Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vail Limited acquired 45% of McGillis Corporation's 55,000 common shares for $17 per share on January 1, 2021. On June 15, McGillis declared a

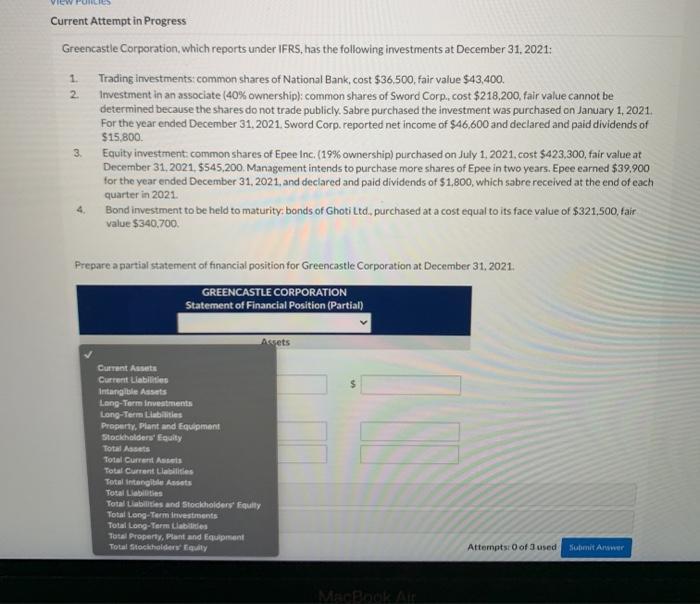

Vail Limited acquired 45% of McGillis Corporation's 55,000 common shares for $17 per share on January 1, 2021. On June 15, McGillis declared a dividend of $146,000 and Aurora received its share of the dividend on the same day. On December 31, McGillis reported net income of $290,000 for the year. At December 31, McGillis's shares were trading at $20 per share. Vail accounts for this investment using the equity method. Vail also acquired 15% of the 373,000 common shares of Crystal Inc for $27 per share on March 18, 2021. On June 30, Crystal declared a $277,000 dividend and Aurora received its share of these dividends on that day. On December 31, Crystal reported net income of $609,000 for the year. At December 31, Crystal's shares were trading at $25 per share. Vail intends to hold on to the Crystal shares es as a long-term investment for the dividend income. Vail uses the fair value through profit or loss model for this investment. a Record the above transactions for the year ended December 31, 2021. (List transactions in chronological order. List all debit entries before credit entries. Credit account titles are automatically indented when the amount is entered. Do not indent manually. If no entry is required, select "No Entry for the account titles and enter O for the amounts.) Account Titles and Explanation Date 5 > (To record Vail 's share of McGillis's profit.) (To record unrealized gain / (loss) Debit II MacBook Air ! Credit View PURCES Current Attempt in Progress Greencastle Corporation, which reports under IFRS, has the following investments at December 31, 2021: Trading investments: common shares of National Bank, cost $36.500, fair value $43,400. Investment in an associate (40% ownership): common shares of Sword Corp., cost $218,200, fair value cannot be determined because the shares do not trade publicly. Sabre purchased the investment was purchased on January 1, 2021. For the year ended December 31, 2021, Sword Corp. reported net income of $46,600 and declared and paid dividends of $15,800. 1. 2 3. 4. Equity investment: common shares of Epee Inc. (19% ownership) purchased on July 1, 2021, cost $423,300, fair value at December 31, 2021, $545,200. Management intends to purchase more shares of Epee in two years. Epee earned $39.900 for the year ended December 31, 2021, and declared and paid dividends of $1,800, which sabre received at the end of each quarter in 2021. Bond investment to be held to maturity: bonds of Ghoti Ltd., purchased at a cost equal to its face value of $321,500, fair value $340,700. Prepare a partial statement of financial position for Greencastle Corporation at December 31, 2021. GREENCASTLE CORPORATION Statement of Financial Position (Partial) Current Assets Current Liabilities Intangible Assets Long-Term investments Long-Term Liabilities Property, Plant and Equipment Stockholders' Equity Assets Total Assets Total Current Assets Total Current Liabilities Total Intangible Assets Total Liabilities Total Liabilities and Stockholders' Equity Total Long-Term investments Total Long-Term Liabilities Total Property, Plant and Equipment Total Stockholders' Equity 01 Attempts: 0 of 3 used. Submit Answer

Step by Step Solution

★★★★★

3.35 Rating (158 Votes )

There are 3 Steps involved in it

Step: 1

ANSWER Solution to Q1 Date Particulars Debit Credit ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started