Question

Value Novartis shares using Discounted Cash Flow Valuation Method. Clearly state major assumptions regarding cash flow projections, terminal value calculations and discount rate. Use required

Value Novartis shares using Discounted Cash Flow Valuation Method. Clearly state major assumptions regarding cash flow projections, terminal value calculations and discount rate. Use required return on equity of 8.5%. D

o you think Novartis shares are fairly valued?

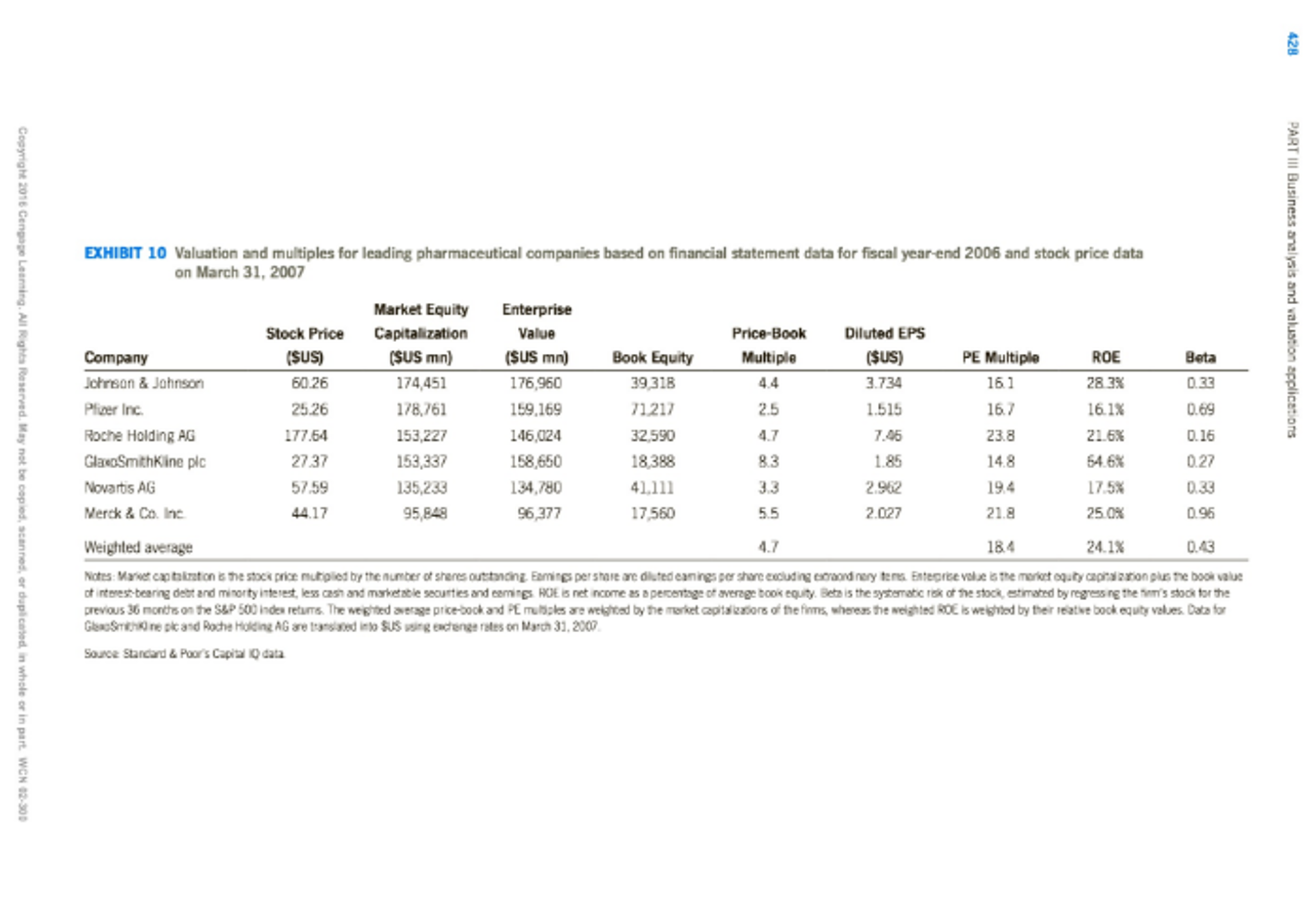

Based on your analysis, what assumptions was the market making about Novartis future performance?

Include valuation summary for question as a one-page appendix. Use graphs/charts/tables to emphasize your arguments.

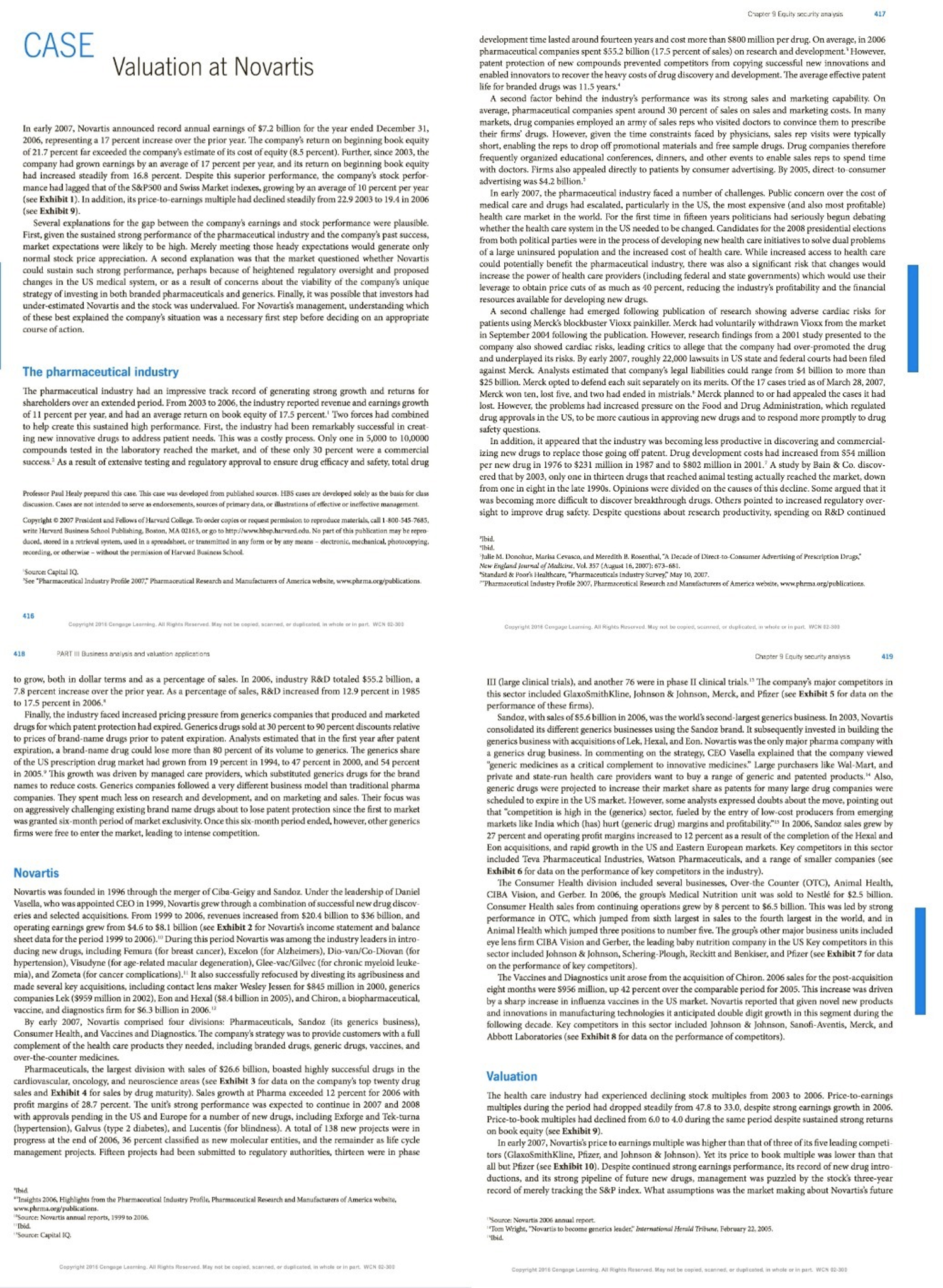

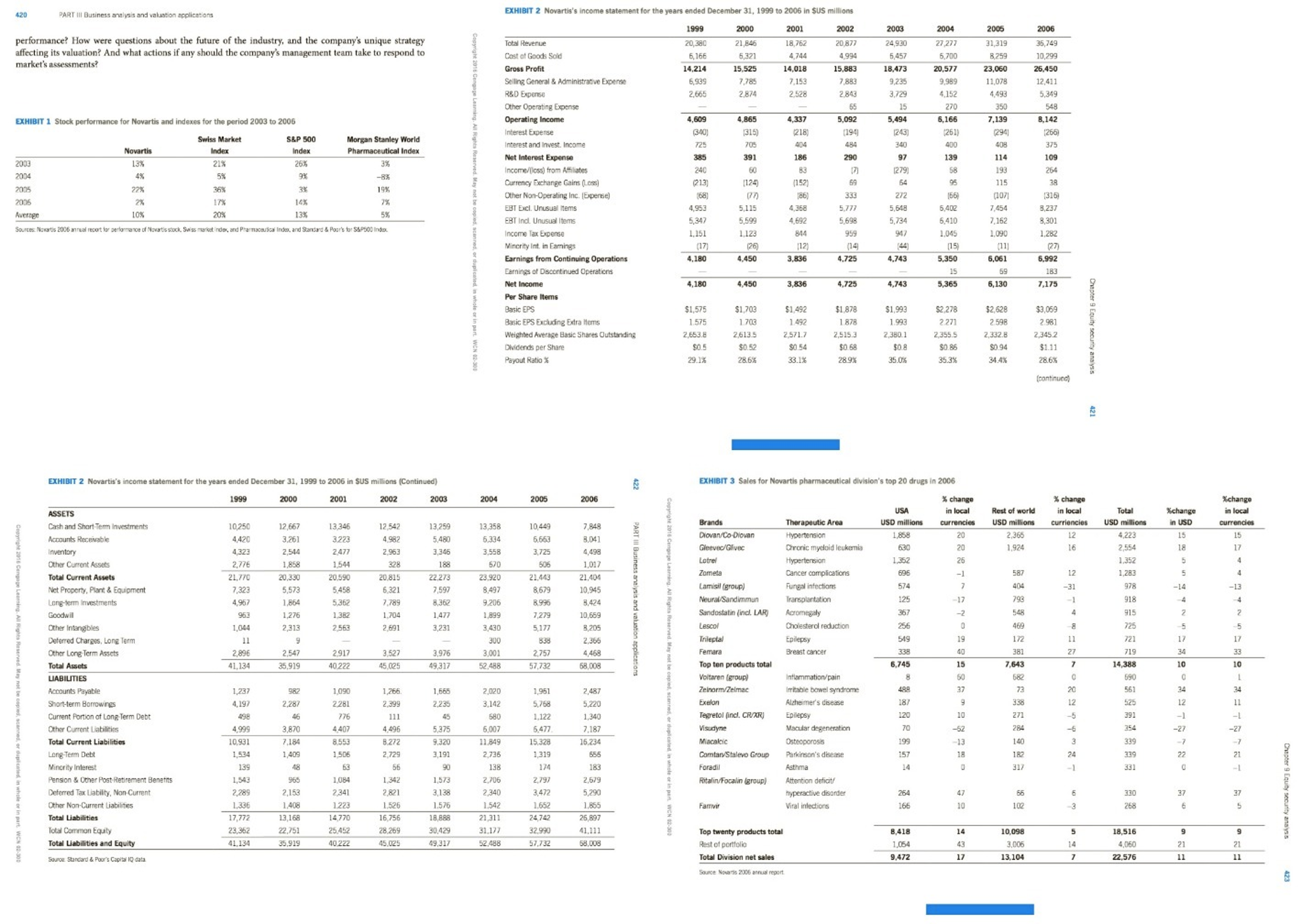

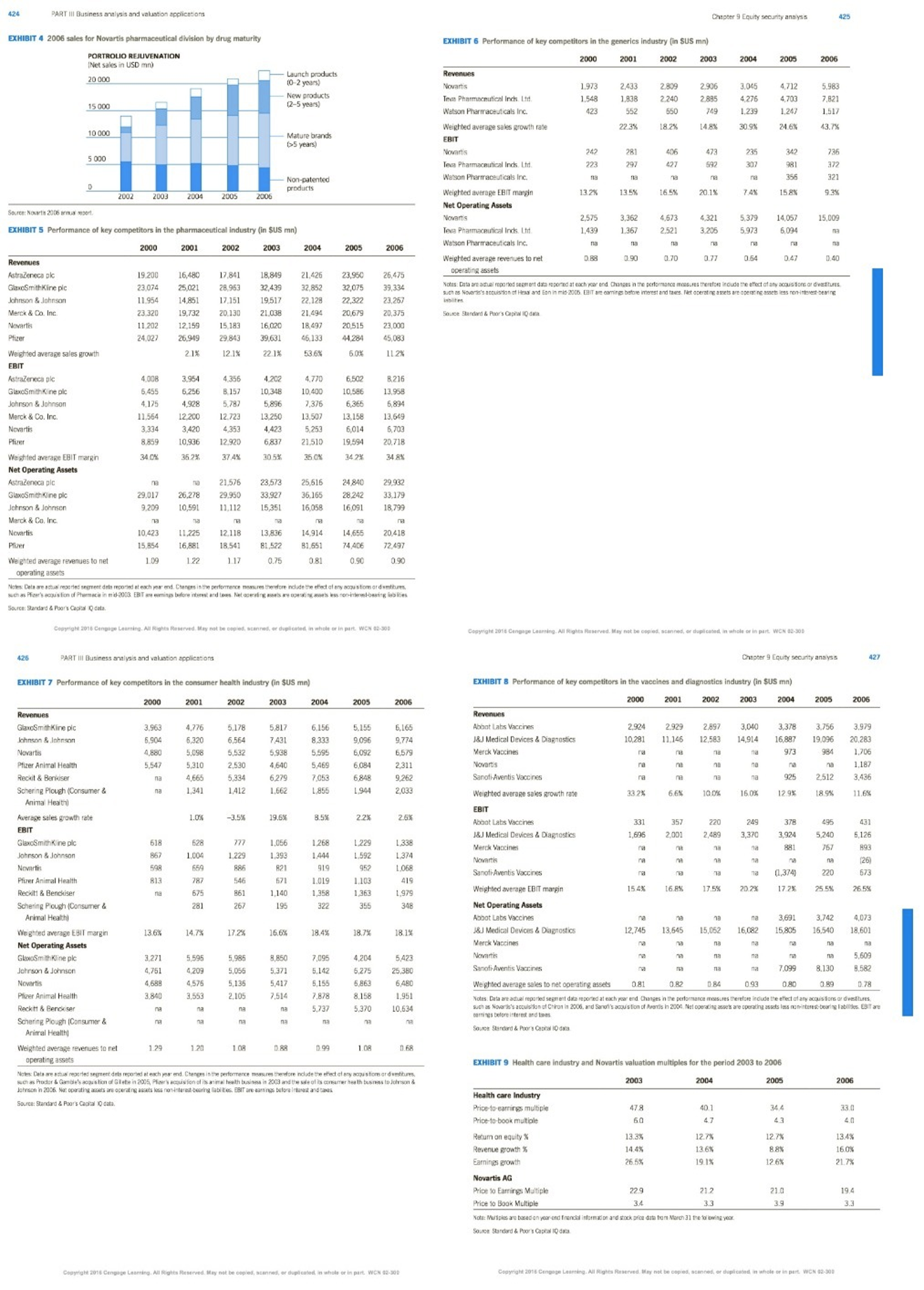

Please find the case below:

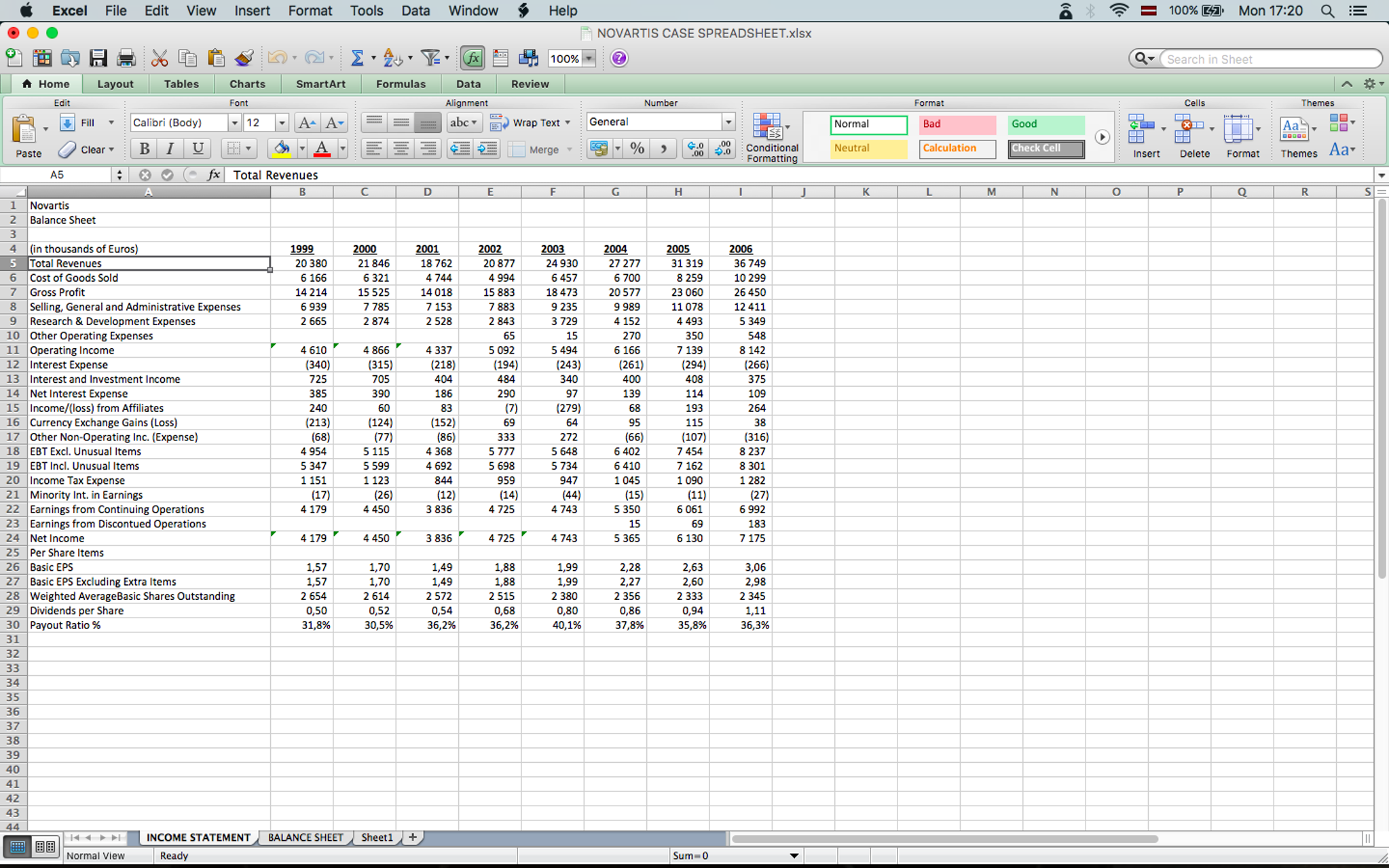

Please find the screenshot of the spreadsheet below:

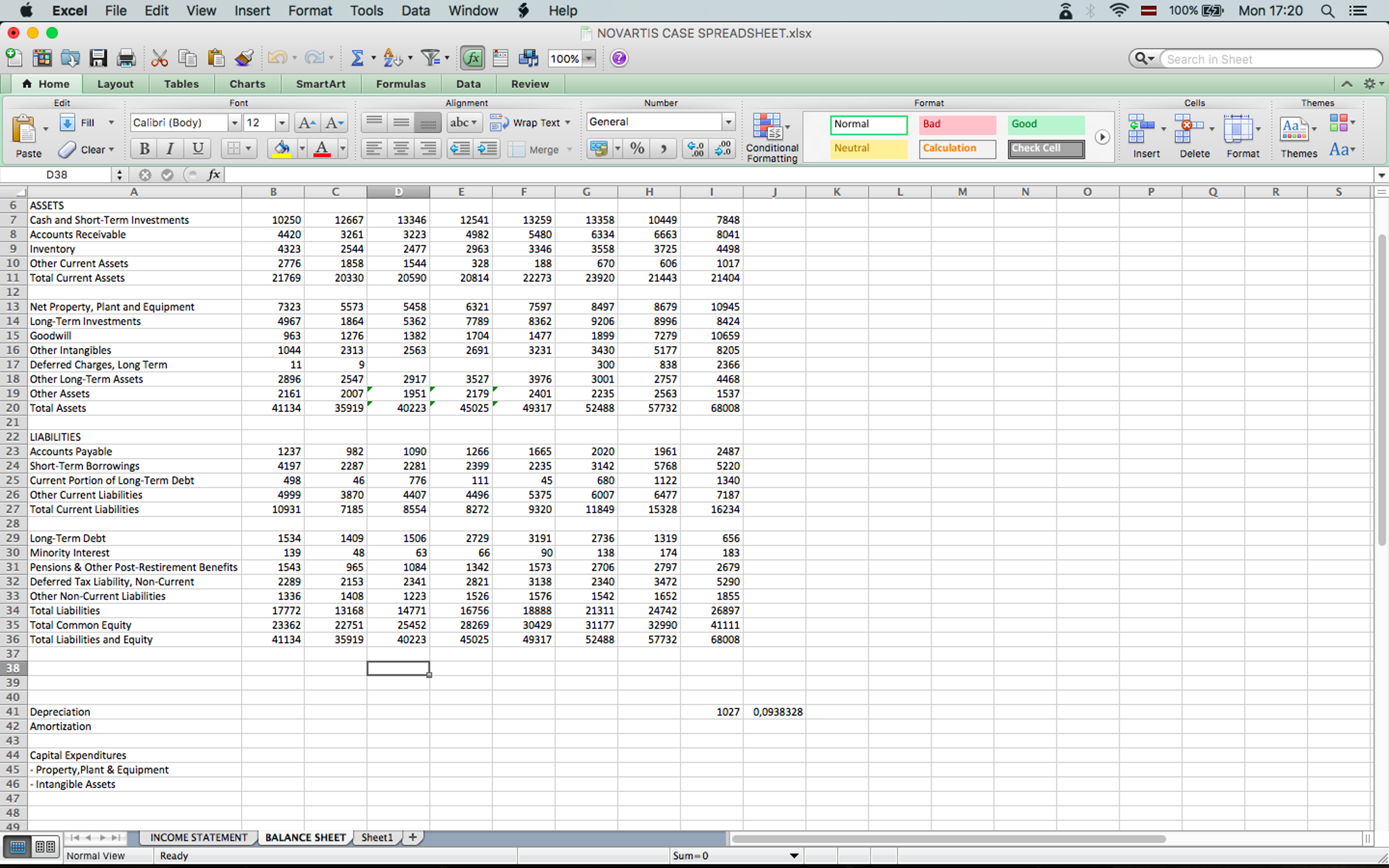

Please find the screenshot of the spreadsheet below:

Also, here's a link to it: https://failiem.lv/u/kckmn2kd

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started