Answered step by step

Verified Expert Solution

Question

1 Approved Answer

V. You want to save $2,000 today for retirement in 40 years. You have to choose between the two plans listed in (i) and

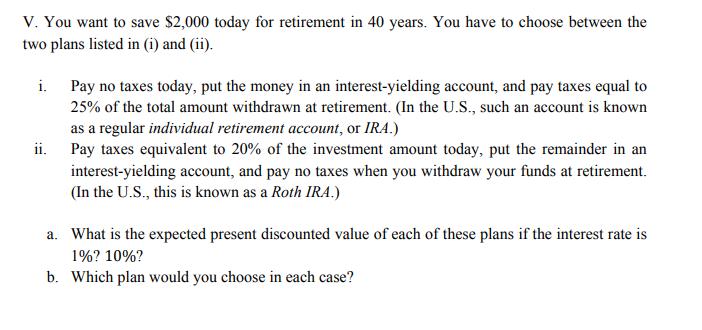

V. You want to save $2,000 today for retirement in 40 years. You have to choose between the two plans listed in (i) and (ii). i. Pay no taxes today, put the money in an interest-yielding account, and pay taxes equal to 25% of the total amount withdrawn at retirement. (In the U.S., such an account is known as a regular individual retirement account, or IRA.) ii. Pay taxes equivalent to 20% of the investment amount today, put the remainder in an interest-yielding account, and pay no taxes when you withdraw your funds at retirement. (In the U.S., this is known as a Roth IRA.) a. What is the expected present discounted value of each of these plans if the interest rate is 1%? 10%? b. Which plan would you choose in each case?

Step by Step Solution

★★★★★

3.48 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

Answer a1 We have Expected present discounted value of Plan i at 1 interes...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started