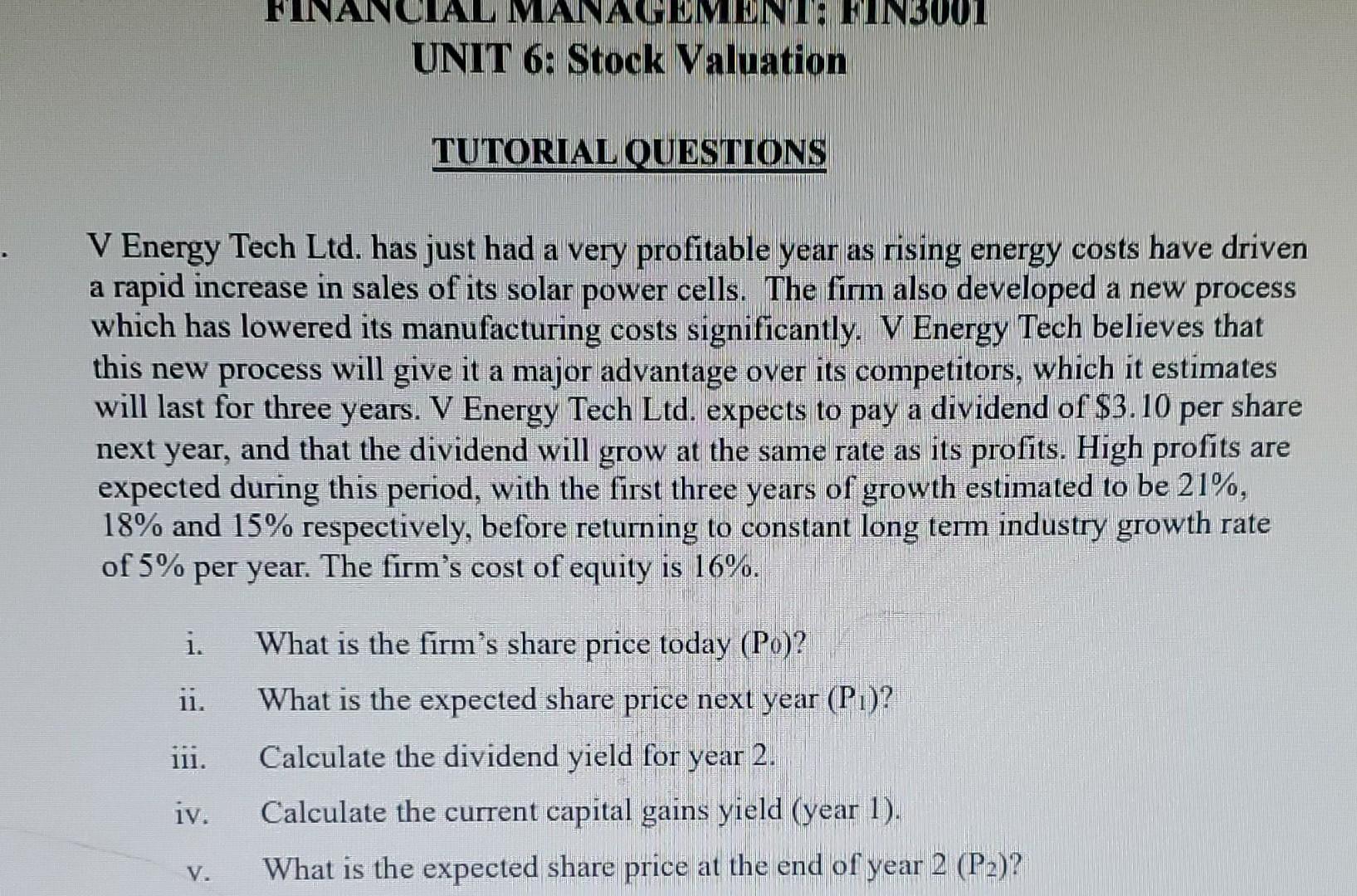

V Energy Tech Ltd. has just had a very profitable year as rising energy costs have driven a rapid increase in sales of its solar power cells. The firm also developed a new process which has lowered its manufacturing costs significantly. V Energy Tech believes that this new process will give it a major advantage over its competitors, which it estimates will last for three years. V Energy Tech Ltd. expects to pay a dividend of $3.10 per share next year, and that the dividend will grow at the same rate as its profits. High profits are expected during this period, with the first three years of growth estimated to be 21%, 18% and 15% respectively, before returning to constant long term industry growth rate of 5% per year. The firm's cost of equity is 16%. i. What is the firm's share price today (P0) ? ii. What is the expected share price next year (P1) ? iii. Calculate the dividend yield for year 2 . iv. Calculate the current capital gains yield (year 1). v. What is the expected share price at the end of year 2(P2)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started