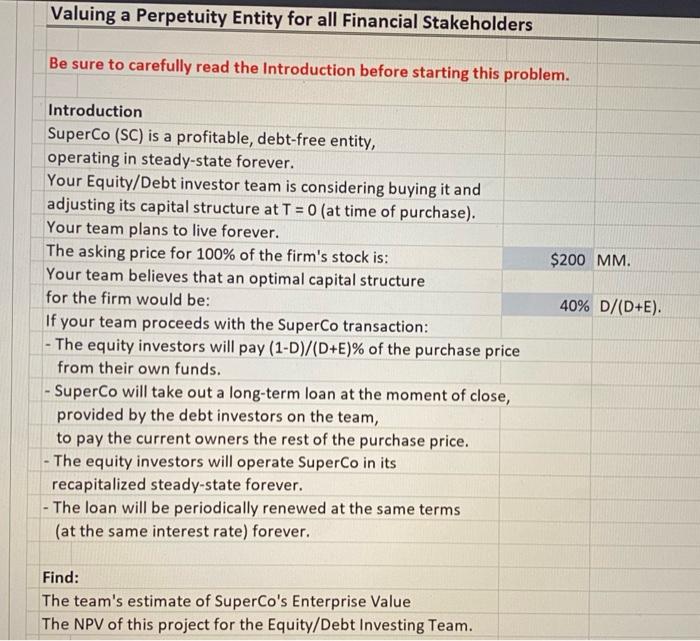

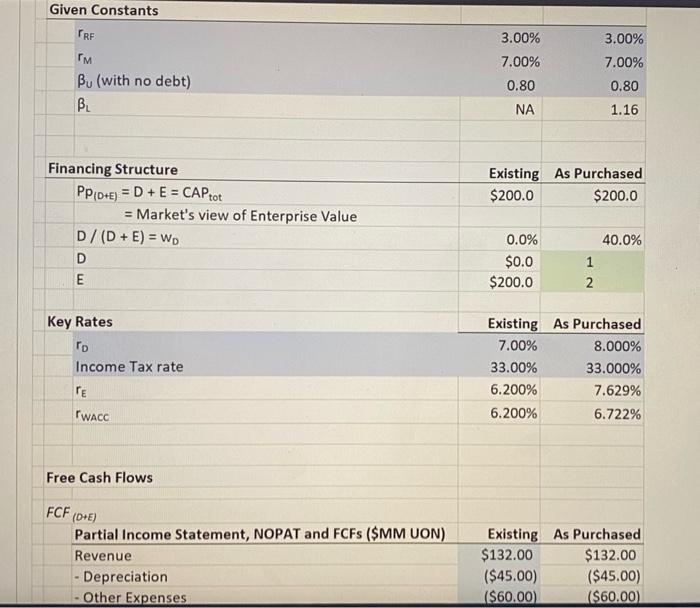

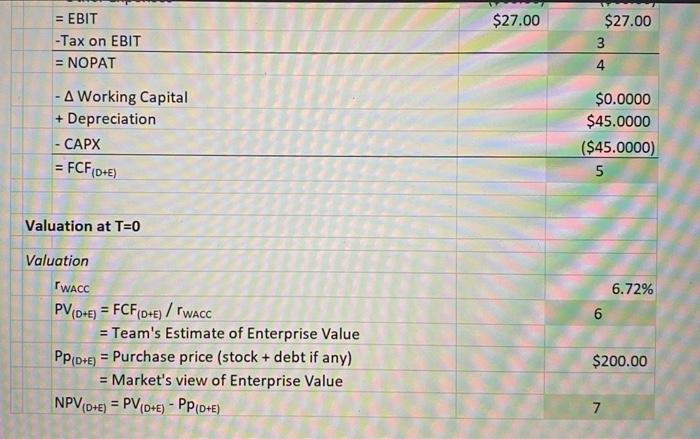

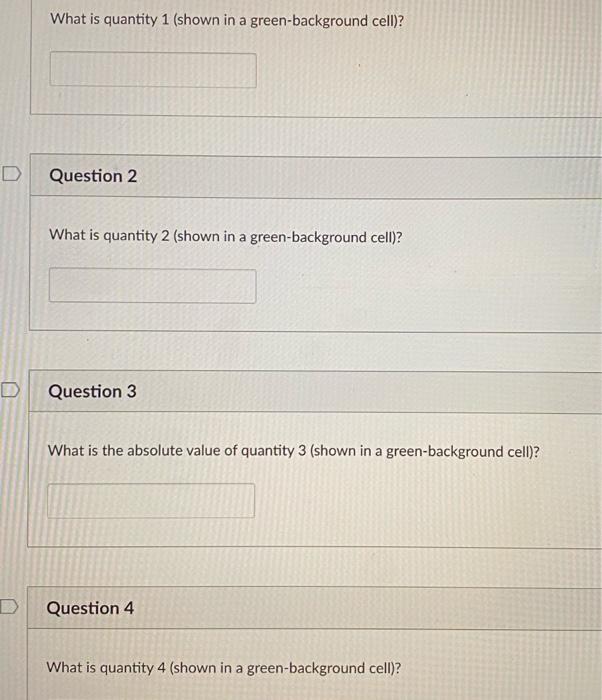

Valuing a Perpetuity Entity for all Financial Stakeholders Be sure to carefully read the Introduction before starting this problem. $200 MM 40% D/(D+E). Introduction SuperCo (SC) is a profitable, debt-free entity, operating in steady-state forever. Your Equity/Debt investor team is considering buying it and adjusting its capital structure at T = 0 (at time of purchase). Your team plans to live forever. The asking price for 100% of the firm's stock is: Your team believes that an optimal capital structure for the firm would be: If your team proceeds with the SuperCo transaction: - The equity investors will pay (1-D)/(D+E)% of the purchase price from their own funds. - SuperCo will take out a long-term loan at the moment of close, provided by the debt investors on the team, to pay the current owners the rest of the purchase price. The equity investors will operate SuperCo in its recapitalized steady-state forever. - The loan will be periodically renewed at the same terms (at the same interest rate) forever. Find: The team's estimate of SuperCo's Enterprise Value The NPV of this project for the Equity/Debt Investing Team. Given Constants FRE 3.00% 3.00% 7.00% 7.00% Bu (with no debt) BL 0.80 0.80 1.16 NA Existing As Purchased $200.0 $200.0 Financing Structure PPIDE) = D + E = CAPtot = Market's view of Enterprise Value D/(D + E) = WD D E 40.0% 0.0% $0.0 $200.0 1 2 Key Rates To Income Tax rate Existing As Purchased 7.00% 8.000% 33.00% 33.000% 6.200% 7.629% 6.200% 6.722% WACC Free Cash Flows FCF (D+E) Partial Income Statement, NOPAT and FCFS ($MM UON) Revenue Depreciation Other Expenses Existing As Purchased $132.00 $132.00 ($45.00) ($45.00) ($60.00) ($60.00) - $27.00 = EBIT -Tax on EBIT = NOPAT $27.00 3 4 A Working Capital + Depreciation - CAPX = FCF (DE) $0.0000 $45.0000 ($45.0000) 5 - Valuation at T=0 6.72% 6 Valuation WACC PV/DHE) = FCF D+E) / WACC = Team's Estimate of Enterprise Value PpkD+E) = Purchase price (stock + debt if any) = Market's view of Enterprise Value NPV(D+E) = PV(0) - PP(DE) $200.00 7 What is quantity 1 (shown in a green background cell)? Question 2 What is quantity 2 (shown in a green-background cell)? D Question 3 What is the absolute value of quantity 3 (shown in a green-background cell)? D Question 4 What is quantity 4 (shown in a green-background cell)? Valuing a Perpetuity Entity for all Financial Stakeholders Be sure to carefully read the Introduction before starting this problem. $200 MM 40% D/(D+E). Introduction SuperCo (SC) is a profitable, debt-free entity, operating in steady-state forever. Your Equity/Debt investor team is considering buying it and adjusting its capital structure at T = 0 (at time of purchase). Your team plans to live forever. The asking price for 100% of the firm's stock is: Your team believes that an optimal capital structure for the firm would be: If your team proceeds with the SuperCo transaction: - The equity investors will pay (1-D)/(D+E)% of the purchase price from their own funds. - SuperCo will take out a long-term loan at the moment of close, provided by the debt investors on the team, to pay the current owners the rest of the purchase price. The equity investors will operate SuperCo in its recapitalized steady-state forever. - The loan will be periodically renewed at the same terms (at the same interest rate) forever. Find: The team's estimate of SuperCo's Enterprise Value The NPV of this project for the Equity/Debt Investing Team. Given Constants FRE 3.00% 3.00% 7.00% 7.00% Bu (with no debt) BL 0.80 0.80 1.16 NA Existing As Purchased $200.0 $200.0 Financing Structure PPIDE) = D + E = CAPtot = Market's view of Enterprise Value D/(D + E) = WD D E 40.0% 0.0% $0.0 $200.0 1 2 Key Rates To Income Tax rate Existing As Purchased 7.00% 8.000% 33.00% 33.000% 6.200% 7.629% 6.200% 6.722% WACC Free Cash Flows FCF (D+E) Partial Income Statement, NOPAT and FCFS ($MM UON) Revenue Depreciation Other Expenses Existing As Purchased $132.00 $132.00 ($45.00) ($45.00) ($60.00) ($60.00) - $27.00 = EBIT -Tax on EBIT = NOPAT $27.00 3 4 A Working Capital + Depreciation - CAPX = FCF (DE) $0.0000 $45.0000 ($45.0000) 5 - Valuation at T=0 6.72% 6 Valuation WACC PV/DHE) = FCF D+E) / WACC = Team's Estimate of Enterprise Value PpkD+E) = Purchase price (stock + debt if any) = Market's view of Enterprise Value NPV(D+E) = PV(0) - PP(DE) $200.00 7 What is quantity 1 (shown in a green background cell)? Question 2 What is quantity 2 (shown in a green-background cell)? D Question 3 What is the absolute value of quantity 3 (shown in a green-background cell)? D Question 4 What is quantity 4 (shown in a green-background cell)