Question

VALERIAN Ltd, a retail toy company, commenced operations on 1 July 2016 by issuing 100 000 $2.50 shares, payable in full on application on a

VALERIAN Ltd, a retail toy company, commenced operations on 1 July 2016 by issuing 100 000 $2.50 shares, payable in full on application on a first-come, first-served basis. By 22 July 2016 the shares were fully subscribed and duly allotted. There were no share issue costs. For the year ending 30 June 2017, the company recorded the following aggregate transactions:

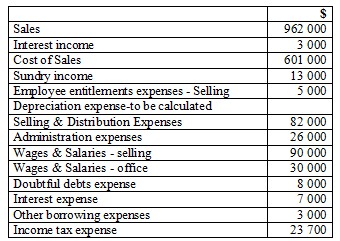

The following additional information was noted during the preparation of financial statements for the year ended 30 June 2017:

(a) A cash dividend of 10 c6ents per share was declared and paid during the 2017 financial year and a final dividend for 2017 of $15 000 was proposed but not recognised in the financial statements. (b) The land was revalued upward by $20 000 (related income tax 6 000) by Verifiable Valuations Pty Ltd during the year ended 30 June 2017. (c) Transferred $10 000 out of retained earnings into general reserve. (d) $40 000 of other loans is repayable in one year. (e) The Bank loan is for 5 years and repayable in full at the end of the term. The interest rate is 9% and it is secured over the land. (f) The provision for employee entitlements includes $4 000 payable within 1 year. (g) The credit managers recommendation that no bad debts be written off was adopted by the directors. (h) VALERIAN Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement. (i) VALERIAN Ltd measures inventory at the lower of cost and net realizable value. The cost model is applied to buildings, plant and equipment.

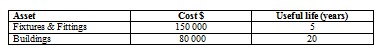

The following assets were purchased on 1 July 2016:

Summarised account balances are provided below:

Required: For the year ending 30 June, 2017, note comparatives not required: 1. prepare a preliminary trial balance for VALERIAN Ltd; 2. Prepare a statement of profit or loss and other comprehensive income for VALERIAN Ltd in accordance with the requirements of AASB 101. VALERIAN Ltd uses the single statement format for the statement of profit or loss and other comprehensive income and classifies expenses by function within the statement; 3. Prepare a statement of changes in equity for VALERIAN Ltd in accordance with the requirements of AASB 101; 4. Prepare a statement of financial position for VALERIAN Ltd in accordance with AASB 101. Use the currenton-current presentation format 5. Prepare appropriate notes to the accounts. (You do not need to prepare notes related to income taxes. Include the following note as note 1. You may optionally add accounting policies to this note): 1. Summary of significant accounting policies Basis of accounting The financial report is a general purpose financial report which has been prepared on the historical cost basis, except where stated otherwise. Statement of Compliance The financial statements have be5en prepared in accordance with the requirements of the Corporations Act, Australian Accounting Standards which include Australian equivalents to International Financial Reporting Standards (AIFRSs) and AASB Interpretations. Compliance with AIFRSs ensures the financial statements and notes comply with International Financial Reporting Standards

Sales Interest income Cost of Sales 962 000 3 000 601 000 13 000 5 000 ndrv income Employee entitlements expenses Selling Depreciation expense-to be calculated Selling & Distribution Expenses Administration expenses Wages & Salaries selling Wages & Salaries office 82 000 26 000 90 000 30 000 Doubt ful debts expense Interest expense Other borrowing expenses Income tax expense 7000 3 000 23 700

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started