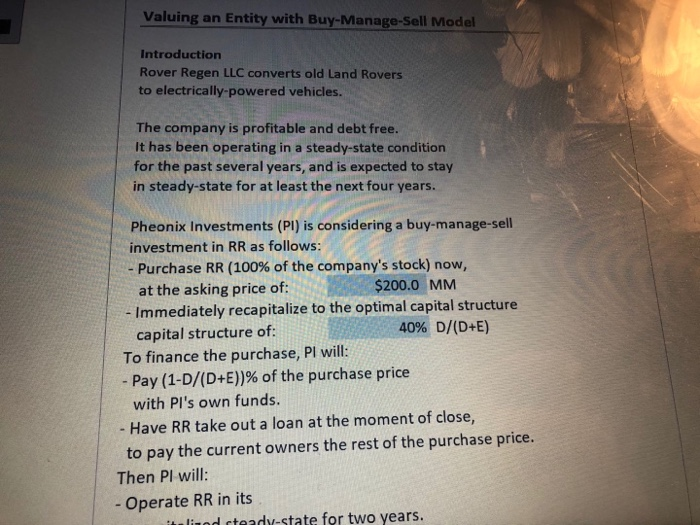

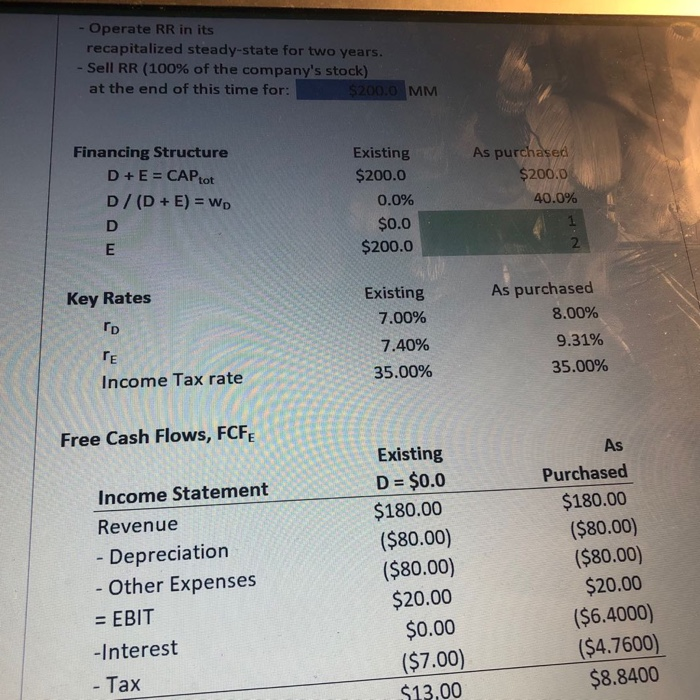

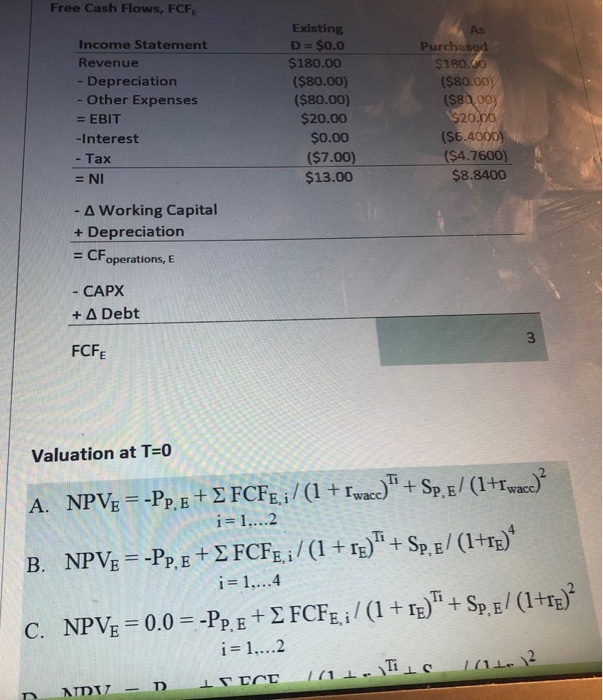

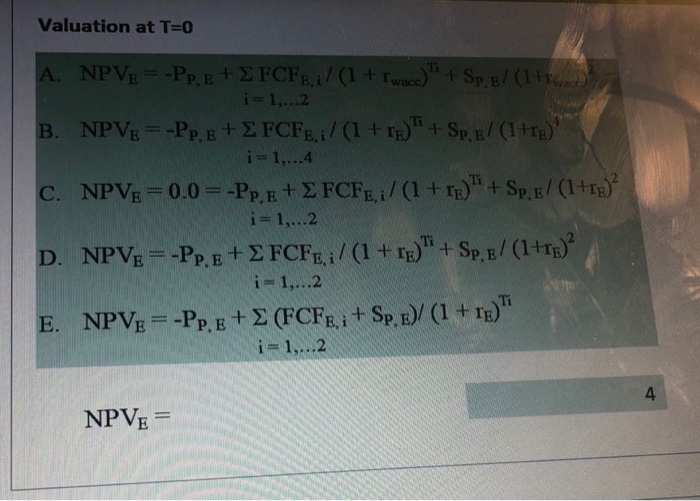

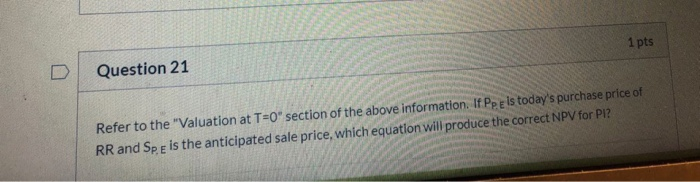

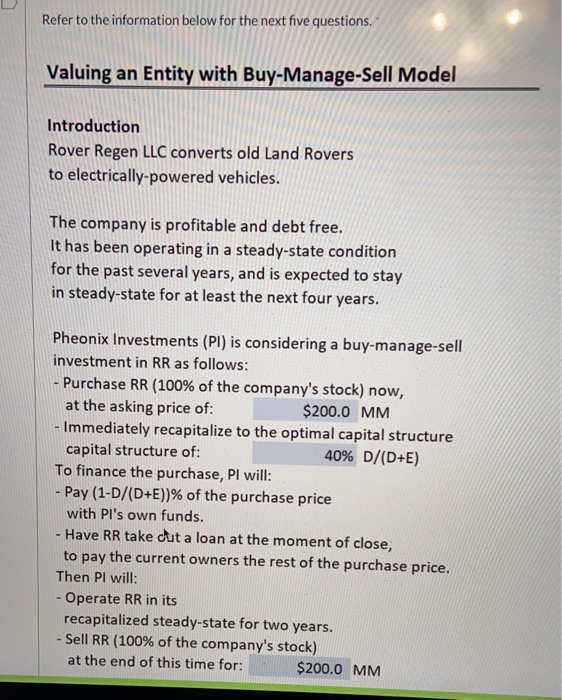

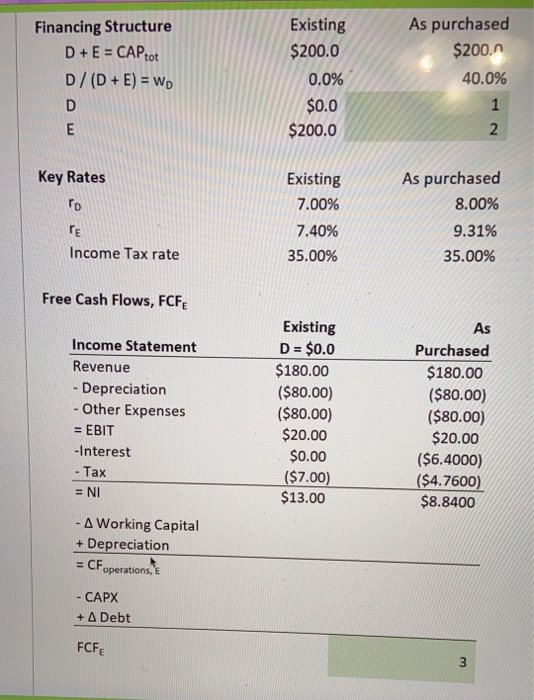

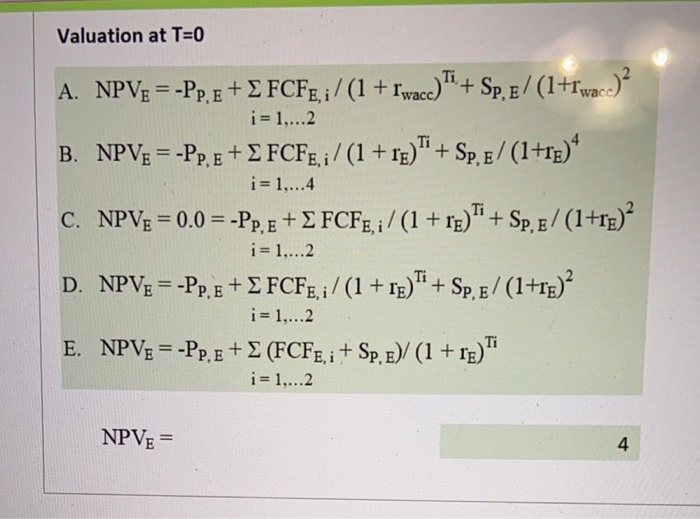

Valuing an Entity with Buy-Manage-Sell Model Introduction Rover Regen LLC converts old Land Rovers to electrically-powered vehicles. The company is profitable and debt free. It has been operating in a steady-state condition for the past several years, and is expected to stay in steady-state for at least the next four years. Pheonix Investments (PI) is considering a buy-manage-sell investment in RR as follows: - Purchase RR (100% of the company's stock) now, at the asking price of: $200.0 MM - Immediately recapitalize to the optimal capital structure capital structure of: 40% D/(D+E) To finance the purchase, Pl will: Pay (1-D/(D+E))% of the purchase price with PI's own funds. - Have RR take out a loan at the moment of close, to pay the current owners the rest of the purchase price. Then Pl will: - Operate RR in its tuli od steady-state for two years. - Operate RR in its recapitalized steady-state for two years. Sell RR (100% of the company's stock) at the end of this time for: $200.0 MM Financing Structure D+E = CAPtot D/(D + E) = WD D E Existing $200.0 0.0% $0.0 $200.0 As purchased $200.0 40.0% 2. Key Rates Existing 7.00% As purchased 8.00% 9.31% 35.00% TE 7.40% 35.00% Income Tax rate Free Cash Flows, FCFE As Income Statement Revenue Depreciation - Other Expenses = EBIT -Interest - Tax Existing D = $0.0 $180.00 ($80.00) ($80.00) $20.00 $0.00 ($7.00) $13,00 Purchased $180.00 ($80.00) ($80.00) $20.00 ($6.4000) ($4.7600) $8.8400 Free Cash Flows, FCF Income Statement Revenue Depreciation - Other Expenses = EBIT -Interest - = NI Existing D = $0.0 $180.00 ($80.00) ($80.00) $20.00 $0.00 ($7.00) $13.00 Purchased $180.80 ($80.00) ($89.00) $20.00 ($6.4000) ($4.7600) $8.8400 - A Working Capital + Depreciation = CF. operations, E - CAPX + A Debt 3 FCF Valuation at T=0 A. NPV = -Pp, e + FCFE. i/(1+1wace)" + Sp, E/ (1+rwac)? i= 1,...2 B. NPV = -Pp, E+FCFE, / (1 + 1E)" + Sp, / (1+r) i= 1,...4 C. NPV = 0.0 = -Pp, e + 2 FCFE. i/ (1 + 1e)" + Sp,E/ (1+re)? i= 1....2 161 1. Tils - D ITDCT T MDTZ Valuation at T=0 A. NPVE = -Pp. E + FCF :/ (1+rwace) " + Sp. E/ (1+rast) i=1....2 B. NPVE = -Pp. E+E FCFE/ (1 + Te)"+Sp./ (1+) i= 1,...4 C. NPV = 0.0 = -Pp, E + FCFr,i/ (1 + r)" + Sp, E/ (1+r)? i= 1,...2 D. NPV = -Pp. e + 2 FCF, :/ (1 + r)" + Sp, r/ (1+r)? i= 1,...2 Ti E. NPV= -Pp, e +E (FCFg.: + Sp. t)) (1 + re)" i= 1,...2 4 NPVE 1 pts Question 21 Refer to the "Valuation at T=0" section of the above information. If Pee is today's purchase price of RR and Spa is the anticipated sale price, which equation will produce the correct NPV for Pl? 1 pts D Question 22 What is the NPV of this project for PI? (This is shown above as quantity "4" with a light green background). Refer to the information below for the next five questions. Valuing an Entity with Buy-Manage-Sell Model Introduction Rover Regen LLC converts old Land Rovers to electrically-powered vehicles. The company is profitable and debt free. It has been operating in a steady-state condition for the past several years, and is expected to stay in steady-state for at least the next four years. - Pheonix Investments (PI) is considering a buy-manage-sell investment in RR as follows: - Purchase RR (100% of the company's stock) now, at the asking price of: $200.0 MM - Immediately recapitalize to the optimal capital structure capital structure of: 40% D/(D+E) To finance the purchase, PI will: Pay (1-D/(D+E))% of the purchase price with PI's own funds. Have RR take cut a loan at the moment of close, to pay the current owners the rest of the purchase price. Then Pl will: - Operate RR in its recapitalized steady-state for two years. Sell RR (100% of the company's stock) at the end of this time for: $200.0 MM - Financing Structure D+E = CAP Tot D/(D + E) = Wp D E Existing $200.0 0.0% $0.0 $200.0 As purchased $200.0 40.0% 1 2 Key Rates Existing 7.00% 7.40% 35.00% As purchased 8.00% 9.31% 35.00% TE Income Tax rate Free Cash Flows, FCFE Income Statement Revenue - Depreciation - Other Expenses = EBIT -Interest - Tax = NI Existing D = $0.0 $180.00 ($80.00) ($80.00) $20.00 $0.00 ($7.00) $13.00 As Purchased $180.00 ($80.00) ($80.00) $20.00 ($6.4000) ($4.7600) $8.8400 - A Working Capital + Depreciation = CF operations, - CAPX + A Debt FCFE 3 Valuation at T=0 A. NPVE =-Pp, e + FCFg, i/ (1 + Iwaca) "* + Sp.e/(1+Iwac)? i = 1....2 B. NPV = -Pp, e + S FCFe,i/ (1+ Te)" + Sp, e/ (1+r) i= 1,...4 C. NPV= = 0.0 = -Pp, e + S FCF, i/ (1 + re)" + Sp, E/ (1+re)? i = 1,...2 D. NPV = -Pp, e + E FCFE, / (1 + re)** + Sp, E/ (1+r)? i= 1....2 E. NPVE = -Pp, e + (FCFe, i + Sp, e)/ (1 + Te)" i= 1,...2 NPVE = 4 1 pts Question 22 What is the NPV of this project for PI? (This is shown above as quantity "4" with a light green background). Question 20 1 pts What is the annual, as-purchased Free Cash Flow from RR to its owners? (This is shown above as quantity "3" with a light green background). Valuing an Entity with Buy-Manage-Sell Model Introduction Rover Regen LLC converts old Land Rovers to electrically-powered vehicles. The company is profitable and debt free. It has been operating in a steady-state condition for the past several years, and is expected to stay in steady-state for at least the next four years. Pheonix Investments (PI) is considering a buy-manage-sell investment in RR as follows: - Purchase RR (100% of the company's stock) now, at the asking price of: $200.0 MM - Immediately recapitalize to the optimal capital structure capital structure of: 40% D/(D+E) To finance the purchase, Pl will: Pay (1-D/(D+E))% of the purchase price with PI's own funds. - Have RR take out a loan at the moment of close, to pay the current owners the rest of the purchase price. Then Pl will: - Operate RR in its tuli od steady-state for two years. - Operate RR in its recapitalized steady-state for two years. Sell RR (100% of the company's stock) at the end of this time for: $200.0 MM Financing Structure D+E = CAPtot D/(D + E) = WD D E Existing $200.0 0.0% $0.0 $200.0 As purchased $200.0 40.0% 2. Key Rates Existing 7.00% As purchased 8.00% 9.31% 35.00% TE 7.40% 35.00% Income Tax rate Free Cash Flows, FCFE As Income Statement Revenue Depreciation - Other Expenses = EBIT -Interest - Tax Existing D = $0.0 $180.00 ($80.00) ($80.00) $20.00 $0.00 ($7.00) $13,00 Purchased $180.00 ($80.00) ($80.00) $20.00 ($6.4000) ($4.7600) $8.8400 Free Cash Flows, FCF Income Statement Revenue Depreciation - Other Expenses = EBIT -Interest - = NI Existing D = $0.0 $180.00 ($80.00) ($80.00) $20.00 $0.00 ($7.00) $13.00 Purchased $180.80 ($80.00) ($89.00) $20.00 ($6.4000) ($4.7600) $8.8400 - A Working Capital + Depreciation = CF. operations, E - CAPX + A Debt 3 FCF Valuation at T=0 A. NPV = -Pp, e + FCFE. i/(1+1wace)" + Sp, E/ (1+rwac)? i= 1,...2 B. NPV = -Pp, E+FCFE, / (1 + 1E)" + Sp, / (1+r) i= 1,...4 C. NPV = 0.0 = -Pp, e + 2 FCFE. i/ (1 + 1e)" + Sp,E/ (1+re)? i= 1....2 161 1. Tils - D ITDCT T MDTZ Valuation at T=0 A. NPVE = -Pp. E + FCF :/ (1+rwace) " + Sp. E/ (1+rast) i=1....2 B. NPVE = -Pp. E+E FCFE/ (1 + Te)"+Sp./ (1+) i= 1,...4 C. NPV = 0.0 = -Pp, E + FCFr,i/ (1 + r)" + Sp, E/ (1+r)? i= 1,...2 D. NPV = -Pp. e + 2 FCF, :/ (1 + r)" + Sp, r/ (1+r)? i= 1,...2 Ti E. NPV= -Pp, e +E (FCFg.: + Sp. t)) (1 + re)" i= 1,...2 4 NPVE 1 pts Question 21 Refer to the "Valuation at T=0" section of the above information. If Pee is today's purchase price of RR and Spa is the anticipated sale price, which equation will produce the correct NPV for Pl? 1 pts D Question 22 What is the NPV of this project for PI? (This is shown above as quantity "4" with a light green background). Refer to the information below for the next five questions. Valuing an Entity with Buy-Manage-Sell Model Introduction Rover Regen LLC converts old Land Rovers to electrically-powered vehicles. The company is profitable and debt free. It has been operating in a steady-state condition for the past several years, and is expected to stay in steady-state for at least the next four years. - Pheonix Investments (PI) is considering a buy-manage-sell investment in RR as follows: - Purchase RR (100% of the company's stock) now, at the asking price of: $200.0 MM - Immediately recapitalize to the optimal capital structure capital structure of: 40% D/(D+E) To finance the purchase, PI will: Pay (1-D/(D+E))% of the purchase price with PI's own funds. Have RR take cut a loan at the moment of close, to pay the current owners the rest of the purchase price. Then Pl will: - Operate RR in its recapitalized steady-state for two years. Sell RR (100% of the company's stock) at the end of this time for: $200.0 MM - Financing Structure D+E = CAP Tot D/(D + E) = Wp D E Existing $200.0 0.0% $0.0 $200.0 As purchased $200.0 40.0% 1 2 Key Rates Existing 7.00% 7.40% 35.00% As purchased 8.00% 9.31% 35.00% TE Income Tax rate Free Cash Flows, FCFE Income Statement Revenue - Depreciation - Other Expenses = EBIT -Interest - Tax = NI Existing D = $0.0 $180.00 ($80.00) ($80.00) $20.00 $0.00 ($7.00) $13.00 As Purchased $180.00 ($80.00) ($80.00) $20.00 ($6.4000) ($4.7600) $8.8400 - A Working Capital + Depreciation = CF operations, - CAPX + A Debt FCFE 3 Valuation at T=0 A. NPVE =-Pp, e + FCFg, i/ (1 + Iwaca) "* + Sp.e/(1+Iwac)? i = 1....2 B. NPV = -Pp, e + S FCFe,i/ (1+ Te)" + Sp, e/ (1+r) i= 1,...4 C. NPV= = 0.0 = -Pp, e + S FCF, i/ (1 + re)" + Sp, E/ (1+re)? i = 1,...2 D. NPV = -Pp, e + E FCFE, / (1 + re)** + Sp, E/ (1+r)? i= 1....2 E. NPVE = -Pp, e + (FCFe, i + Sp, e)/ (1 + Te)" i= 1,...2 NPVE = 4 1 pts Question 22 What is the NPV of this project for PI? (This is shown above as quantity "4" with a light green background). Question 20 1 pts What is the annual, as-purchased Free Cash Flow from RR to its owners? (This is shown above as quantity "3" with a light green background)