Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Valuing a Texas Vineyard ( Real Options ) You have been asked by an entrepreneur to value a potential vineyard in the Texas Hill Country,

Valuing a Texas Vineyard

Real Options

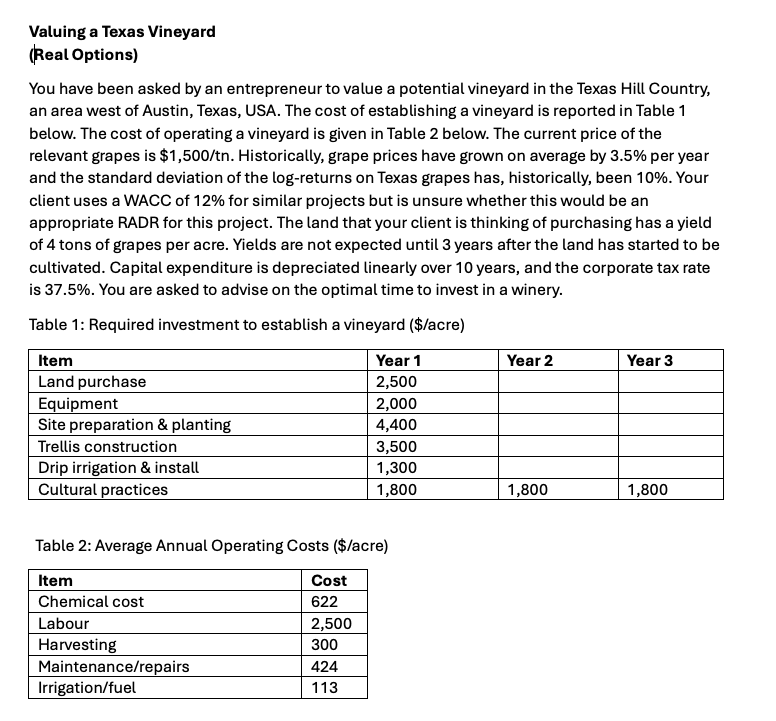

You have been asked by an entrepreneur to value a potential vineyard in the Texas Hill Country,

an area west of Austin, Texas, USA. The cost of establishing a vineyard is reported in Table

below. The cost of operating a vineyard is given in Table below. The current price of the

relevant grapes is $ Historically, grape prices have grown on average by per year

and the standard deviation of the logreturns on Texas grapes has, historically, been Your

client uses a WACC of for similar projects but is unsure whether this would be an

appropriate RADR for this project. The land that your client is thinking of purchasing has a yield

of tons of grapes per acre. Yields are not expected until years after the land has started to be

cultivated. Capital expenditure is depreciated linearly over years, and the corporate tax rate

is You are asked to advise on the optimal time to invest in a winery.

Table : Required investment to establish a vineyard $acre

Table : Average Annual Operating Costs $acre

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started