Question

Value the shares of subject-company as at the end of 2019 using the income approach by discounting the stream of Net Free Cash Flow to

Value the shares of subject-company as at the end of 2019 using the income approach by discounting the stream of Net Free Cash Flow to Invested Capital Benefits. Round to the nearest whole cent (i.e. $12.9876 would be written as 12.99). State on a per share basis. Use the mid-year discounting rule.

Assume the seed value to the perpetuity beginning in 2024 is Free Cash Flow to Invested Capital = 62,180 and that the perpetuity growth rate will be 3.7% annually. Cost of Equity is 10.18% and WACC is 8.14%. The appropriate tax rate for this problem is 25.50%. Shares outstanding at the valuation date equals 6,557. Assume the market value of interest bearing liabilities is $16,664 at the end of 2019. Also assume MVIC using End of Year discounting in December 31, 2019 dollars would equal $1,186,579.45.

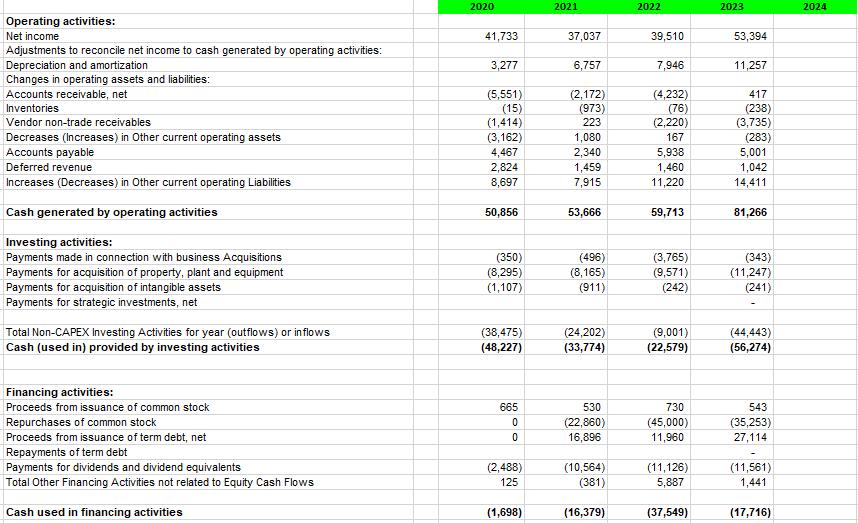

Operating activities: Net income Adjustments to reconcile net income to cash generated by operating activities: Depreciation and amortization Changes in operating assets and liabilities: Accounts receivable, net Inventories Vendor non-trade receivables Decreases (Increases) in Other current operating assets Accounts payable Deferred revenue Increases (Decreases) in Other current operating Liabilities Cash generated by operating activities Investing activities: Payments made in connection with business Acquisitions Payments for acquisition of property, plant and equipment Payments for acquisition of intangible assets Payments for strategic investments, net Total Non-CAPEX Investing Activities for year (outflows) or inflows Cash (used in) provided by investing activities Financing activities: Proceeds from issuance of common stock Repurchases of common stock Proceeds from issuar of term debt, net Repayments of term debt Payments for dividends and dividend equivalents Total Other Financing Activities not related to Equity Cash Flows Cash used in financing activities 2020 41,733 3,277 (5,551) (15) (1,414) (3,162) 4,467 2,824 8,697 50,856 (350) (8,295) (1,107) (38,475) (48,227) 665 0 (2,488) 125 (1,698) 2021 37,037 6,757 (2,172) (973) 223 1,080 2,340 1,459 7,915 53,666 (496) (8,165) (911) (24,202) (33,774) 530 (22,860) 16,896 (10,564) (381) (16,379) 2022 39,510 7,946 (4,232) (76) (2,220) 167 5,938 1,460 11,220 59,713 (3,765) (9,571) (242) (9,001) (22,579) 730 (45,000) 1,960 (11,126) 5,887 (37,549) 2023 53,394 11,257 417 (238) (3,735) (283) 5,001 1,042 14,411 81,266 (343) (11,247) (241) (44,443) (56,274) 543 (35,253) 27,114 (11,561) 1,441 (17,716) 2024

Step by Step Solution

3.57 Rating (175 Votes )

There are 3 Steps involved in it

Step: 1

The value of the shares of subjectcompany as at the end of 2019 is 45297 per share Here is the calcu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started