Answered step by step

Verified Expert Solution

Question

1 Approved Answer

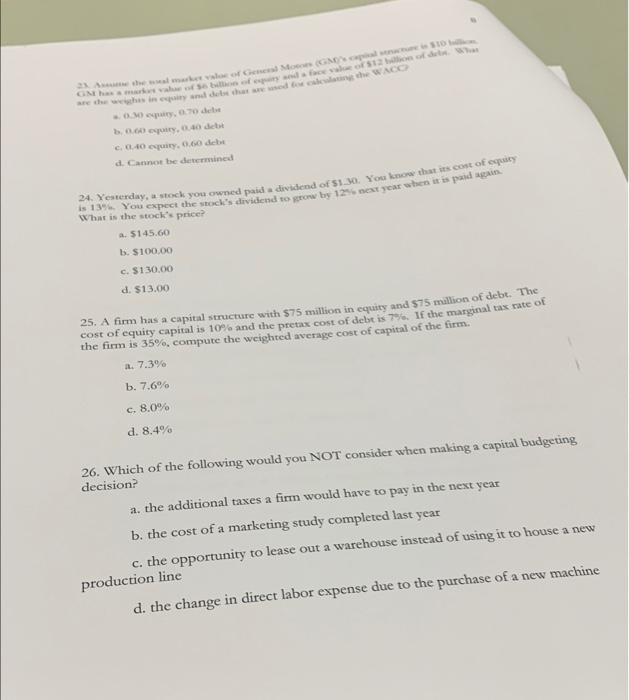

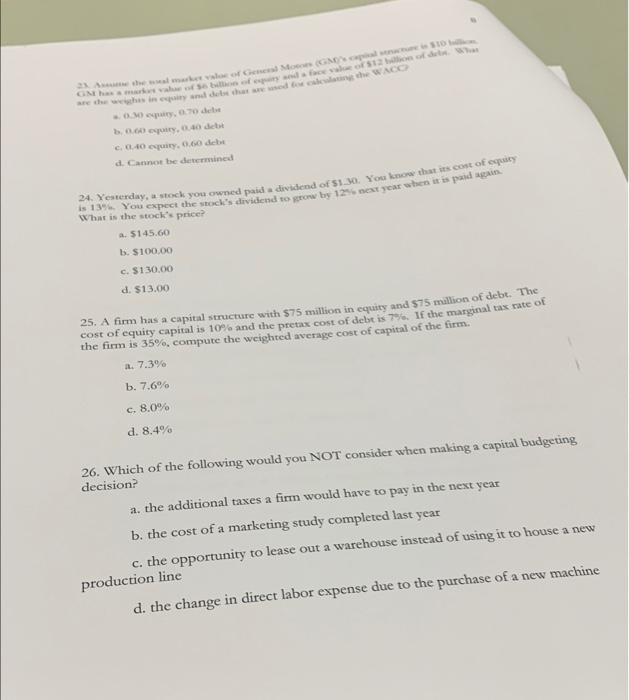

v wwNS w the whes then dot me the WACC 0:30. debe l 47 4H CHI, 4 khe v C. 140 quity 0.60 debe d.

v

wwNS w the whes then dot me the WACC 0:30. debe l 47 4H CHI, 4 khe v C. 140 quity 0.60 debe d. Cannot be determined 24. Venerday, a sock you owned paid a dividend of Si. 30: You know that is cont of equity What is You expect the stock decent to you tos 12. next year when it is paid again 5145.60 b. S100.00 c. $130.00 d. $13.00 25. A firm has a capital structure with $75 million in equity and $75 million of debt. The cost of equity capital is 10% and the pretax cost of delt ist. If the marginal tax rate of the firm is 35%, compute the weighted average cost of capital of the firm. a. 7.39 b. 7.6% c. 8.0% d. 8.4% 26. Which of the following would you NOT consider when making a capital budgeting decision? a. the additional taxes a firm would have to pay in the next year b. the cost of a marketing study completed last year c. the opportunity to lease out a warehouse instead of using it to house a new production line d. the change in direct labor expense due to the purchase of a new machine

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started