Question

Valuation: Value Max (Pty) Ltd. performed the valuation on both land and buildings in November 2022. They issued a tax invoice of R25 000 to

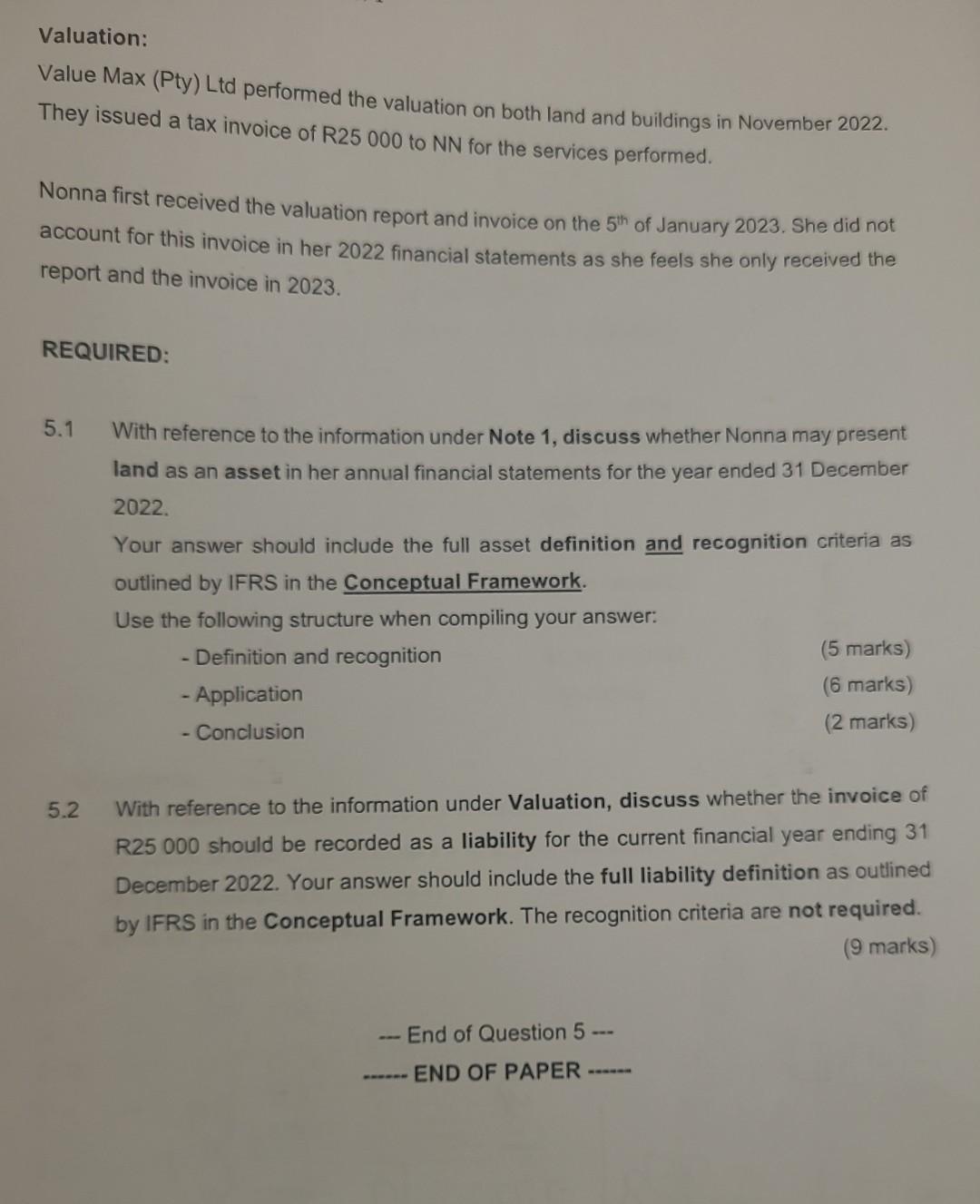

Valuation:

Value Max (Pty) Ltd. performed the valuation on both land and buildings in November 2022. They issued a tax invoice of R25 000 to NN for services performed.

Nonna first received the valuation report and invoice on the 5th of January 2023. She did not account for this invoice in her 2022 financial statements as she feels she only received the report and the invoice in 2023.

Required

With reference to the information under Note1, discuss whether Nonna may present land as an asset in her annual financial statements for the year ended 31 December 2022. Your answer should include the full asset definition and recognition criteria as outlined by IFRS in the Conceptual Framework.

Use the following structure when compiling your answer:

Definition of recognition

Application

Conclusion

With reference to the information under valuation, discuss whether the invoice of R25 000 should be recorded as a liability for the current financial year ending 31 December 2022. Your answer should include the full liability definition as outlined by IFRS in the Conceptual Framework. The recognition criteria are not required.

Valuation: Value Max (Pty) Ltd performed the valuation on both land and buildings in November 2022. They issued a tax invoice of R25 000 to NN for the services performed. Nonna first received the valuation report and invoice on the 5th of January 2023. She did not account for this invoice in her 2022 financial statements as she feels she only received the report and the invoice in 2023. REQUIRED: 5.1 With reference to the information under Note 1, discuss whether Nonna may present land as an asset in her annual financial statements for the year ended 31 December 2022. Your answer should include the full asset definition and recognition criteria as outlined by IFRS in the Conceptual Framework. Use the following structure when compiling your answer: - Definition and recognition ( 5 marks) - Application ( 6 marks) - Conclusion (2 marks) 5.2 With reference to the information under Valuation, discuss whether the invoice of R25 000 should be recorded as a liability for the current financial year ending 31 December 2022. Your answer should include the full liability definition as outlined by IFRS in the Conceptual Framework. The recognition criteria are not required. (9 marks) - End of Question 5 --. ..... END OF PAPERStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started