Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Value of a mixed stream Harte Systems, Inc., a maker of electronic surviance equipment is considering seling the rights to market is home security system

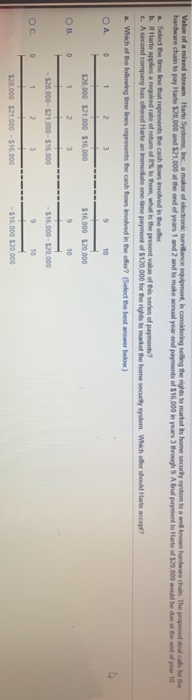

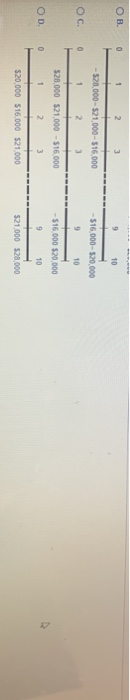

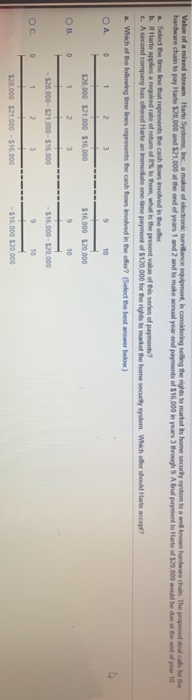

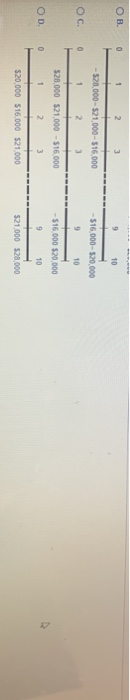

Value of a mixed stream Harte Systems, Inc., a maker of electronic surviance equipment is considering seling the rights to market is home security system to a well known hardware chain. The proposed deals for the hardware chain to pay Harte 528,000 and 521,000 at the end of years 1 and 2 and to make annual year end payments of S16,000 in years through 9 A final payment to Hate of $20.000 would be due at the end of year to a. Seled the timeline that represents the cash flows involved in the offer b. If Harte applies a required rate of return of to them, what is the present value of this series of payments? c. A second company has ofered Harte an immediate one time payment of $120,000 for the rights to market the home security system. Which offer should Hate accept? Which of the following timelines represents the cash flows involved in the offer? (Select the best answer below) 2 3 9 10 528,000 521.000 $16000 516 000 520 000 OB 0 1 10 $28,000 - 521.000-516,000 -516,000 - 520,000 Oc 0 528.000 521.000 - 516,000 - $16.000 520.000 . 0 10 000 98-000 es - 000 nes 000 ocs - 000 98 . 10 328,000 21,000 - 316 000 -516 000 520 000 OD 10 520,000 $16,000 $21,000 S21,000 528,000

Value of a mixed stream Harte Systems, Inc., a maker of electronic surviance equipment is considering seling the rights to market is home security system to a well known hardware chain. The proposed deals for the hardware chain to pay Harte 528,000 and 521,000 at the end of years 1 and 2 and to make annual year end payments of S16,000 in years through 9 A final payment to Hate of $20.000 would be due at the end of year to a. Seled the timeline that represents the cash flows involved in the offer b. If Harte applies a required rate of return of to them, what is the present value of this series of payments? c. A second company has ofered Harte an immediate one time payment of $120,000 for the rights to market the home security system. Which offer should Hate accept? Which of the following timelines represents the cash flows involved in the offer? (Select the best answer below) 2 3 9 10 528,000 521.000 $16000 516 000 520 000 OB 0 1 10 $28,000 - 521.000-516,000 -516,000 - 520,000 Oc 0 528.000 521.000 - 516,000 - $16.000 520.000 . 0 10 000 98-000 es - 000 nes 000 ocs - 000 98 . 10 328,000 21,000 - 316 000 -516 000 520 000 OD 10 520,000 $16,000 $21,000 S21,000 528,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started