Question

Valdivian, a small start-up, has accumulated a significant amount of cash on its balance sheet. Forecasts suggest that of the total cash, $500,000 is not

Valdivian, a small start-up, has accumulated a significant amount of cash on its balance sheet. Forecasts suggest that of the total cash, $500,000 is not needed in the next year. As such, Valdivian's CEO wants you to advise whether the cash should remain in the bank account it’s currently in OR be invested in the stock market.

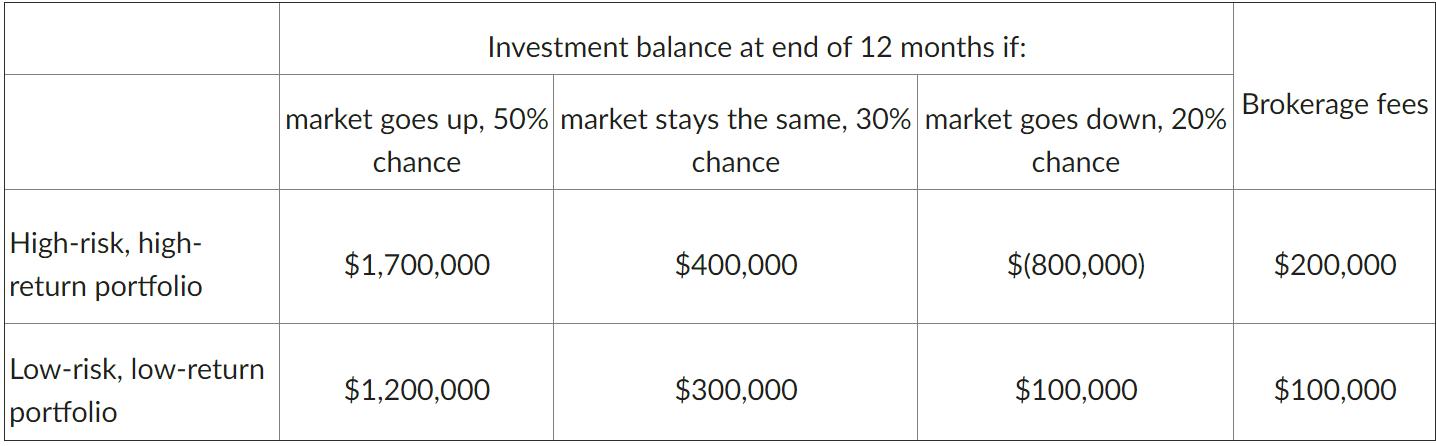

You’ve gathered information about these options: (a) Keep the $500,000 in bank account that does not earn interest; engage the services of a broker who will invest in (b) a high-risk, high-return portfolio or (c) a low-risk, low-return portfolio. The broker provided this information using the portfolios’ historical performance.

Draw the decision tree to decide between these three options.

Investment balance at end of 12 months if: market goes up, 50% market stays the same, 30% market goes down. 20% Brokerage fees chance chance chance High-risk, high- return portfolio $1,700,000 $400,000 $(800,000) $200,000 Low-risk, low-return $1,200,000 $300,000 $100,000 $100,000 portfolio

Step by Step Solution

3.44 Rating (151 Votes )

There are 3 Steps involved in it

Step: 1

option 1 oftion 2 option altion 3 Invest in Amount Keep in Swest in ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started