Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Valuation using APV: (5 points) Propel Corporation plans to make a $75 million investment, funded completely with debt, for a new 3-year project. The

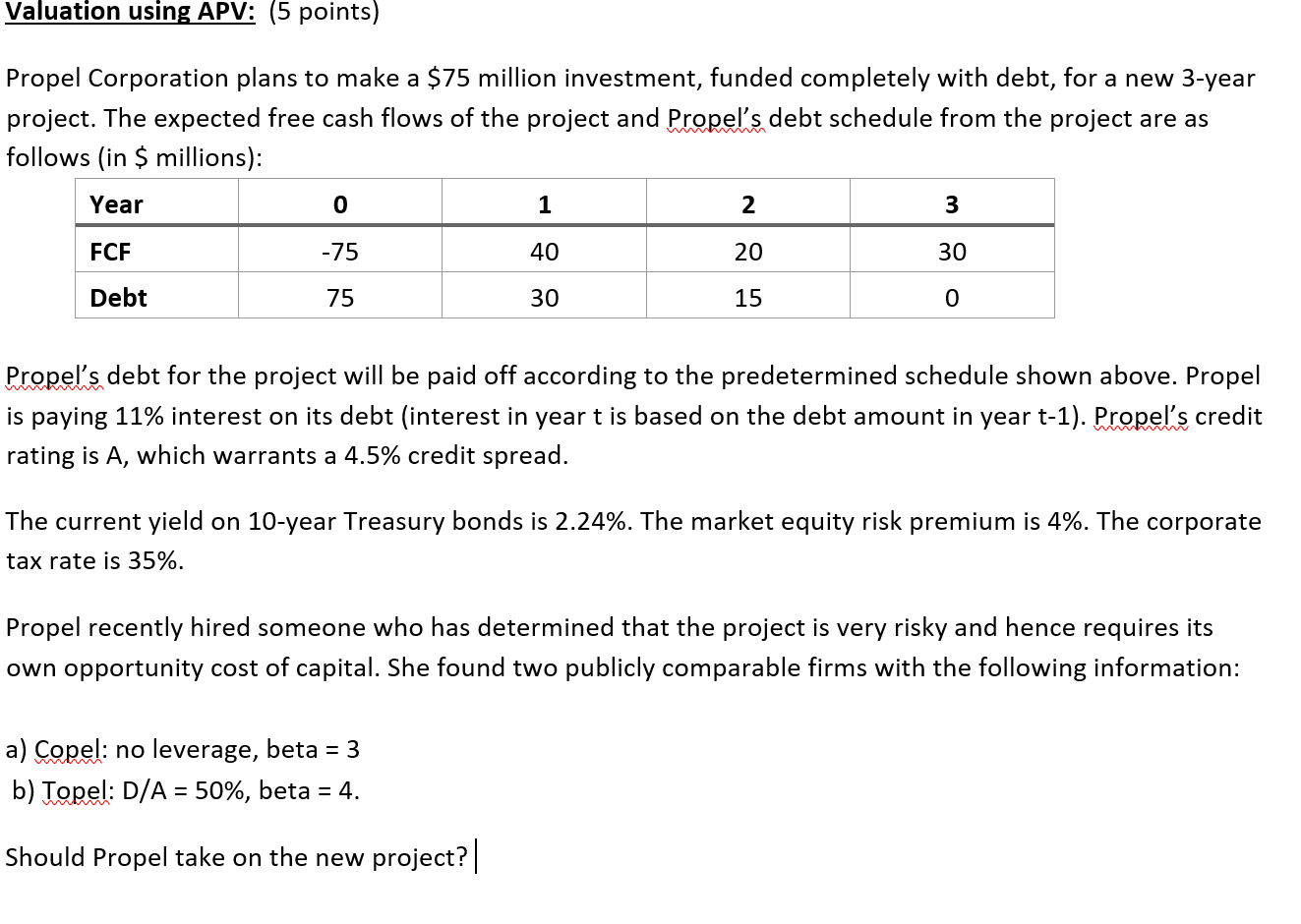

Valuation using APV: (5 points) Propel Corporation plans to make a $75 million investment, funded completely with debt, for a new 3-year project. The expected free cash flows of the project and Propel's debt schedule from the project are as follows (in $ millions): Year FCF Debt 0 1 2 3 -75 40 75 30 20 15 30 0 Propel's debt for the project will be paid off according to the predetermined schedule shown above. Propel is paying 11% interest on its debt (interest in year t is based on the debt amount in year t-1). Propel's credit rating is A, which warrants a 4.5% credit spread. The current yield on 10-year Treasury bonds is 2.24%. The market equity risk premium is 4%. The corporate tax rate is 35%. Propel recently hired someone who has determined that the project is very risky and hence requires its own opportunity cost of capital. She found two publicly comparable firms with the following information: a) Copel: no leverage, beta = 3 b) Topel: D/A = 50%, beta = 4. Should Propel take on the new project? |

Step by Step Solution

★★★★★

3.46 Rating (162 Votes )

There are 3 Steps involved in it

Step: 1

To evaluate whether Propel should take on the new project we can use the Adjusted Present Value APV ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 2 attachments)

664232abacc53_984564.pdf

180 KBs PDF File

664232abacc53_984564.docx

120 KBs Word File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started