Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Valuation of start ups. Use one of the methods in the pictures mentioned to valuate a company that operates three food trucks in Abu Dhabi.

Valuation of start ups.

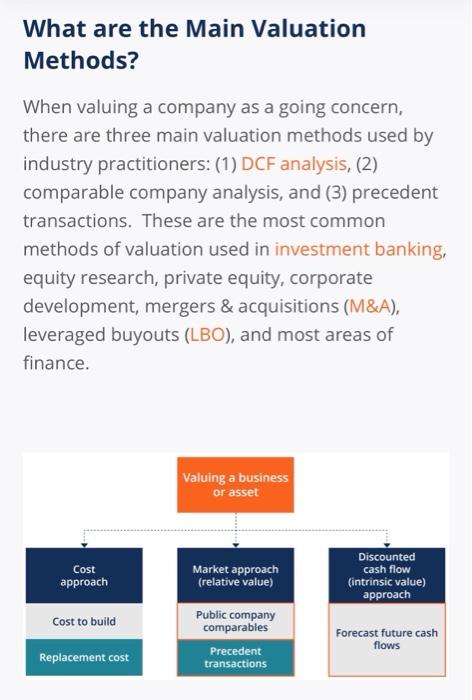

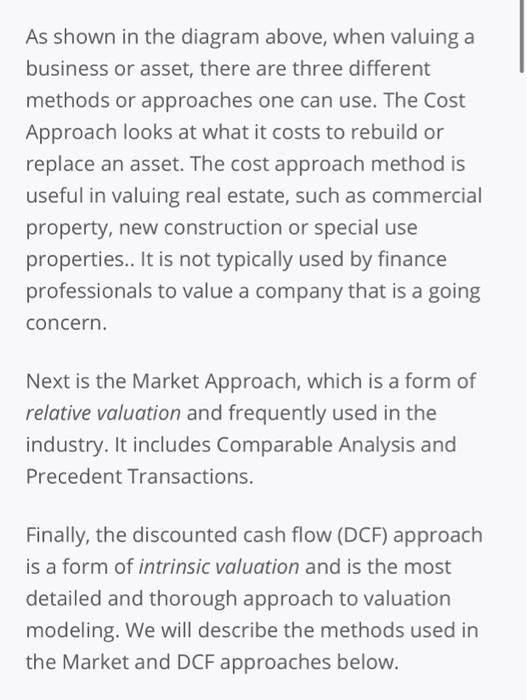

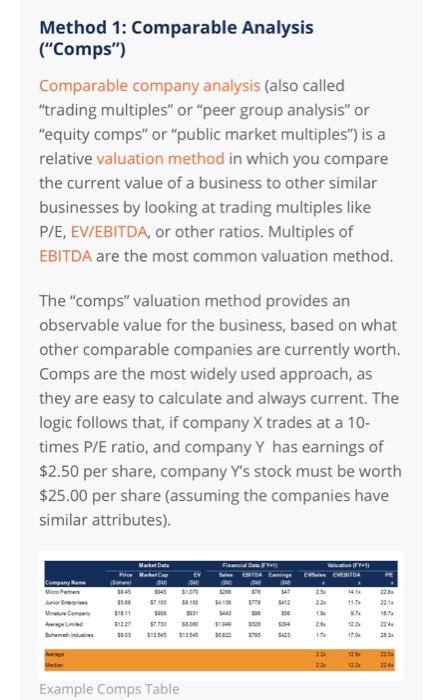

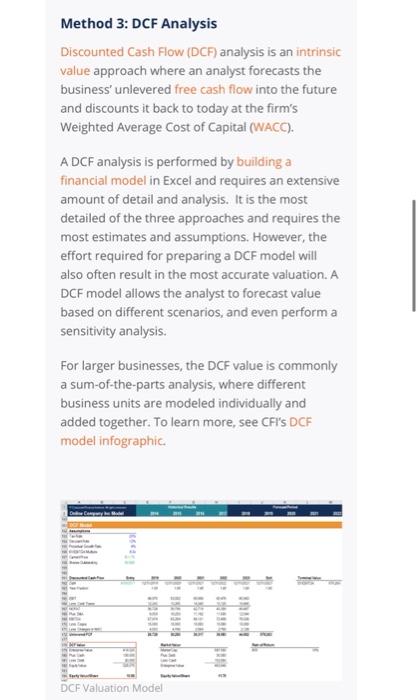

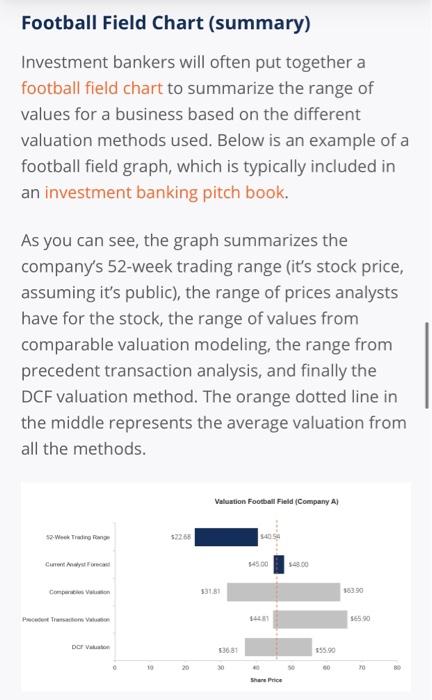

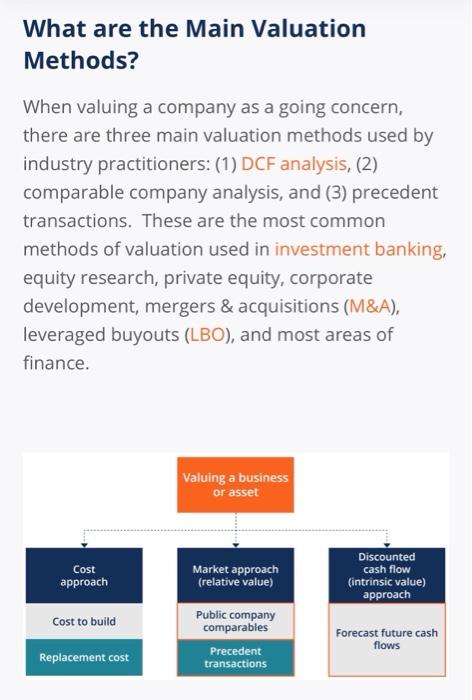

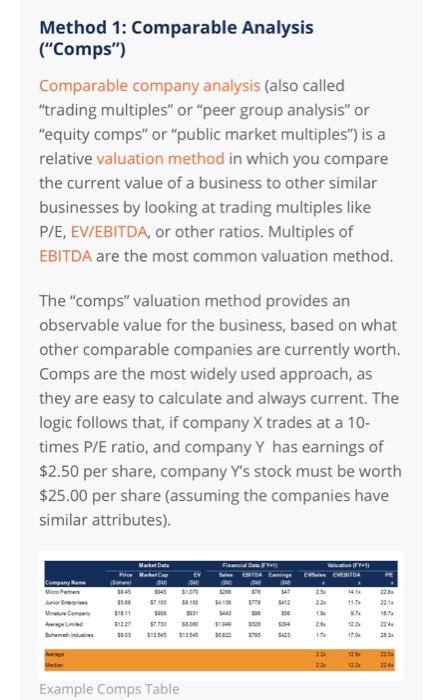

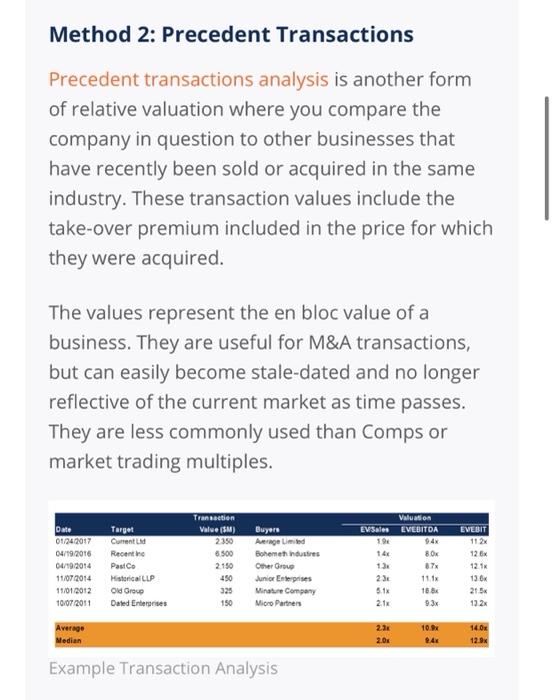

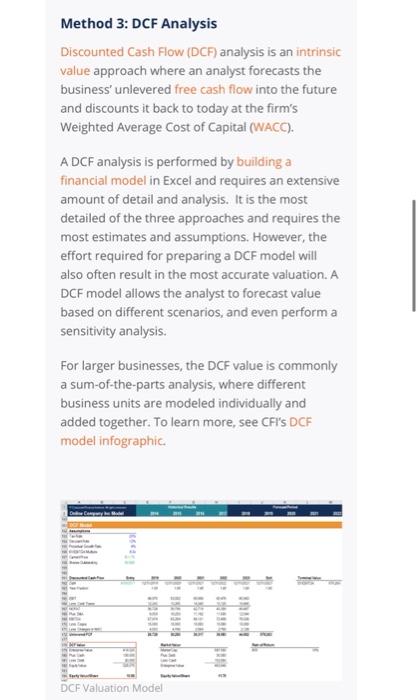

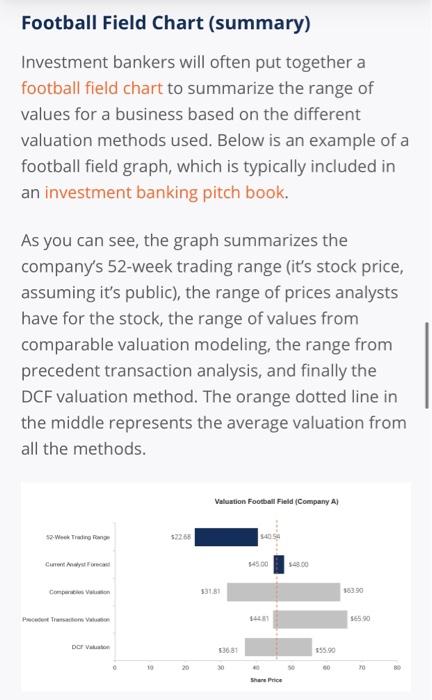

What are the Main Valuation Methods? ? When valuing a company as a going concern, there are three main valuation methods used by industry practitioners: (1) DCF analysis, (2) comparable company analysis, and (3) precedent transactions. These are the most common methods of valuation used in investment banking, equity research, private equity, corporate development, mergers & acquisitions (M&A), leveraged buyouts (LBO), and most areas of finance. Valuing a business or asset Cost approach Market approach (relative value) Discounted cash flow (intrinsic value) approach Cost to build Public company comparables Forecast future cash flows Replacement cost Precedent transactions As shown in the diagram above, when valuing a business or asset, there are three different methods or approaches one can use. The Cost Approach looks at what it costs to rebuild or replace an asset. The cost approach method is useful in valuing real estate, such as commercial property, new construction or special use properties. It is not typically used by finance professionals to value a company that is a going concern. Next is the Market Approach, which is a form of relative valuation and frequently used in the industry. It includes Comparable Analysis and Precedent Transactions. Finally, the discounted cash flow (DCF) approach is a form of intrinsic valuation and is the most detailed and thorough approach to valuation modeling. We will describe the methods used in the Market and DCF approaches below. Method 1: Comparable Analysis ("Comps") Comparable company analysis (also called "trading multiples" or "peer group analysis" or "equity comps" or "public market multiples") is a relative valuation method in which you compare the current value of a business to other similar businesses by looking at trading multiples like P/E, EV/EBITDA, or other ratios. Multiples of EBITDA are the most common valuation method. The "comps" valuation method provides an observable value for the business, based on what other comparable companies are currently worth. Comps are the most widely used approach, as they are easy to calculate and always current. The logic follows that, if company X trades at a 10- times P/E ratio, and company Y has earnings of $2.50 per share, company Y's stock must be worth $25.00 per share (assuming the companies have similar attributes). Viction (FY ELDA Company Name Marketta Prie Natur SM 3043 ST10 thos ano 1 1702 213 22 Example Comps Table Method 2: Precedent Transactions Precedent transactions analysis is another form of relative valuation where you compare the company in question to other businesses that have recently been sold or acquired in the same industry. These transaction values include the take-over premium included in the price for which they were acquired. The values represent the en bloc value of a business. They are useful for M&A transactions, but can easily become stale-dated and no longer reflective of the current market as time passes. They are less commonly used than Comps or market trading multiples. Valuation EVSales EVEBITDA Date 01/24/2017 04/19/2016 04/10 2014 11/07 2014 15/01/2012 10/07/2011 Target Current Recente PastCo Historical LLP Old Group Dated Enterprises Transaction Value (SM) 2350 8.500 2.150 Buyers Average Limited Bohemen hustres Other Group Junior Enterprises Minate Company Micro Parten 80x 87x 13 23 3.1x 21 EVEBIT 112 12 x 12.1 130 215 132 325 150 23 10. Average Median 140x 12.9% 2.0 Example Transaction Analysis Method 3: DCF Analysis Discounted Cash Flow (DCF) analysis is an intrinsic value approach where an analyst forecasts the business' unlevered free cash flow into the future and discounts it back to today at the firm's Weighted Average cost of Capital (WACC). A DCF analysis is performed by building a financial model in Excel and requires an extensive amount of detail and analysis. It is the most detailed of the three approaches and requires the most estimates and assumptions. However, the effort required for preparing a DCF model will also often result in the most accurate valuation. A DCF model allows the analyst to forecast value based on different scenarios, and even perform a sensitivity analysis. For larger businesses, the DCF value is commonly a sum-of-the-parts analysis, where different business units are modeled individually and added together. To learn more, see CFI's DCF model infographic ) DCF Valuation Model Football Field Chart (summary) Investment bankers will often put together a football field chart to summarize the range of values for a business based on the different valuation methods used. Below is an example of a football field graph, which is typically included in an investment banking pitch book. As you can see, the graph summarizes the company's 52-week trading range (it's stock price, assuming it's public), the range of prices analysts have for the stock, the range of values from comparable valuation modeling, the range from precedent transaction analysis, and finally the DCF valuation method. The orange dotted line in the middle represents the average valuation from all the methods. Valuation Football Field (Company A) So-Week Trading Pong $2258 Current Any Forecast 34500 15390 Precedent Transaction $65.90 DET V 53681 555.90 20 00 Share Price Use one of the methods in the pictures mentioned to valuate a company that operates three food trucks in Abu Dhabi. They have been in operation for 5 years with annual growth of 10% and their annual revenue is 1000 000 AED and profit margin 10%. Justify your answer.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started