Answered step by step

Verified Expert Solution

Question

1 Approved Answer

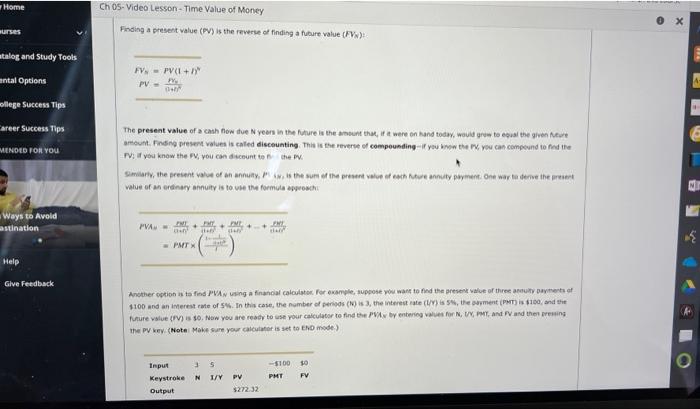

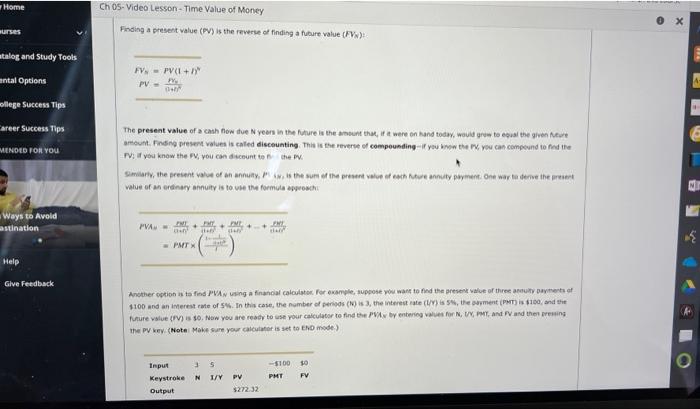

v Finding a present value (FV) is the reverse of finding a fubure value (FVN) : FVs=PV(1+h)PV=1+D2WV value of an erdinsty annuity is to vie

v

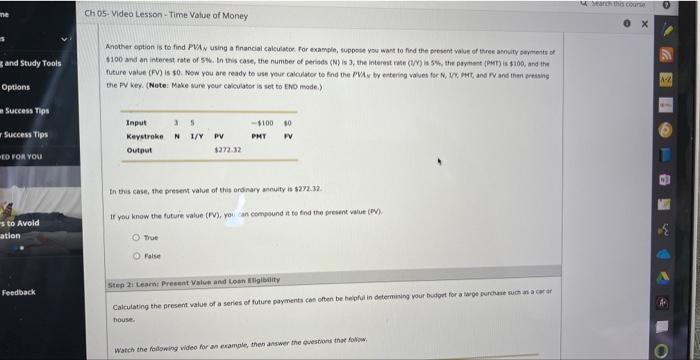

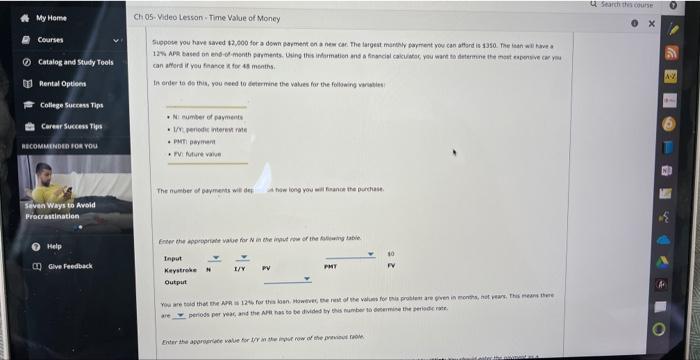

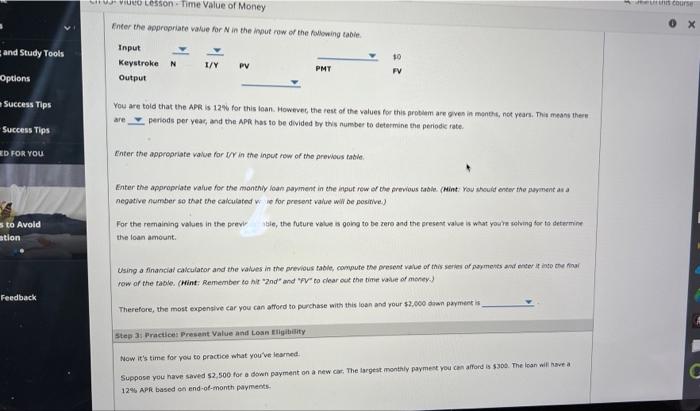

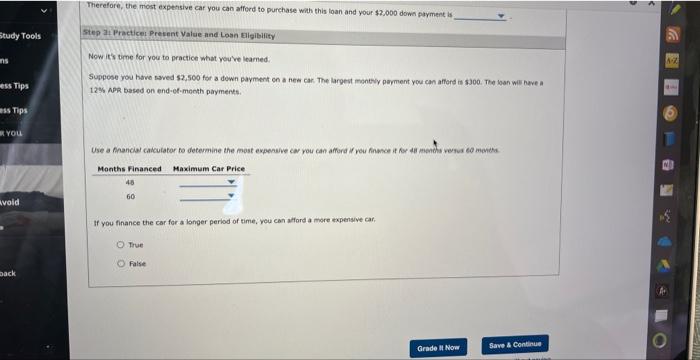

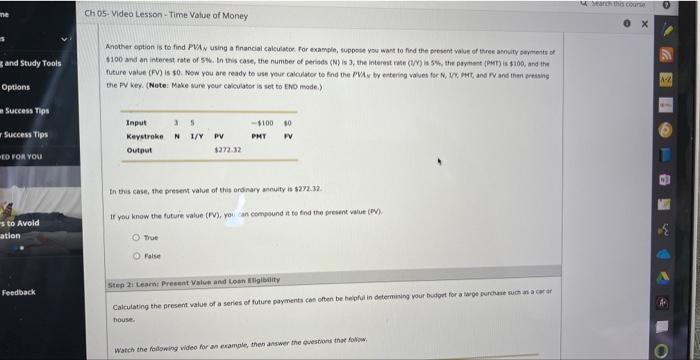

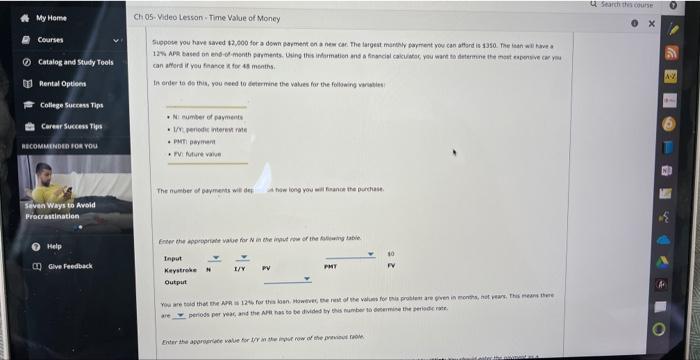

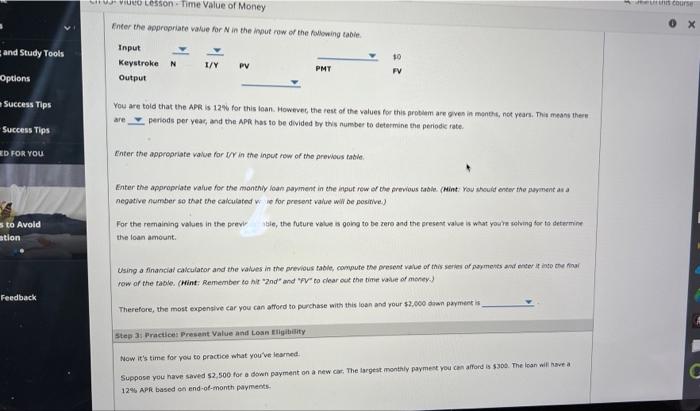

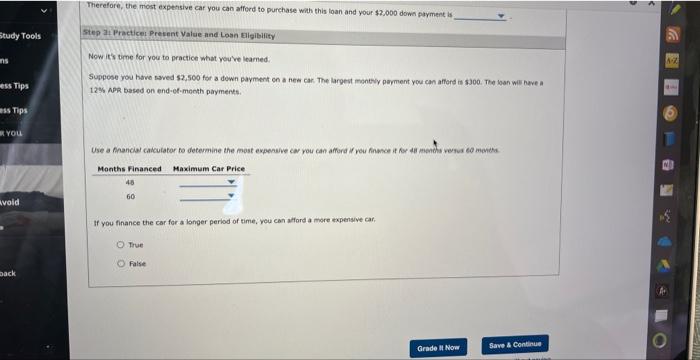

Finding a present value (FV) is the reverse of finding a fubure value (FVN) : FVs=PV(1+h)PV=1+D2WV value of an erdinsty annuity is to vie the formula ewwosci. =BMT(101+1+21) the PV kev (Note Make sure your calculater is set to tho mose) the PY wer. (Note: Make sure your calculator is set to Eho mode.) th tous case, the present value of thit ardinary annuity is 3272.32. If you know the future value (F). you can compound it te tha the present value (DM). Thue False Step 2i Learnt Present Value and Losn Eligibility Calculating the presemt value of a series of future payments cos often be heipfui in detemning vour budget for a woe furtrine fich an a car ar house. Watch the foconing video for an example, then answer the evestions thot follow, can amerit if you finwece of for 44 menths, In erder to de this, you ceed. io determine the values for the foldwing virustict) 4 Fi mumber of paymetiti - 1/T penceis interem rvete 4. PMit payment + BVi Nutiste varen The number of poyments wit dey A fuw long you wit finance the purchase. Enter the aborseridet walie for for in the irpue fow the promeul riole. Fnter the appropriate value for N in the ipout row of the following tabie You are toid that the APR is 12% for this loan. Howevec the rese of the values for this protiem are gres in mantere, not years. Thit means these are periods per yeac, and the APR has to be divided by twis number to determine the periodic rate. Enter the approariafe value for y in the ingut row of the prewbus tative. Enter the appropriate value for the monehiy loan payment in the input row of the previous table. (Mint: rou shoult encer tho puyment as a negative number so that the caiculated i ine for present value will be positive) For the remaining values in the previ. ble, the future volue a going to be zero and the presest value is what youis seching for ta determine the loan amount. Using of financial calculator and the values in the previous taole, compute the present value of this series of Nopments ast triter if insto che trai row of the table. (Wint; Remember co hit "2nd" and "PV" to clear out the timit value of money.) Therefore, the most expensive car you can atroed to purchase with this lean and your $2.,000 das payment is Step 35 Practices Present Value and Losa Eigibisity Now it's time foe you to practice what you've lesmed. Suppose you have soved 52,509 fot a dewn payment on a new car, The targest monthily paymest you can afford is 5300 . The losen will abve a 12% APR based en end-of-month payments. Now it's time for you to practice what you ve leamed. Suppese you have raved $2,500 for a dewn bayment in a nee car. The largest mentevy peyment you can afford is s300. The wan we hove a 12%MPR based on end-ef-menth payments. If you finance the car for a longer period of time, you can alford a more expensye car. True False Finding a present value (FV) is the reverse of finding a fubure value (FVN) : FVs=PV(1+h)PV=1+D2WV value of an erdinsty annuity is to vie the formula ewwosci. =BMT(101+1+21) the PV kev (Note Make sure your calculater is set to tho mose) the PY wer. (Note: Make sure your calculator is set to Eho mode.) th tous case, the present value of thit ardinary annuity is 3272.32. If you know the future value (F). you can compound it te tha the present value (DM). Thue False Step 2i Learnt Present Value and Losn Eligibility Calculating the presemt value of a series of future payments cos often be heipfui in detemning vour budget for a woe furtrine fich an a car ar house. Watch the foconing video for an example, then answer the evestions thot follow, can amerit if you finwece of for 44 menths, In erder to de this, you ceed. io determine the values for the foldwing virustict) 4 Fi mumber of paymetiti - 1/T penceis interem rvete 4. PMit payment + BVi Nutiste varen The number of poyments wit dey A fuw long you wit finance the purchase. Enter the aborseridet walie for for in the irpue fow the promeul riole. Fnter the appropriate value for N in the ipout row of the following tabie You are toid that the APR is 12% for this loan. Howevec the rese of the values for this protiem are gres in mantere, not years. Thit means these are periods per yeac, and the APR has to be divided by twis number to determine the periodic rate. Enter the approariafe value for y in the ingut row of the prewbus tative. Enter the appropriate value for the monehiy loan payment in the input row of the previous table. (Mint: rou shoult encer tho puyment as a negative number so that the caiculated i ine for present value will be positive) For the remaining values in the previ. ble, the future volue a going to be zero and the presest value is what youis seching for ta determine the loan amount. Using of financial calculator and the values in the previous taole, compute the present value of this series of Nopments ast triter if insto che trai row of the table. (Wint; Remember co hit "2nd" and "PV" to clear out the timit value of money.) Therefore, the most expensive car you can atroed to purchase with this lean and your $2.,000 das payment is Step 35 Practices Present Value and Losa Eigibisity Now it's time foe you to practice what you've lesmed. Suppose you have soved 52,509 fot a dewn payment on a new car, The targest monthily paymest you can afford is 5300 . The losen will abve a 12% APR based en end-of-month payments. Now it's time for you to practice what you ve leamed. Suppese you have raved $2,500 for a dewn bayment in a nee car. The largest mentevy peyment you can afford is s300. The wan we hove a 12%MPR based on end-ef-menth payments. If you finance the car for a longer period of time, you can alford a more expensye car. True False

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started