Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Valuation for ZipCo Limited (4 marks): Apply three valuation models, i.e. residual income model, residual operating income model and free cash flow model, to estimate

Valuation for ZipCo Limited (4 marks):

- Apply three valuation models, i.e. residual income model, residual operating income model and free cash flow model, to estimate the intrinsic value of the company. Provide calculations and results of the valuation models in a table and include it as an appendix in the report.

- Compare and discuss the estimates obtained from the three models. Compare the estimates with the actual share price observed in the stock market when valuation is performed and conclude whether the firm is currently overvalued or undervalued.

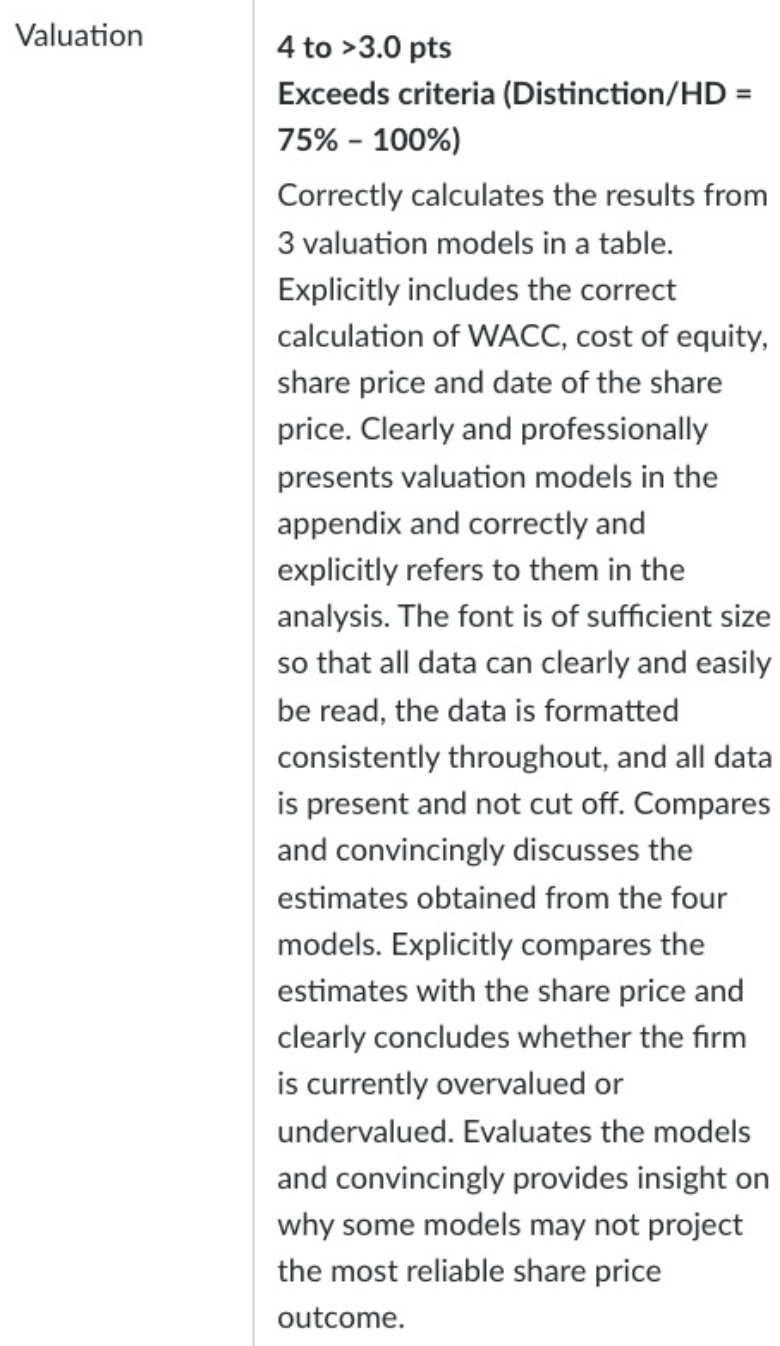

Valuation 4 to >3.0 pts Exceeds criteria (Distinction/HD = 75% - 100%) Correctly calculates the results from 3 valuation models in a table. Explicitly includes the correct calculation of WACC, cost of equity, share price and date of the share price. Clearly and professionally presents valuation models in the appendix and correctly and explicitly refers to them in the analysis. The font is of sufficient size so that all data can clearly and easily be read, the data is formatted consistently throughout, and all data is present and not cut off. Compares and convincingly discusses the estimates obtained from the four models. Explicitly compares the estimates with the share price and clearly concludes whether the firm is currently overvalued or undervalued. Evaluates the models and convincingly provides insight on why some models may not project the most reliable share price outcome.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To conduct a valuation of ZipCo Limited using the residual income model residual operating income model and free cash flow model we would require part...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started