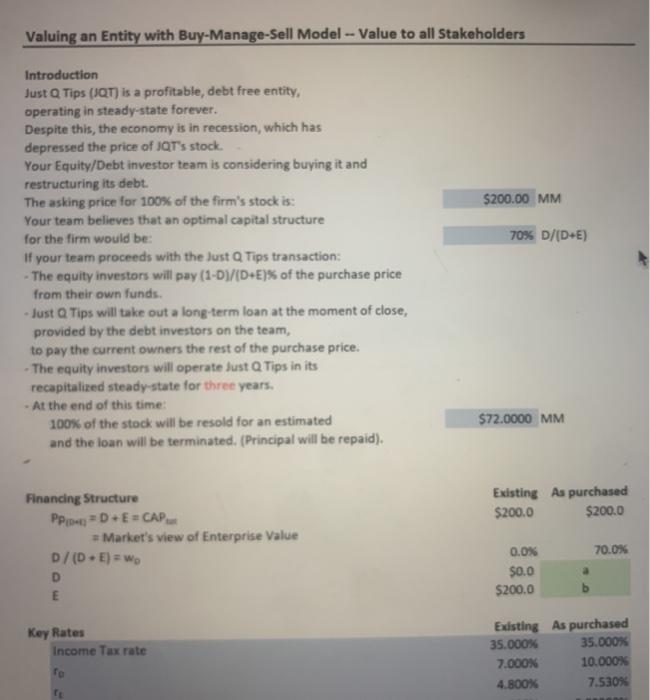

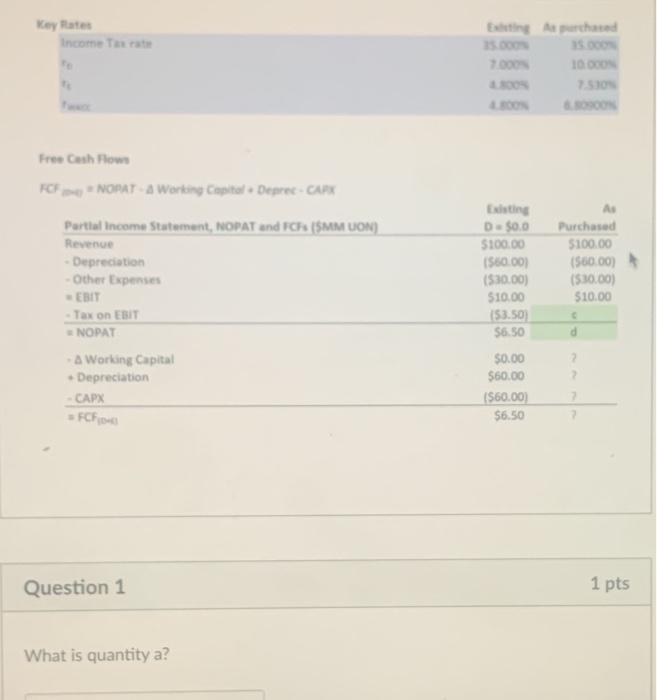

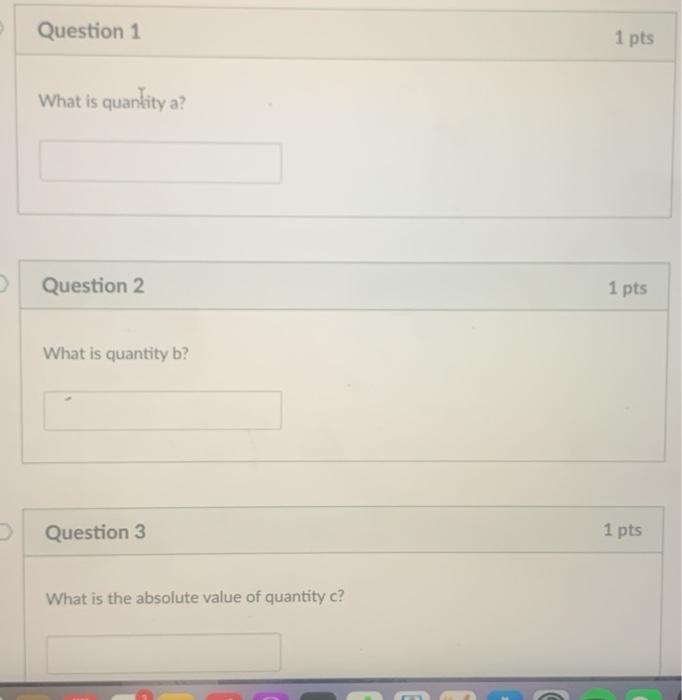

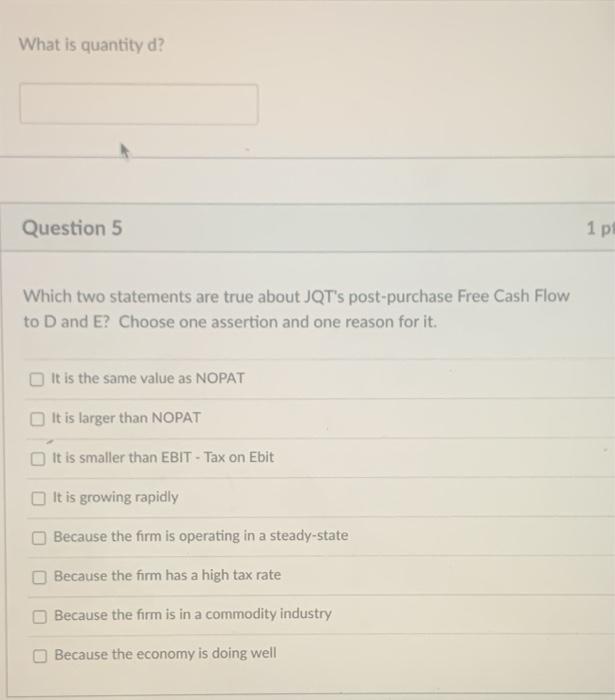

Valuing an Entity with Buy-Manage-Sell Model -- Value to all Stakeholders $200.00 MM 70% D/(D+E) Introduction Just Q Tips (QT) is a profitable, debt free entity, operating in steady-state forever. Despite this, the economy is in recession, which has depressed the price of IQT's stock. Your Equity/Debt investor team is considering buying it and restructuring its debt. The asking price for 100% of the firm's stock is: Your team believes that an optimal capital structure for the firm would be: If your team proceeds with the Just Q Tips transaction: - The equity investors will pay (1-0)/( DE)% of the purchase price from their own funds. Just Q Tips will take out a long-term loan at the moment of close, provided by the debt investors on the team, to pay the current owners the rest of the purchase price. - The equity investors will operate Just Q Tips in its recapitalized steady-state for three years. - At the end of this time 100% of the stock will be resold for an estimated and the loan will be terminated. (Principal will be repaid). $72.0000 MM Existing As purchased $200.0 $200.0 Financing Structure PP = D.E=CAP Market's view of Enterprise Value D/( DE) = wo D E 70.0% 0.0% $0.0 $200.0 b Key Rates Income Tax rate Exdsting As purchased 35.000% 35.000% 7.000N 10.000% 4.800X 7.530% To Key Flat Income Tax rate ting Arad 10.00 ON Free Cash Flows FCF NOPATA Working Capital Deprec-CAR Partial Income Statement, NOPAT and FC SMM LON) Revenue - Depreciation -Other Expenses - EBIT Tax on EBIT NOPAT Existing D$0.0 5100.00 1560.00 1530.00) 510.00 153.50 $6.50 Purchased $100.00 (560.00) (530.00) $10.00 - A Working Capital Depreciation - $0.00 $60.00 (560.00 $6.50 FCF Question 1 1 pts What is quantity a? Question 1 1 pts What is quanlity a? Question 2 1 pts What is quantity b? Question 3 1 pts What is the absolute value of quantity c? What is quantity d? Question 5 1 p Which two statements are true about JQT's post-purchase Free Cash Flow to D and E? Choose one assertion and one reason for it. It is the same value as NOPAT It is larger than NOPAT It is smaller than EBIT - Tax on Ebit It is growing rapidly Because the firm is operating in a steady-state Because the firm has a high tax rate Because the firm is in a commodity industry Because the economy is doing well