Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Value the firm using the discounted cash flows method (includes building a forecast and calculating the discount rat Facebook Income Statement (in millions, except per

Value the firm using the discounted cash flows method (includes building a forecast and calculating the discount rat

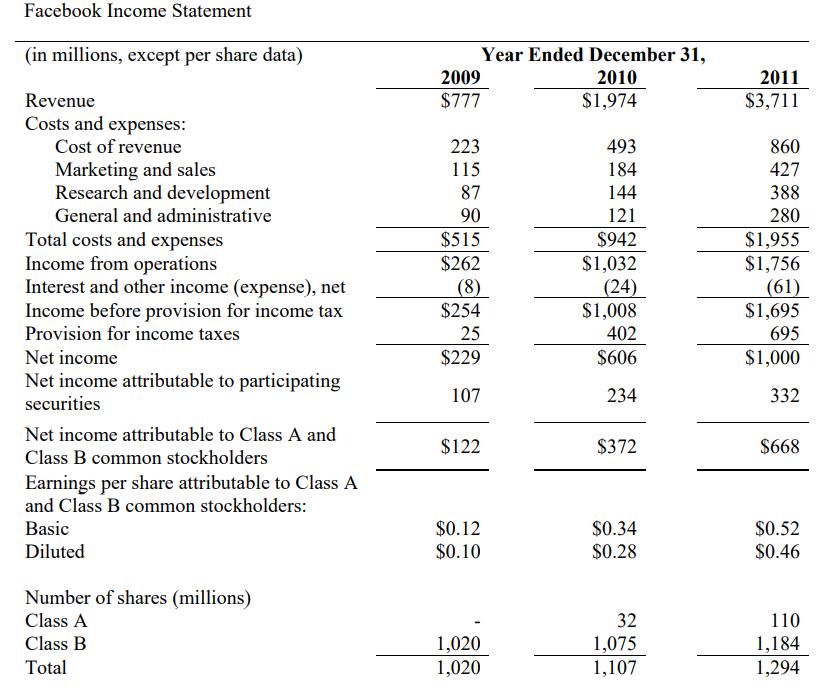

Facebook Income Statement (in millions, except per share data) Revenue Costs and expenses: Cost of revenue Marketing and sales Research and development General and administrative Total costs and expenses Income from operations Interest and other income (expense), net Income before provision for income tax Provision for income taxes Net income Net income attributable to participating securities Net income attributable to Class A and Class B common stockholders Earnings per share attributable to Class A and Class B common stockholders: Basic Diluted Number of shares (millions) Class A Class B Total Year Ended December 31, 2010 $1,974 2009 $777 223 115 87 90 $515 $262 (8) $254 25 $229 107 $122 $0.12 $0.10 1,020 1,020 493 184 144 121 $942 $1,032 (24) $1,008 402 $606 234 $372 $0.34 $0.28 32 1,075 1,107 2011 $3,711 860 427 388 280 $1,955 $1,756 (61) $1,695 695 $1,000 332 $668 $0.52 $0.46 110 1,184 1,294

Step by Step Solution

★★★★★

3.44 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

Answer To value Facebook using the discounted cash flow DCF method we need to follow these steps 1 Forecast Facebooks future cash flows 2 Determine th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started