Question

Vale S.A. is a publicly traded company (symbol: VALE) that engages in the research, production, and sale of iron ore, nickel, copper, and other precious

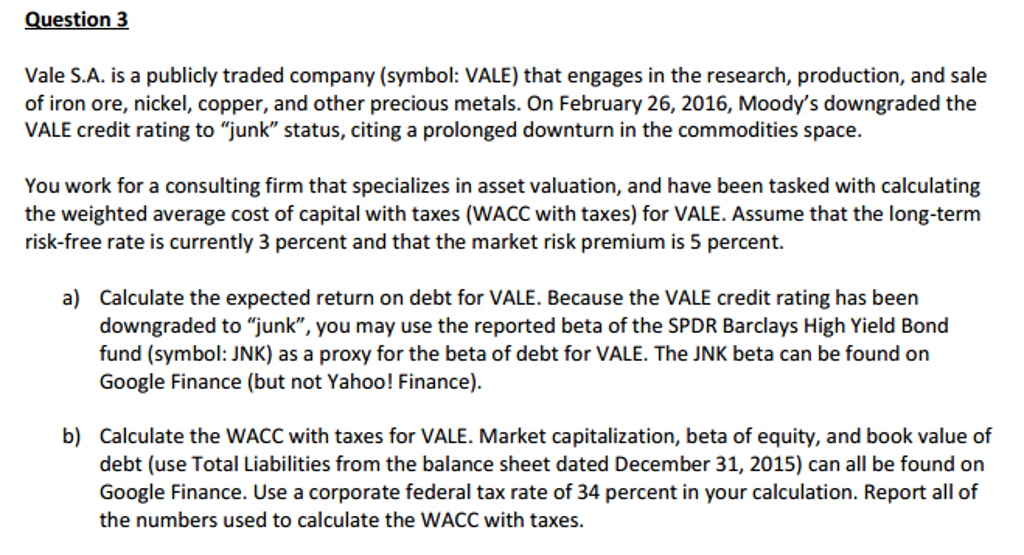

Vale S.A. is a publicly traded company (symbol: VALE) that engages in the research, production, and sale of iron ore, nickel, copper, and other precious metals. On February 26, 2016, Moodys downgraded the VALE credit rating to junk status, citing a prolonged downturn in the commodities space. You work for a consulting firm that specializes in asset valuation, and have been tasked with calculating the weighted average cost of capital with taxes (WACC with taxes) for VALE. Assume that the long-term risk-free rate is currently 3 percent and that the market risk premium is 5 percent.

a) Calculate the expected return on debt for VALE. Because the VALE credit rating has been downgraded to junk, you may use the reported beta of the SPDR Barclays High Yield Bond fund (symbol: JNK) as a proxy for the beta of debt for VALE. The JNK beta can be found on Google Finance (but not Yahoo! Finance).

b) Calculate the WACC with taxes for VALE. Market capitalization, beta of equity, and book value of debt (use Total Liabilities from the balance sheet dated December 31, 2015) can all be found on Google Finance. Use a corporate federal tax rate of 34 percent in your calculation. Report all of the numbers used to calculate the WACC with taxes.

step by step work please.

Question3 Vale S.A. is a publicly traded company (symbol: VALE) that engages in the research, production, and sale of iron ore, nickel, copper, and other precious metals. On February 26, 2016, Moody's downgraded the VALE credit rating to "junk" status, citing a prolonged downturn in the commodities space. You work for a consulting firm that specializes in asset valuation, and have been tasked with calculating the weighted average cost of capital with taxes (WACC with taxes) for VALE. Assume that the long-term risk-free rate is currently 3 percent and that the market risk premium is 5 percent. a) Calculate the expected return on debt for VALE. Because the VALE credit rating has been downgraded to "junk", you may use the reported beta of the SPDR Barclays High Yield Bond fund (symbol: JNK) as a proxy for the beta of debt for VALE. The JNK beta can be found on Google Finance (but not Yahoo! Finance). b) Calculate the WACC with taxes for VALE. Market capitalization, beta of equity, and book value of debt (use Total Liabilities from the balance sheet dated December 31, 2015) can all be found on Google Finance. Use a corporate federal tax rate of 34 percent in your calculation. Report all of the numbers used to calculate the WACC with taxesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started