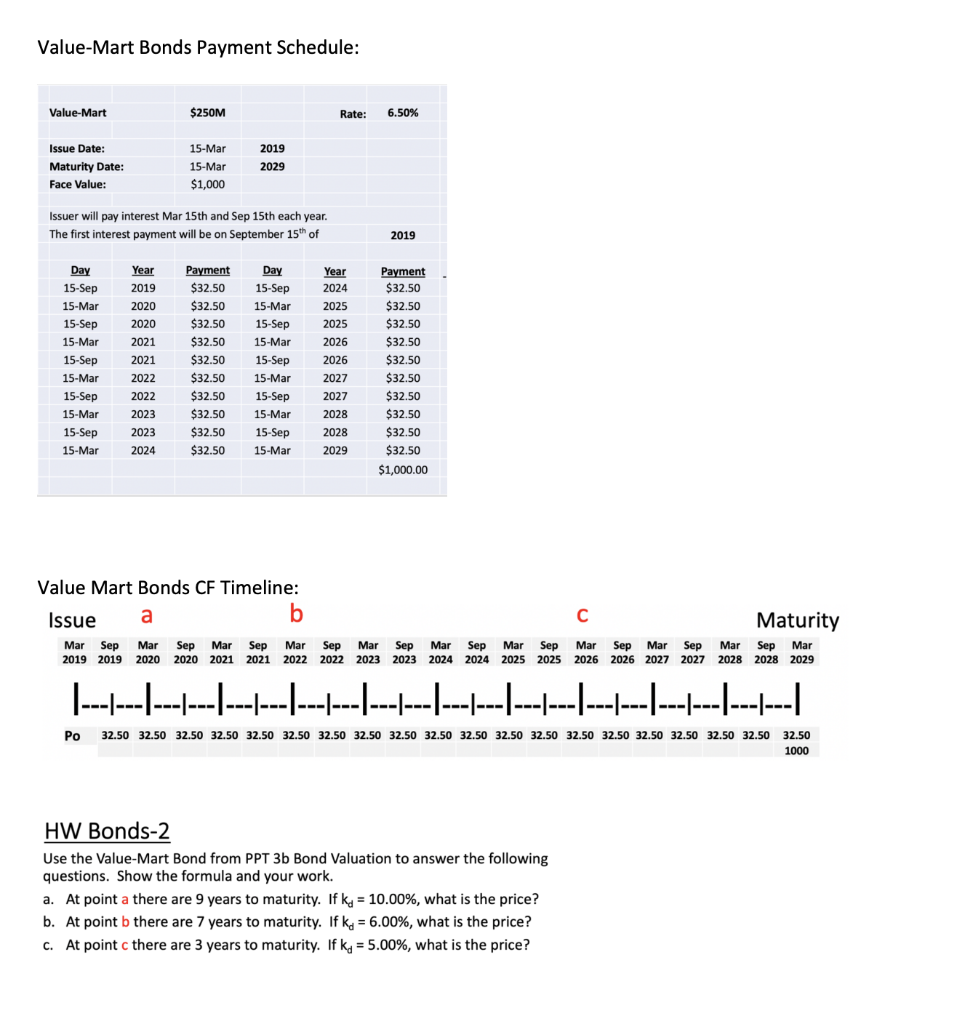

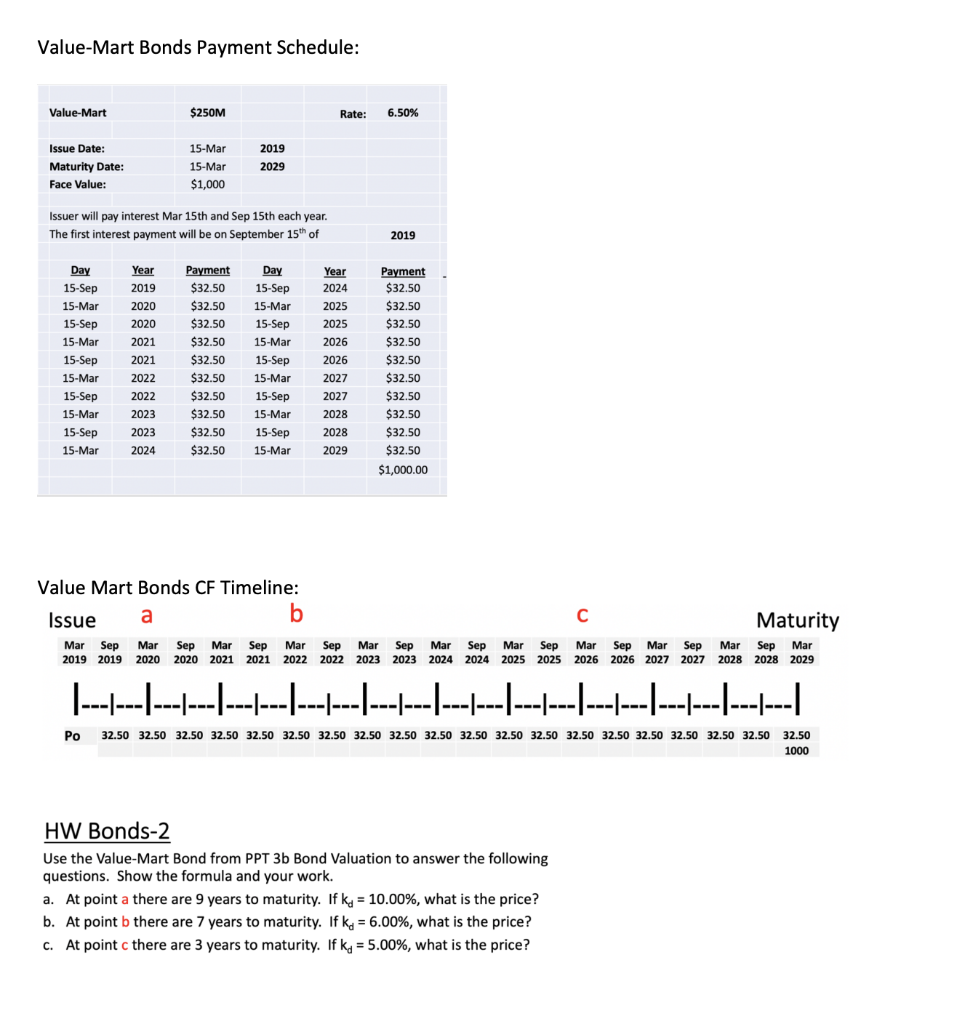

Value-Mart Bonds Payment Schedule: Value-Mart $250M Rate: 6.50% % 2019 Issue Date: Maturity Date: Face Value: 15-Mar 15-Mar $1,000 2029 Issuer will pay interest Mar 15th and Sep 15th each year. The first interest payment will be on September 15th of 2019 Day 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep - 15-Mar 15-Sep 15-Mar - Year 2019 2020 2020 2021 2021 2022 2022 2023 2023 2024 Payment $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 Day 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar Year 2024 2025 2025 2026 2026 2027 Payment $32.50 $32.50 $32.50 $32.50 $ $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $1,000.00 2027 2028 2028 2029 Value Mart Bonds CF Timeline: Issue a a b Maturity Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar 2019 2019 2020 2020 2021 2021 2022 2022 2023 2023 2024 2024 2025 2025 2026 2026 2027 2027 2028 2028 2029 |---|---|-------|-------|-------|------|-------|-------|------|-----|-------| Po 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 1000 HW Bonds-2 Use the Value-Mart Bond from PPT 3b Bond Valuation to answer the following questions. Show the formula and your work. a. At point a there are 9 years to maturity. If ks = 10.00%, what is the price? b. At point b there are 7 years to maturity. If ks = 6.00%, what is the price? c. At point c there are 3 years to maturity. If kg = 5.00%, what is the price? = Value-Mart Bonds Payment Schedule: Value-Mart $250M Rate: 6.50% % 2019 Issue Date: Maturity Date: Face Value: 15-Mar 15-Mar $1,000 2029 Issuer will pay interest Mar 15th and Sep 15th each year. The first interest payment will be on September 15th of 2019 Day 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep - 15-Mar 15-Sep 15-Mar - Year 2019 2020 2020 2021 2021 2022 2022 2023 2023 2024 Payment $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 Day 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar 15-Sep 15-Mar Year 2024 2025 2025 2026 2026 2027 Payment $32.50 $32.50 $32.50 $32.50 $ $32.50 $32.50 $32.50 $32.50 $32.50 $32.50 $1,000.00 2027 2028 2028 2029 Value Mart Bonds CF Timeline: Issue a a b Maturity Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar Sep Mar 2019 2019 2020 2020 2021 2021 2022 2022 2023 2023 2024 2024 2025 2025 2026 2026 2027 2027 2028 2028 2029 |---|---|-------|-------|-------|------|-------|-------|------|-----|-------| Po 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 32.50 1000 HW Bonds-2 Use the Value-Mart Bond from PPT 3b Bond Valuation to answer the following questions. Show the formula and your work. a. At point a there are 9 years to maturity. If ks = 10.00%, what is the price? b. At point b there are 7 years to maturity. If ks = 6.00%, what is the price? c. At point c there are 3 years to maturity. If kg = 5.00%, what is the price? =