Answered step by step

Verified Expert Solution

Question

1 Approved Answer

v Sometimes compensation packages include bonuses designed to provide performance incentives to employees. The difficulty bonus can cause accountants is not an accounting problem, but

v

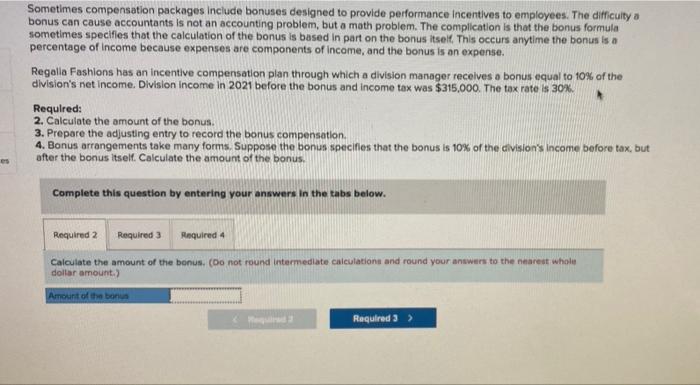

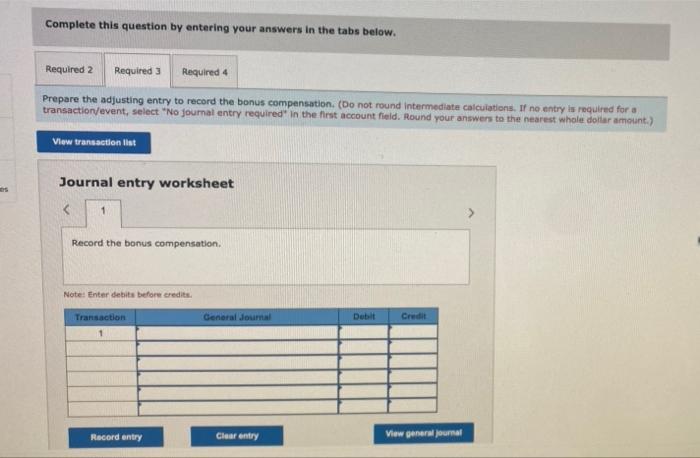

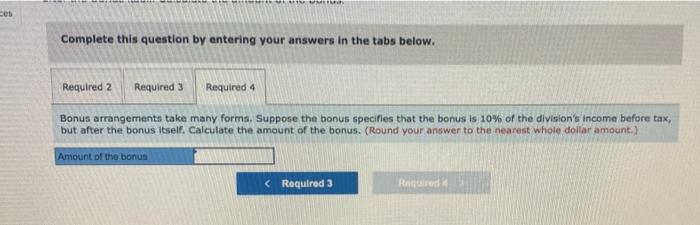

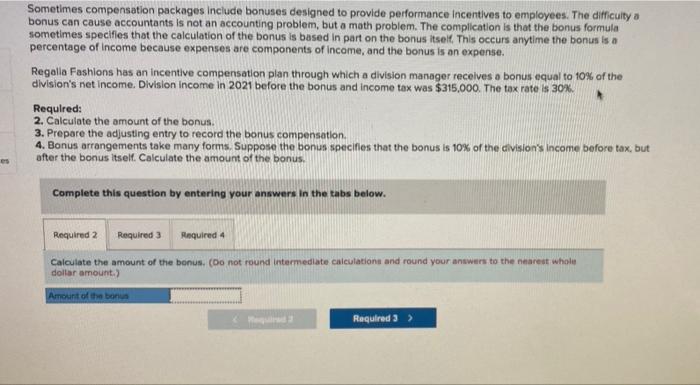

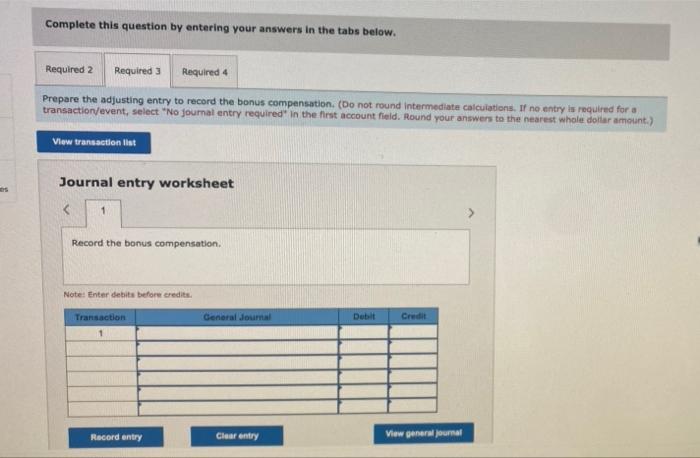

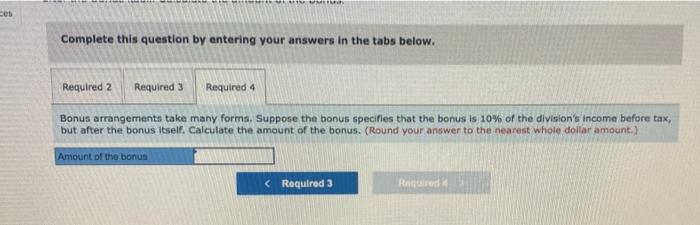

Sometimes compensation packages include bonuses designed to provide performance incentives to employees. The difficulty bonus can cause accountants is not an accounting problem, but a math problem. The complication is that the bonus formula sometimes specifies that the calculation of the bonus is based in part on the bonus itself. This occurs anytime the bonus is a percentage of income because expenses are components of income, and the bonus is on expense. Regallo Fashions has an incentive compensation plan through which a division manager receives a bonus equal to 10% of the division's net income. Division Income in 2021 before the bonus and income tax was $315,000. The tax rate is 30% Required: 2. Calculate the amount of the bonus. 3. Prepare the adjusting entry to record the bonus compensation 4. Bonus arrangements take many forms. Suppose the bonus specifles that the bonus is 10% of the division's income before tax, but after the bonus itself. Calculate the amount of the bonus Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Calculate the amount of the bonus. (Do not round Intermediate calculations and round your answers to the nearest whole dollar amount.) Amount of the bonus Required 3 > Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Prepare the adjusting entry to record the bonus compensation. (Do not round Intermediate calculations. If no entry is required for a transaction/event, select "No journal entry required in the first account field. Round your answers to the nearest whole dollar amount.) View transaction list Journal entry worksheet > Record the bonus compensation. Note: Enter debits before credits Transaction General Journal Debat Credit Record entry Clear entry View general Journal ces Complete this question by entering your answers in the tabs below. Required 2 Required 3 Required 4 Bonus arrangements take many forms. Suppose the bonus specifies that the bonus is 10% of the division's income before tax, but after the bonus itself. Calculate the amount of the bonus. (Round your answer to the nearest whole dollar amount.) Amount of the bonus

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started