Answered step by step

Verified Expert Solution

Question

1 Approved Answer

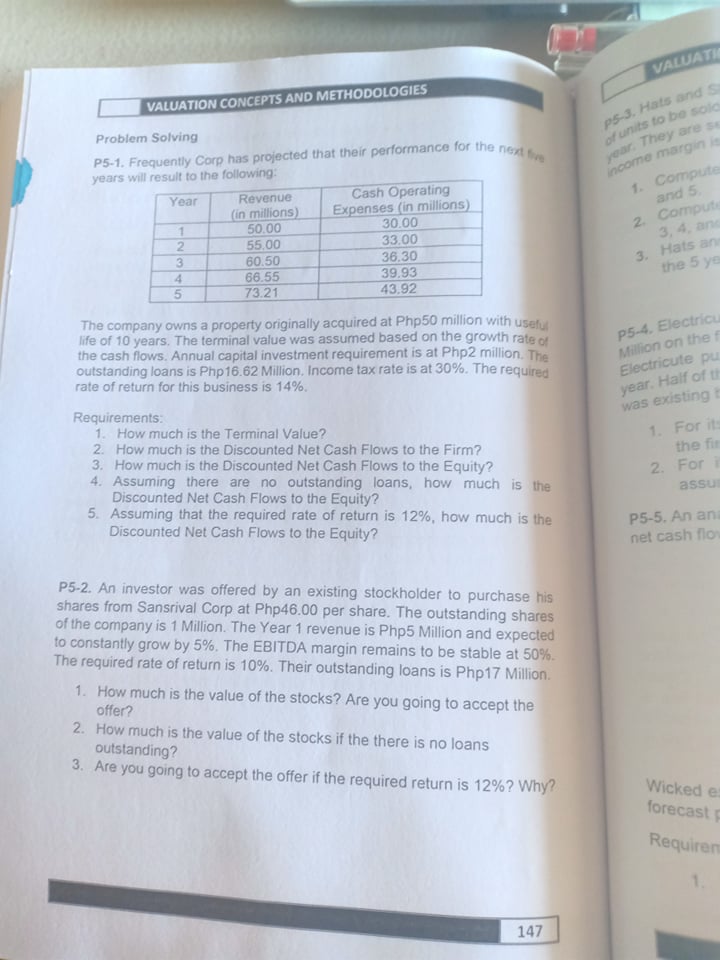

VALUATION CONCEPTS AND METHODOLOGIES Problem Solving P5-1. Frequently Corp has projected that their performance for the next five years will result to the following:

VALUATION CONCEPTS AND METHODOLOGIES Problem Solving P5-1. Frequently Corp has projected that their performance for the next five years will result to the following: Year Revenue (in millions) 1 50.00 2 55.00 3 60.50 4 66.55 5 73.21 Cash Operating Expenses (in millions) 30.00 33.00 36.30 39.93 43.92 The company owns a property originally acquired at Php50 million with useful life of 10 years. The terminal value was assumed based on the growth rate of the cash flows. Annual capital investment requirement is at Php2 million. The outstanding loans is Php16.62 Million. Income tax rate is at 30%. The required rate of return for this business is 14%. Requirements: 1. How much is the Terminal Value? 2. How much is the Discounted Net Cash Flows to the Firm? 3. How much is the Discounted Net Cash Flows to the Equity? 4. Assuming there are no outstanding loans, how much is the Discounted Net Cash Flows to the Equity? 5. Assuming that the required rate of return is 12%, how much is the Discounted Net Cash Flows to the Equity? P5-2. An investor was offered by an existing stockholder to purchase his shares from Sansrival Corp at Php46.00 per share. The outstanding shares of the company is 1 Million. The Year 1 revenue is Php5 Million and expected to constantly grow by 5%. The EBITDA margin remains to be stable at 50%. The required rate of return is 10%. Their outstanding loans is Php17 Million. 1. How much is the value of the stocks? Are you going to accept the offer? 2. How much is the value of the stocks if the there is no loans outstanding? 3. Are you going to accept the offer if the required return is 12%? Why? VALUATIO p5-3. Hats and S of units to be solo year. They are su income margin is 1. Computer and 5 2. Compute 3, 4, and 3. Hats and the 5 ye P5-4. Electricul Million on the f Electricute pu year. Half of th was existing t 1. For its the fin 2. For i assus P5-5. An ana net cash flow Wicked es forecast p Requirem 1. 147

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started