Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Vallable) Cost. 4. The rental cost of a piece of office equipment is $6,000 per month plus $2.27 for each machine hour used over 1,720

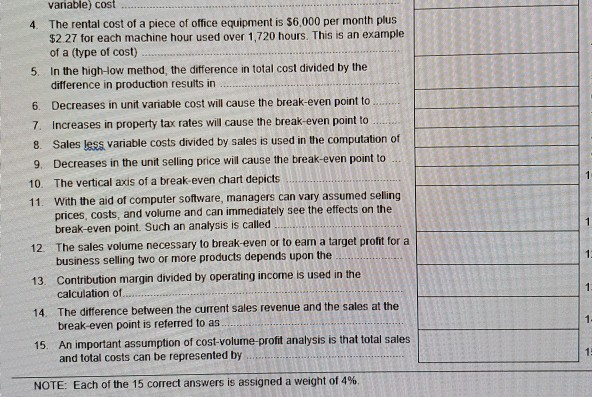

Vallable) Cost. 4. The rental cost of a piece of office equipment is $6,000 per month plus $2.27 for each machine hour used over 1,720 hours. This is an example of a (type of cost) 5. In the high-low method, the difference in total cost divided by the difference in production results in 6. Decreases in unit variable cost will cause the break-even point to 7. Increases in property tax rates will cause the break-even point to 8. Sales less variable costs divided by sales is used in the computation of 9. Decreases in the unit selling price will cause the break-even point to 10. The vertical axis of a break-even chart depicts 11. With the aid of computer software, managers can vary assumed selling prices, costs, and volume and can immediately see the effects on the break-even point. Such an analysis is called 12 The sales volume necessary to break even or to eam a target profit for a business selling two or more products depends upon the 13 Contribution margin divided by operating income is used in the calculation of.. 14. The difference between the current sales revenue and the sales at the break-even point is referred to as 15. An important assumption of cost-volume-profit analysis is that total sales and total costs can be represented by..... NOTE: Each of the 15 correct answers is assigned a weight of 4%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started