Question

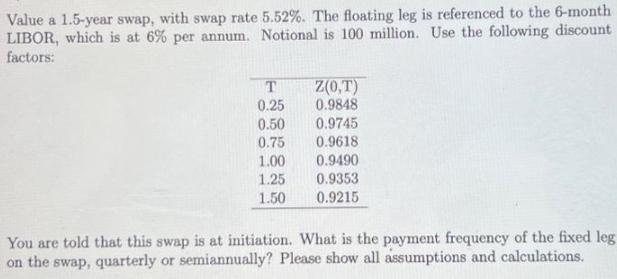

Value a 1.5-year swap, with swap rate 5.52%. The floating leg is referenced to the 6-month LIBOR, which is at 6% per annum. Notional

Value a 1.5-year swap, with swap rate 5.52%. The floating leg is referenced to the 6-month LIBOR, which is at 6% per annum. Notional is 100 million. Use the following discount factors: T 0.25 0.50 0.75 1.00 1.25 1.50 Z(0,T) 0.9848 0.9745 0.9618 0.9490 0.9353 0.9215 You are told that this swap is at initiation. What is the payment frequency of the fixed leg on the swap, quarterly or semiannually? Please show all assumptions and calculations.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To determine the payment frequency of the fixed leg on the swap we need to compare th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get StartedRecommended Textbook for

Value at Risk The New Benchmark for Managing Financial Risk

Authors: Philippe Jorion

3rd edition

0070700427, 71464956, 978-0071464956

Students also viewed these Finance questions

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

Question

Answered: 1 week ago

View Answer in SolutionInn App