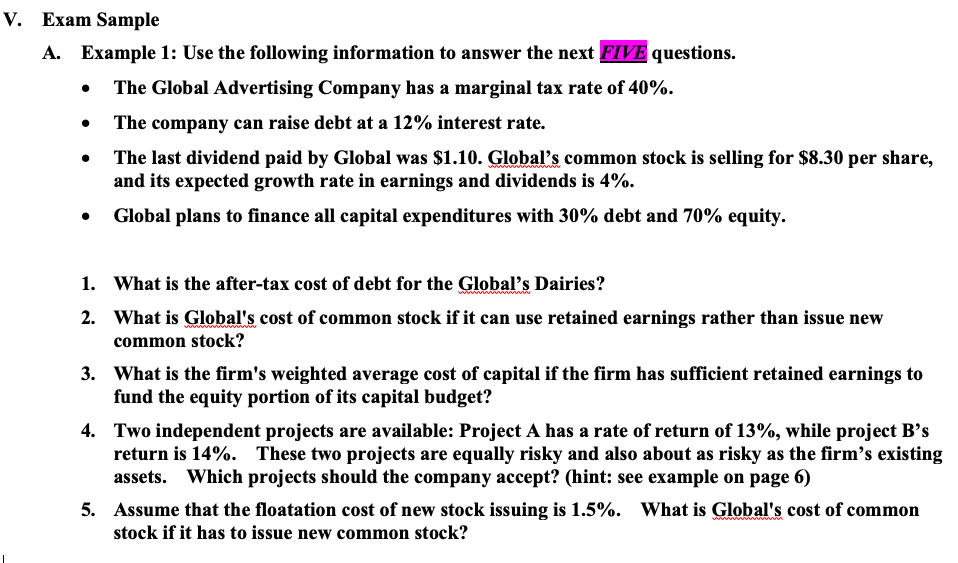

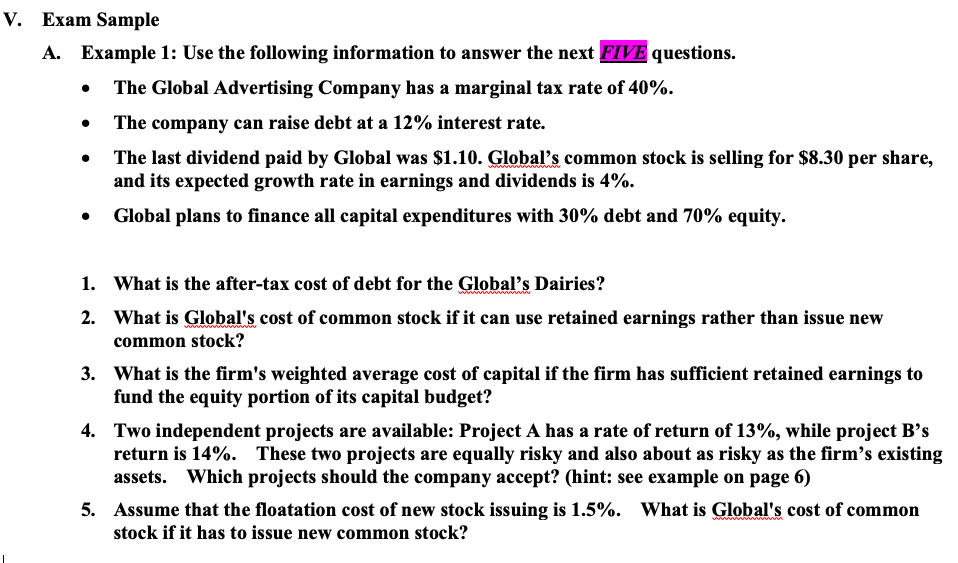

V. Exam Sample A. Example 1: Use the following information to answer the next FIVE questions. The Global Advertising Company has a marginal tax rate of 40%. The company can raise debt at a 12% interest rate. The last dividend paid by Global was $1.10. Global's common stock is selling for $8.30 per share, and its expected growth rate in earnings and dividends is 4%. Global plans to finance all capital expenditures with 30% debt and 70% equity. 1. What is the after-tax cost of debt for the Global's Dairies? 2. What is Global's cost of common stock if it can use retained earnings rather than issue new common stock? 3. What is the firm's weighted average cost of capital if the firm has sufficient retained earnings to fund the equity portion of its capital budget? 4. Two independent projects are available: Project A has a rate of return of 13%, while project B's return is 14%. These two projects are equally risky and also about as risky as the firm's existing assets. Which projects should the company accept? (hint: see example on page 6) 5. Assume that the floatation cost of new stock issuing is 1.5%. What is Global's cost of common stock if it has to issue new common stock? V. Exam Sample A. Example 1: Use the following information to answer the next FIVE questions. The Global Advertising Company has a marginal tax rate of 40%. The company can raise debt at a 12% interest rate. The last dividend paid by Global was $1.10. Global's common stock is selling for $8.30 per share, and its expected growth rate in earnings and dividends is 4%. Global plans to finance all capital expenditures with 30% debt and 70% equity. 1. What is the after-tax cost of debt for the Global's Dairies? 2. What is Global's cost of common stock if it can use retained earnings rather than issue new common stock? 3. What is the firm's weighted average cost of capital if the firm has sufficient retained earnings to fund the equity portion of its capital budget? 4. Two independent projects are available: Project A has a rate of return of 13%, while project B's return is 14%. These two projects are equally risky and also about as risky as the firm's existing assets. Which projects should the company accept? (hint: see example on page 6) 5. Assume that the floatation cost of new stock issuing is 1.5%. What is Global's cost of common stock if it has to issue new common stock