Answered step by step

Verified Expert Solution

Question

1 Approved Answer

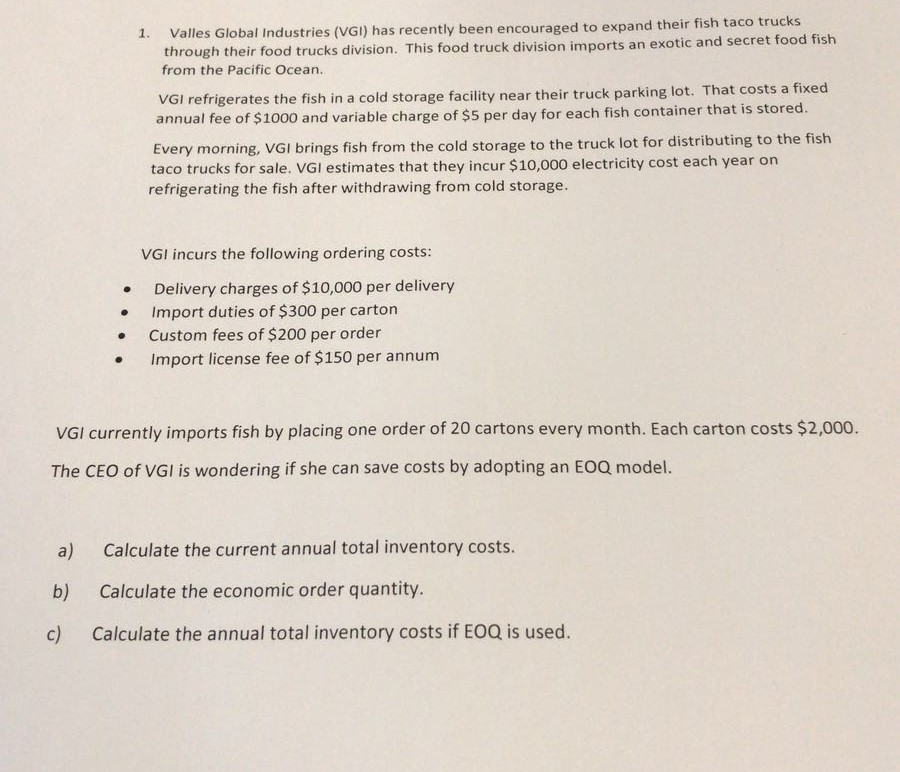

Valles Global Industries (VGI) has recently been encouraged to expand their fish taco trucks through their food trucks division. This food truck division imports an

Valles Global Industries (VGI) has recently been encouraged to expand their fish taco trucks through their food trucks division. This food truck division imports an exotic and from the Pacific Ocean. 1. secret food fish VGI refrigerates the fish in a cold storage facility near their truck parking lot. That costs a fixed annual fee of $1000 and variable charge of $5 per day for each fish container that is stored. Every morning, VGI brings fish from the cold storage to the truck lot for distributing to the fish taco tr ucks for sale. VGI estimates that they incur $10,000 electricity cost each year on refrigerating the fish after withdrawing from cold storage. VGI incurs the following ordering costs . Delivery charges of $10,000 per delivery . Import duties of $300 per carton Custom fees of $200 per order Import license fee of $150 per annum VGI currently imports fish by placing one order of 20 cartons every month. Each carton costs $2,000 The CEO of VGI is wondering if she can save costs by adopting an EOQ model. a) Calculate the current annual total inventory costs. b) Calculate the economic order quantity. c) Calculate the annual total inventory costs if EOQ is used

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started