Answered step by step

Verified Expert Solution

Question

1 Approved Answer

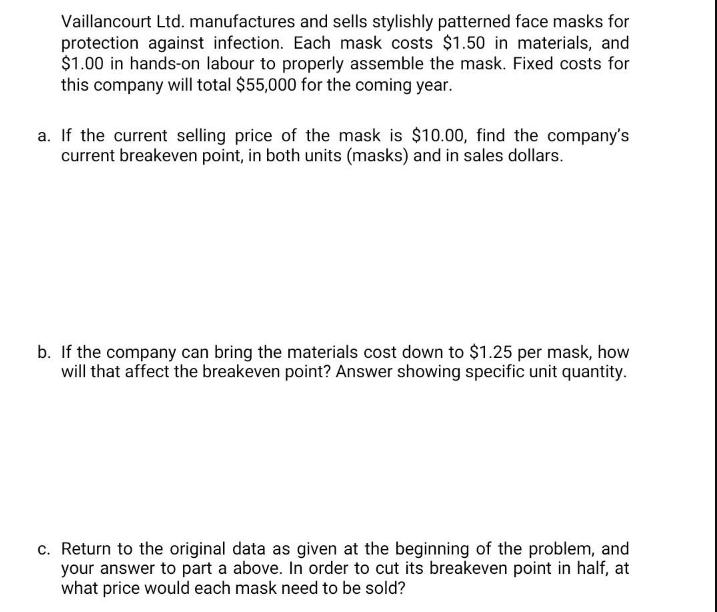

Vaillancourt Ltd. manufactures and sells stylishly patterned face masks for protection against infection. Each mask costs $1.50 in materials, and $1.00 in hands-on labour

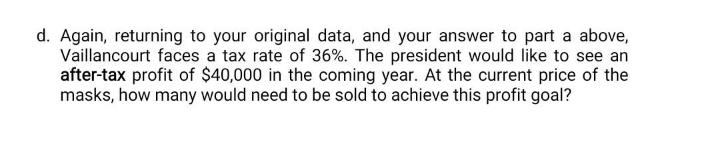

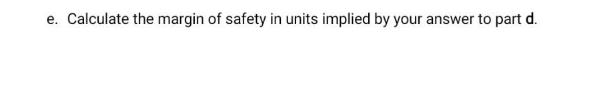

Vaillancourt Ltd. manufactures and sells stylishly patterned face masks for protection against infection. Each mask costs $1.50 in materials, and $1.00 in hands-on labour to properly assemble the mask. Fixed costs for this company will total $55,000 for the coming year. a. If the current selling price of the mask is $10.00, find the company's current breakeven point, in both units (masks) and in sales dollars. b. If the company can bring the materials cost down to $1.25 per mask, how will that affect the breakeven point? Answer showing specific unit quantity. c. Return to the original data as given at the beginning of the problem, and your answer to part a above. In order to cut its breakeven point in half, at what price would each mask need to be sold? d. Again, returning to your original data, and your answer to part a above, Vaillancourt faces a tax rate of 36%. The president would like to see an after-tax profit of $40,000 in the coming year. At the current price of the masks, how many would need to be sold to achieve this profit goal? e. Calculate the margin of safety in units implied by your answer to part d. Comparative balance sheets of Janxen Jeans Company for 2008 and 2007 are as follows: JANXEN JEANS COMPANY Comparative Balance Sheets Dec. 31, 2008 Assets Current assets Cash Accounts receivable Notes receivable Inventories Total current assets Non-current assets Land Machinery Accumulated amortization Total non-current assets Total assets Liabilities Current liabilities Accounts payable Interest payable Total current liabilities Long-term debt Total liabilities Shareholders' equity Common shares Retained earnings $ 180,000 120,000 50,000 439,000 789,000 545,000 483,000 (143,000) 885,000 $1,674,000 $ 125,000 17,000 142,000 350,000 492,000 650,000 532,000 Total shareholders' equity 1,182,000 Total liabilities and shareholders' equity $1,674,000 Dec. 31, 2007 3. No repayment of long-term debt occurred during 2008. 4. Dividends declared and paid during the year were s $ 188,000 133,000 61,000 326,000 708,000 500,000 238,000 (98,000) 640,000 $1,348,000 $ 158,000 10,000 168,000 200,000 368,000 550,000 430,000 980,000 $1,348,000 Additional information: 1. Net income was $146,000 and included amortization expense of $95,000. 2. A machine costing $70,000 was sold for $4,000 less than its book value (cost minus accumulated amortization) of $20,000. Required: Prepare a cash flow statement for the year ended December 31, 2008.

Step by Step Solution

★★★★★

3.48 Rating (161 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started