Answered step by step

Verified Expert Solution

Question

1 Approved Answer

v The management of RTE Telecom Inc. controls 58% of the company's stock. The firm did not meet any of its quarterly sales projections for

v

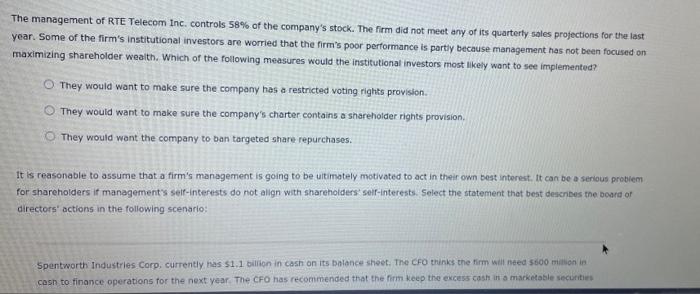

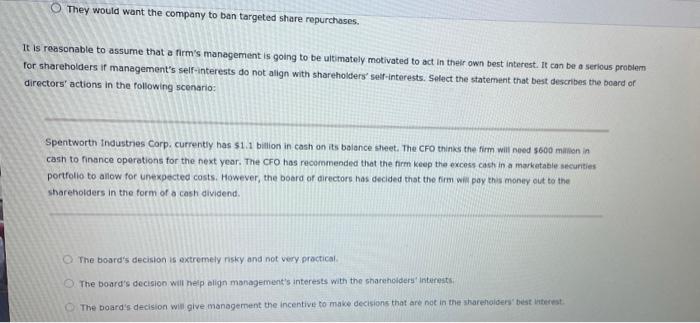

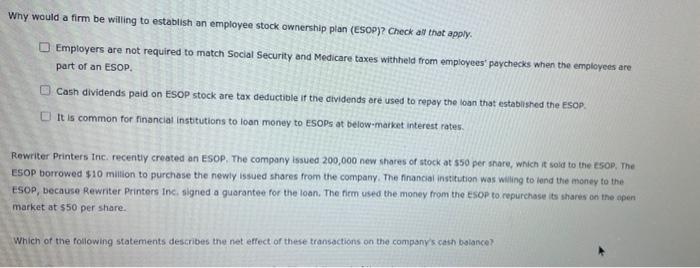

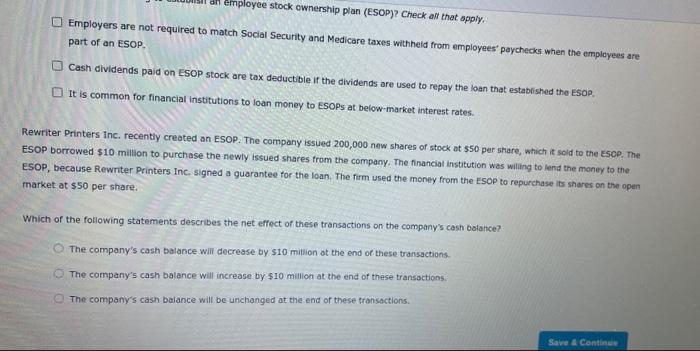

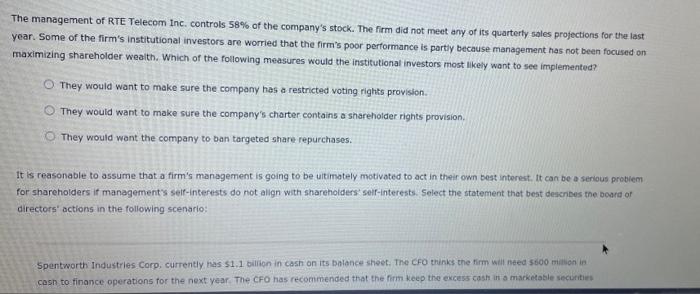

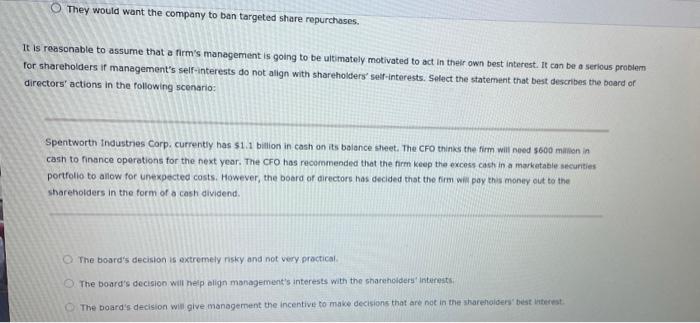

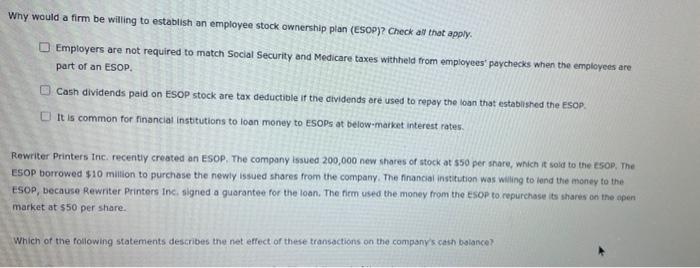

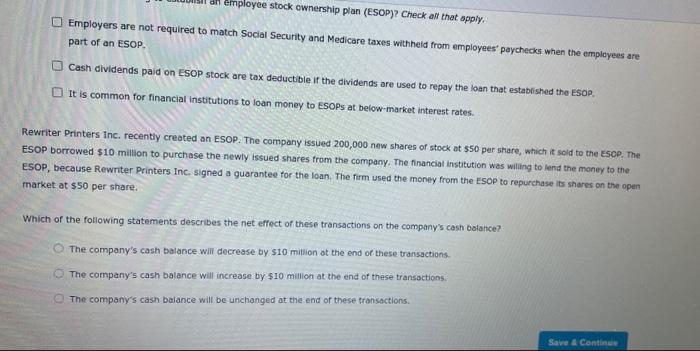

The management of RTE Telecom Inc. controls 58% of the company's stock. The firm did not meet any of its quarterly sales projections for the last year. Some of the firm's institutional investors are worried that the firm's poor performance is partly because management has not been focused on maximizing shareholder wealth. Which of the following measures would the institutional investors most likely want to see implemented? They would want to make sure the company has a restricted voting rights provision They would want to make sure the company's charter contains a shareholder rights provision They would want the company to ban targeted share repurchases. It is reasonable to assume that a firm's management is going to be ultimately motivated to act in their own best interest. It can be a serious problem for shareholders if management's self-interests do not align with shareholders self-interests. Select the statement that best describes the board of directors' actions in the following scenario: Spentworth Industries Corp, currently has $1.1 billion in cash on its balance sheet. The CFO thinks the firm will need 500 million in cash to finance operations for the next year. The CFO has recommended that the firm keep the excess cash in a marketable securities They would want the company to ben targeted share repurchases. It is reasonable to assume that a firm's management is going to be ultimately motivated to act in their own best interest. It can be a serious problem for shareholders if management's self-interests do not align with shareholders' self-interests. Select the statement that best describes the board of directors' actions in the following scenario: Spentworth Industries Corp. currently has $1.1 billion in cash on its balance sheet. The CFO thinks the firm will need 5600 million in cash to finance operations for the next year. The CFO has recommended that the firm keep the excess cash in a marketable securities portfolio to allow for unexpected costs. However, the board of directors has decided that the firm will pay this money out to the shareholders in the form of a cash dividend. The board's decision is extremely risky and not very practical The board's decision will help align management's interests with the shareholders interests The board's decision will give management the incentive to make decisions that are not in the shareholders' best interest Why would a firm be willing to establish an employee stock ownership plan (ESOP)? Check all that apply. Employers are not required to match Social Security and Medicare taxes withheld from employees' paychecks when the employees are part of an ESOP. Cash dividends paid on ESOP stock are tax deductible if the dividends are used to repay the loan that established the ESOP. It is common for financial Institutions to loan money to ESOPs at below market interest rates Rewriter Printers Inc recently created an ESOP. The company issued 200,000 new shares of stock at 550 per share, which it sold to the ESOP, The ESOP borrowed $10 million to purchase the newly issued shares from the company. The financial institution was willing to lend the money to the ESOP, because Rewriter Printers Inc. signed a guarantee for the loan. The tem used the money from the SOP to repurchase its shares on the open market at 550 per share. Which of the following statements describes the net effect of these transactions on the company's cash balance? an einployee stock ownership plan (ESOP)? Check all that apply. Employers are not required to match Social Security and Medicare taxes withheld from employees' paychecks when the employees are part of an ESOP. Cash dividends paid on ESOP stock are tax deductible if the dividends are used to repay the loan that established the Esop, It is common for financial institutions to loan money to ESOPs at below-market interest rates. Rewriter Printers Inc. recently created an ESOP. The company issued 200,000 new shares of stock at $50 per share, which it sold to the ESOP. The ESOP borrowed $10 million to purchase the newly issued shares from the company. The financial institution was willing to lend the money to the ESOP, because Rewriter Printers Inc. signed a guarantee for the loan. The firm used the money from the ESOP to repurchase its shares on the open market at $50 per share. Which of the following statements describes the net effect of these transactions on the company's cash balance The company's cash balance will decrease by $10 million at the end of these transactions The company's cash balance will increase by $10 million at the end of these transactions. The company's cash balance will be unchanged at the end of these transactions Save & Continue

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started