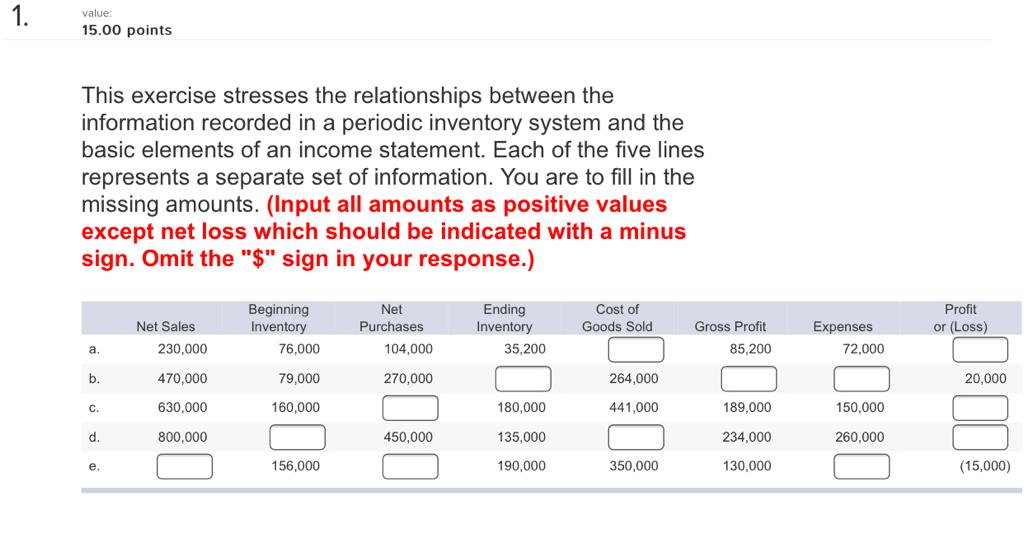

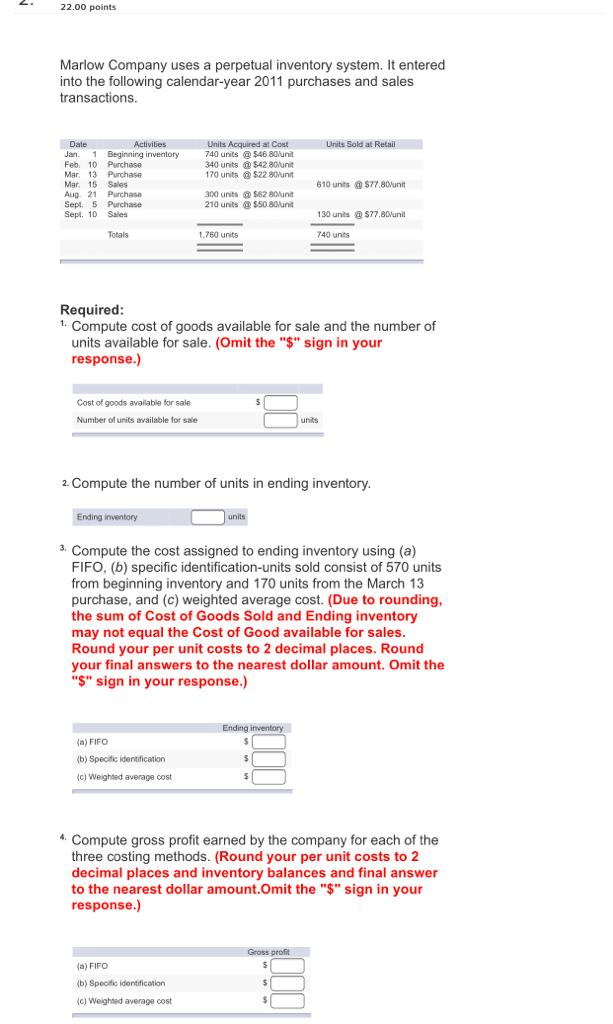

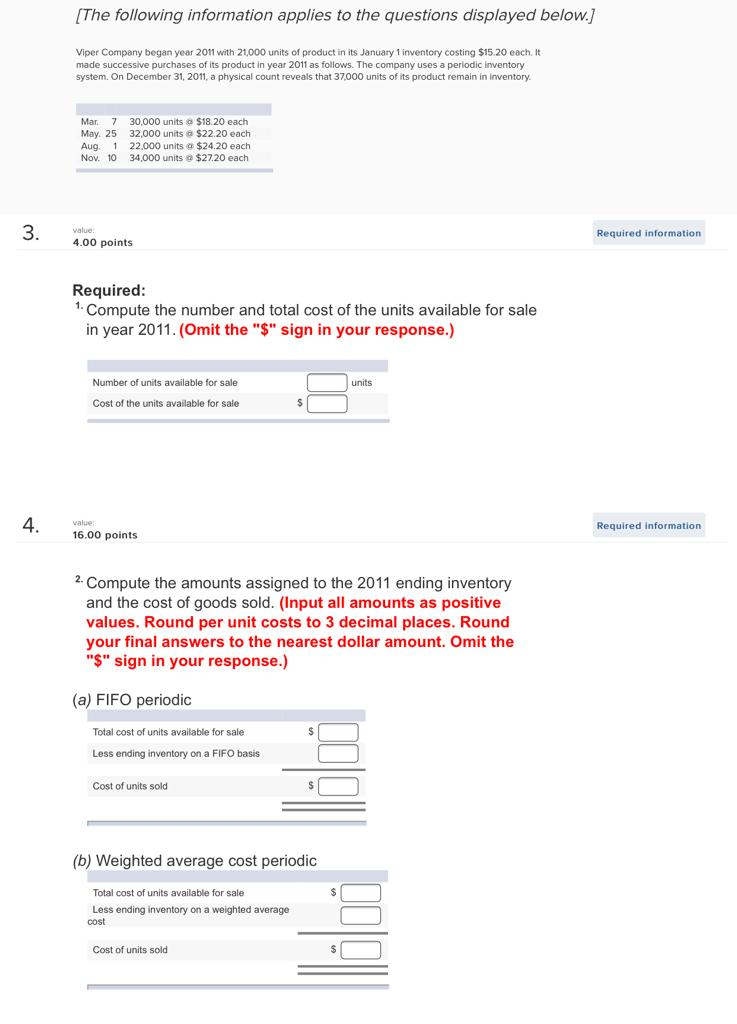

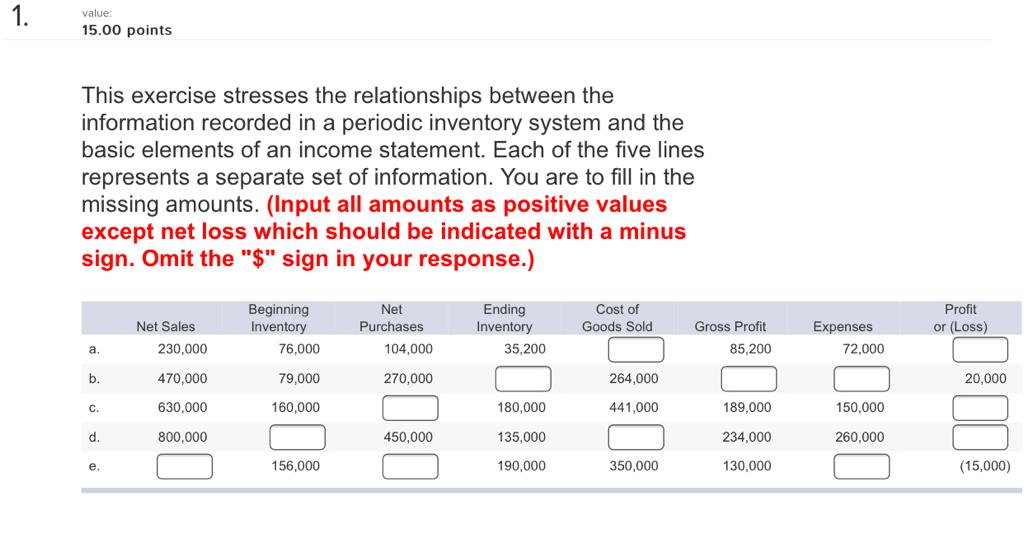

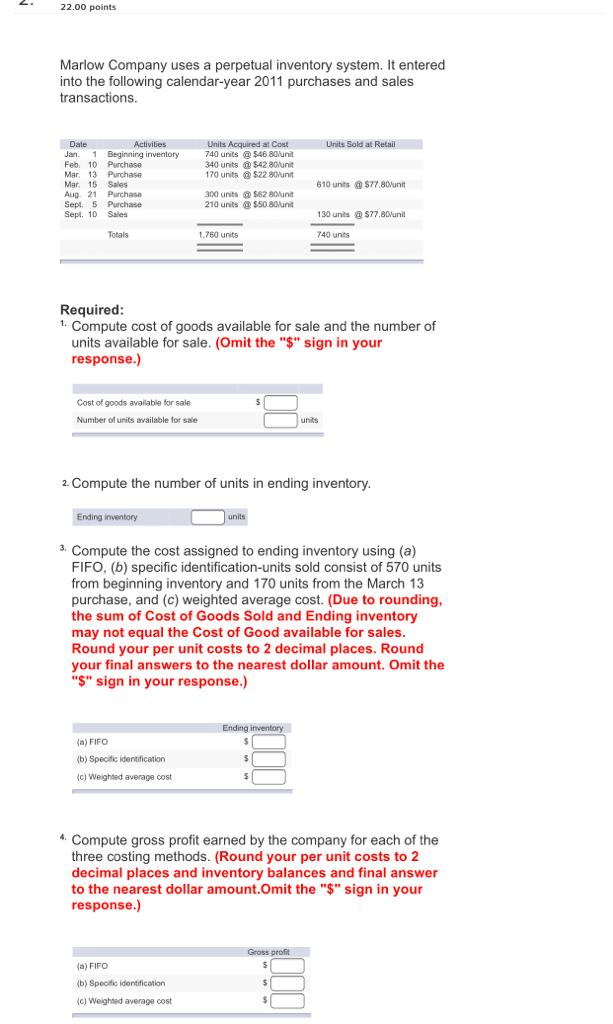

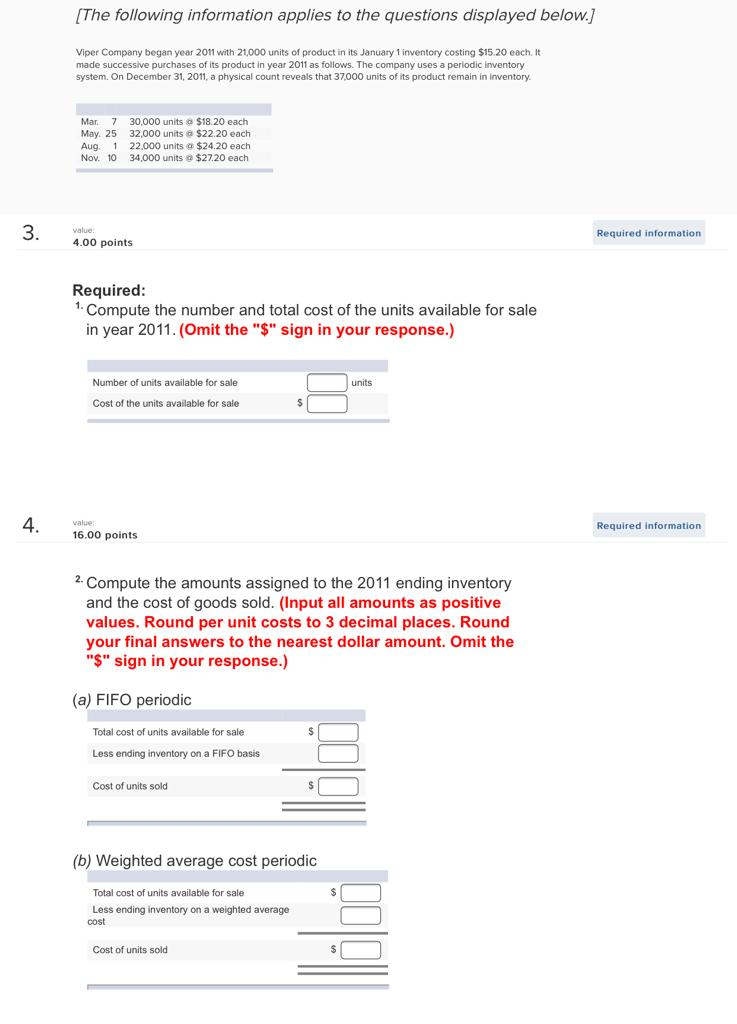

value: 15.00 points This exercise stresses the relationships between the information recorded in a periodic inventory system and the basic elements of an income statement. Each of the five lines represents a separate set of information. You are to fill in the missing amounts. (Input all amounts as positive values except net loss which should be indicated with a minus sign. Omit the "$" sign in your response.) Beginning Inventory 76,000 Net Purchases 104,000 Net Sales 230,000 Ending Inventory 35,200 Cost of Goods Sold Profit or (Loss) Gross Profit 85,200 Expenses 72,000 a. 79,000 270,000 20,000 470,000 630,000 264,000 441,000 160,000 180,000 189,000 150,000 800,000 450,000 234.000 260,000 135,000 190,000 156,000 350,000 130,000 (15,000) 22.00 points Marlow Company uses a perpetual inventory system. It entered into the following calendar-year 2011 purchases and sales transactions Units Sold at Retail Units Acquired at Cost 740 units 566 80/unit 340 units 542 80/unit 170 units $22.90 unit Date Activities Jan 1 Beginning inventory Feb 10 Purchase Mar 13 Purchase Mar 15 Sales Aug 21 Purchase Sept. 5 Purchase Sept. 10 Sales 610 unts @ 577 80/unit 300 units 5628 210 units @ $50.80 unit 130 units @ $77.80/unit Totals 1.750 units 740 units Required: Compute cost of goods available for sale and the number of units available for sale. (Omit the "$" sign in your response.) Cost of goods available for sale Number of units available for sale 2. Compute the number of units in ending inventory Ending inventory units > Compute the cost assigned to ending inventory using (a) FIFO, (b) specific identification-units sold consist of 570 units from beginning inventory and 170 units from the March 13 purchase, and (c) weighted average cost. (Due to rounding, the sum of Cost of Goods Sold and Ending inventory may not equal the Cost of Good available for sales. Round your per unit costs to 2 decimal places. Round your final answers to the nearest dollar amount. Omit the "$" sign in your response.) (a) FIFO (b) Specific identification (c) Weighted average cost 4. Compute gross profit earned by the company for each of the three costing methods. (Round your per unit costs to 2 decimal places and inventory balances and final answer to the nearest dollar amount.Omit the "$" sign in your response.) Gross profil (a) FIFO (b) Specific identification (c) Weighted average cost [The following information applies to the questions displayed below.) Viper Company began year 2011 with 21,000 units of product in its January 1 inventory costing $15.20 each. It made successive purchases of its product in year 2011 as follows. The company uses a periodic Inventory system. On December 31, 2011, a physical count reveals that 37,000 units of its product remain in Inventory Mar. 7 May, 25 Aug. 1 Nov. 10 30,000 units a $18.20 each 32,000 units a $22.20 each 22.000 units $24.20 each 34,000 units $27.20 each 3. value: 4.00 points Required information Required: 1. Compute the number and total cost of the units available for sale in year 2011. (Omit the "$" sign in your response.) Number of units available for sale units Cost of the units available for sale 4. value Required information 16.00 points 2. Compute the amounts assigned to the 2011 ending inventory and the cost of goods sold. (Input all amounts as positive values. Round per unit costs to 3 decimal places. Round your final answers to the nearest dollar amount. Omit the "$" sign in your response.) (a) FIFO periodic Total cost of units available for sale Less ending inventory on a FIFO basis Cost of units sold (b) Weighted average cost periodic Total cost of units available for sale Less ending inventory on a weighted average cost Cost of units sold