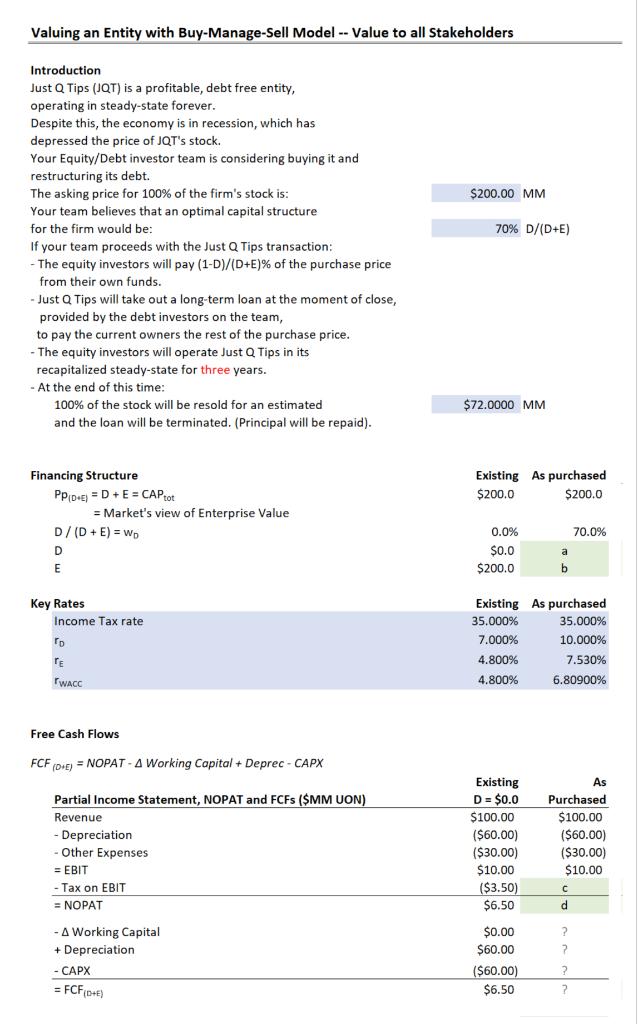

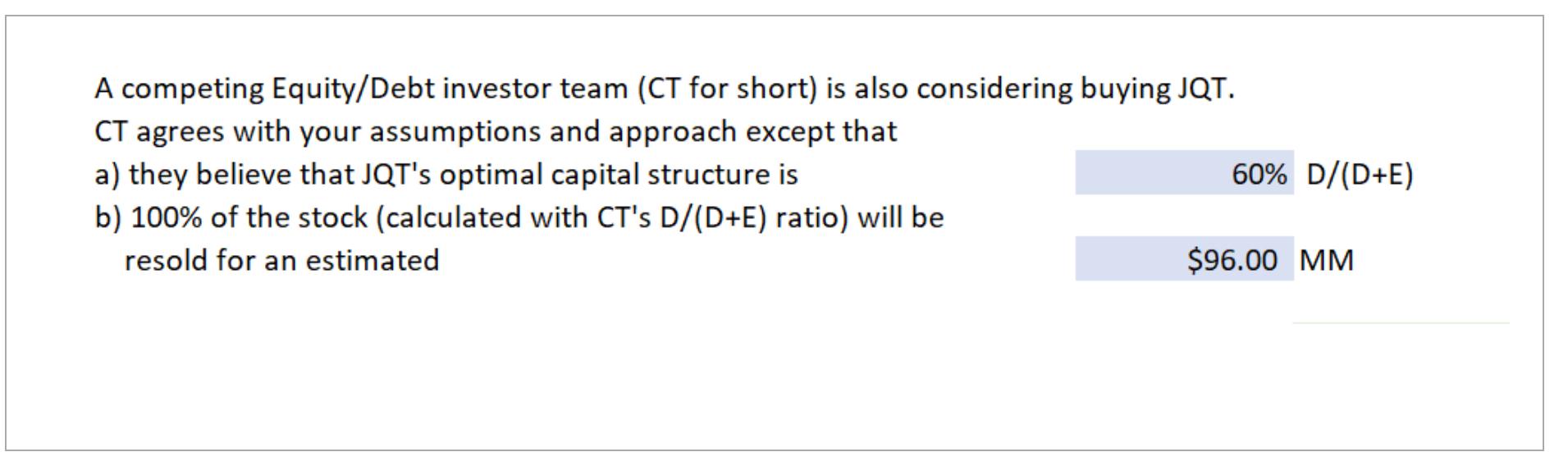

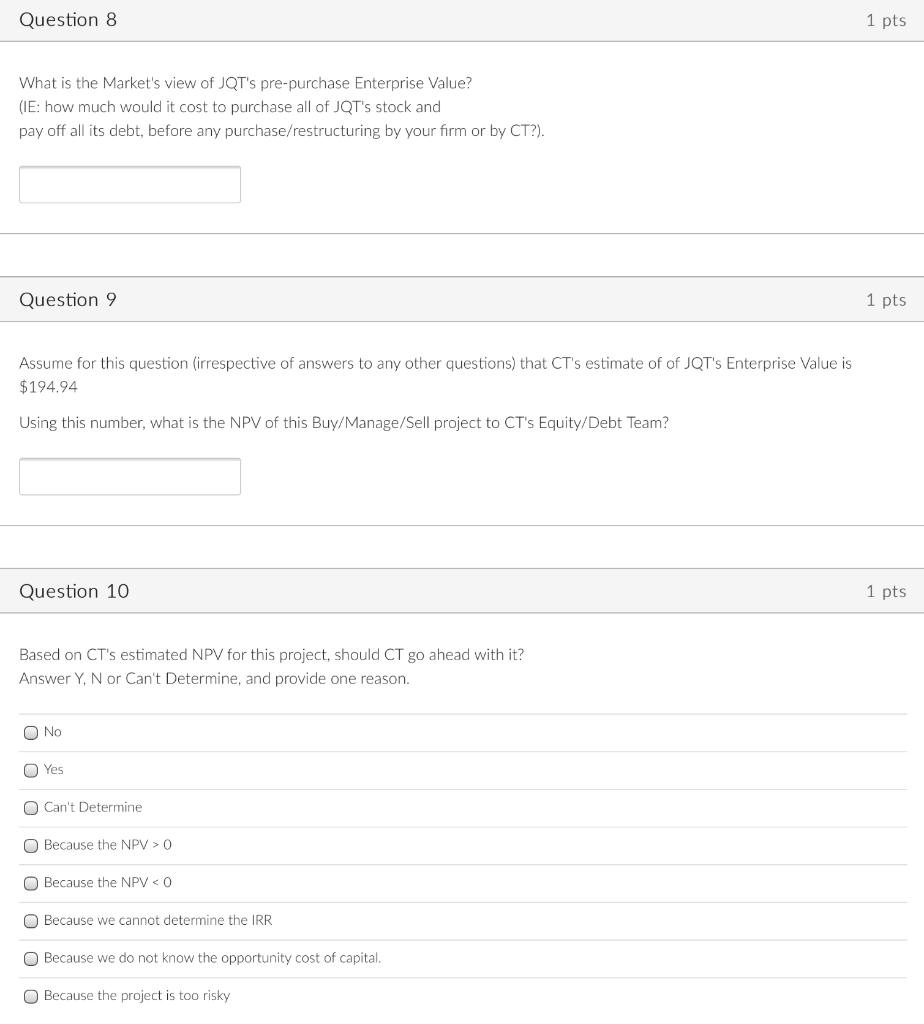

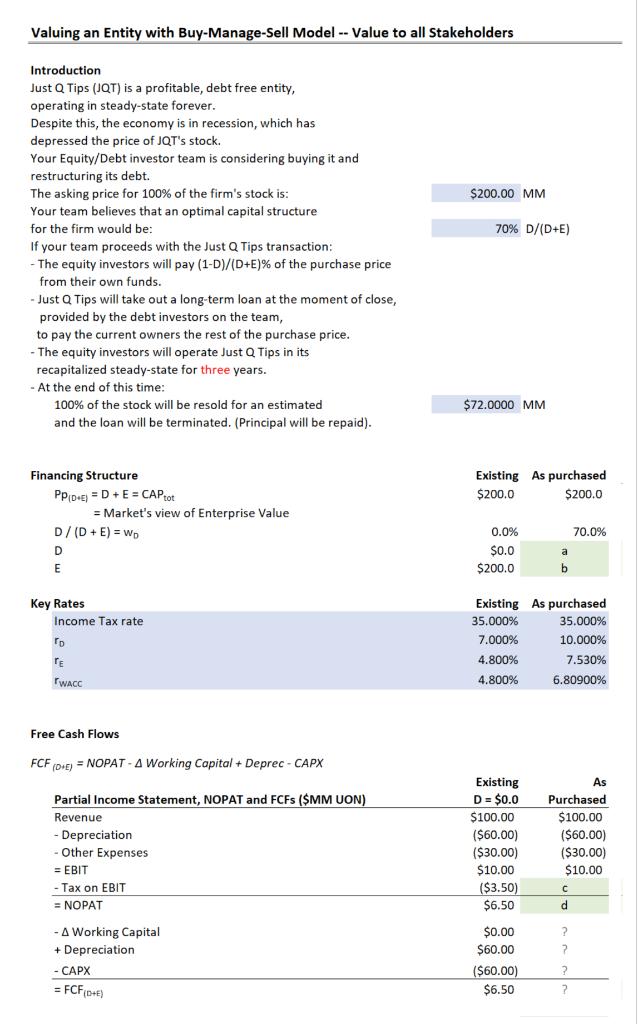

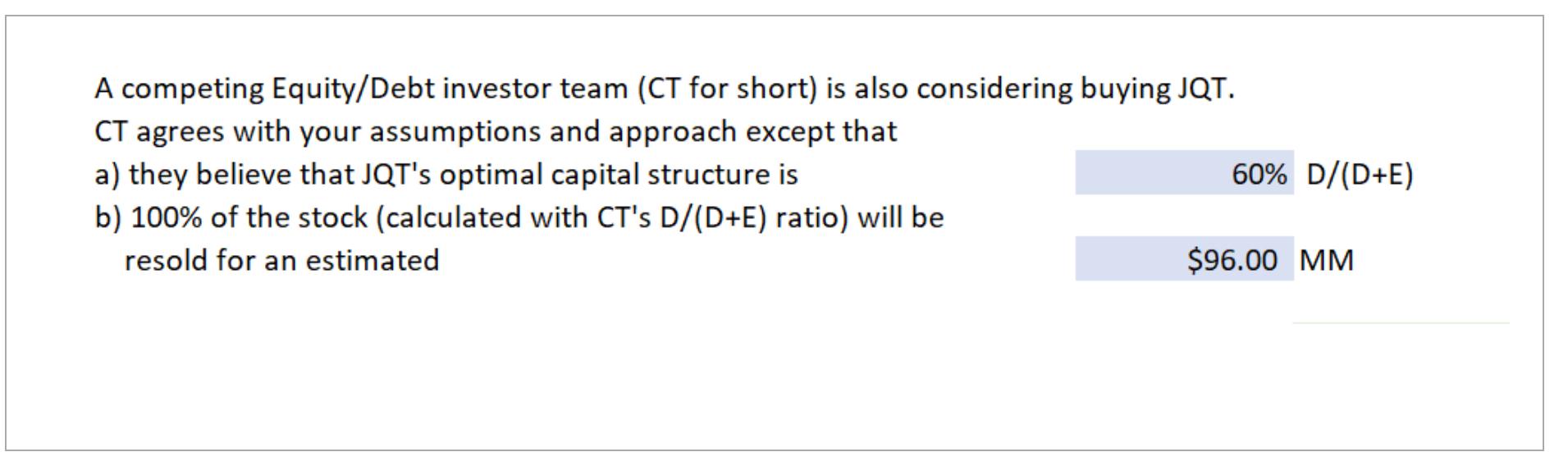

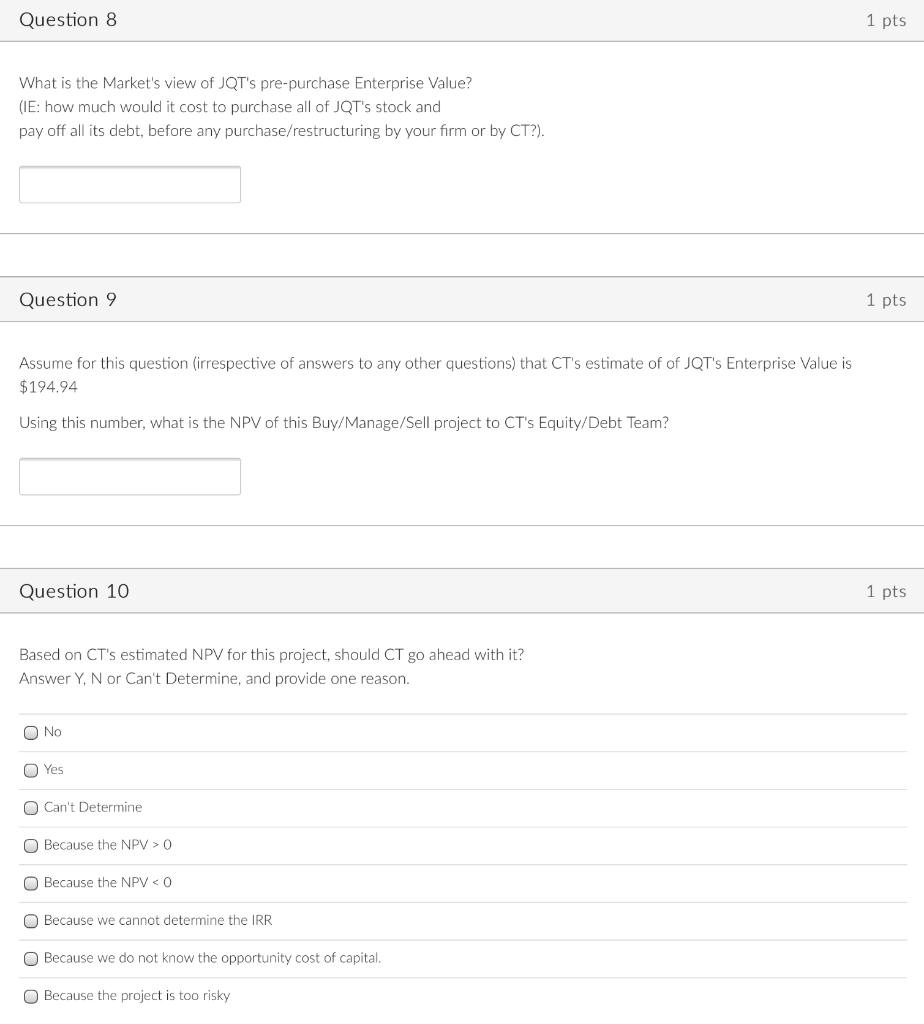

Valuing an Entity with Buy-Manage-Sell Model -- Value to all Stakeholders Introduction Just Q Tips (JQT) is a profitable, debt free entity, operating in steady-state forever. Despite this, the economy is in recession, which has depressed the price of JQT's stock. Your Equity/Debt investor team is considering buying it and restructuring its debt. The asking price for 100% of the firm's stock is: Your team believes that an optimal capital structure for the firm would be: If your team proceeds with the Just Q Tips transaction: - The equity investors will pay (1D)/(D+E)% of the purchase price from their own funds. - Just Q Tips will take out a long-term loan at the moment of close, provided by the debt investors on the team, to pay the current owners the rest of the purchase price. - The equity investors will operate Just Q Tips in its recapitalized steady-state for three years. - At the end of this time: 100% of the stock will be resold for an estimated $72.0000MM and the loan will be terminated. (Principal will be repaid). Financing Structure Existing As purchased Key Rates Existing35.000%7.000%4.800%4.800%Aspurchased35.000%10.000%7.530%6.80900% Free Cash Flows A competing Equity/Debt investor team (CT for short) is also considering buying JQT. CT agrees with your assumptions and approach except that a) they believe that JQT's optimal capital structure is D/(D+E) b) 100% of the stock (calculated with CT 's D/(D+E) ratio) will be resold for an estimated MM What is the Market's view of JQT's pre-purchase Enterprise Value? (IE: how much would it cost to purchase all of JQT's stock and pay off all its debt, before any purchase/restructuring by your firm or by CT?). Question 9 Assume for this question (irrespective of answers to any other questions) that CT's estimate of of JQT's Enterprise Value is $194.94 Using this number, what is the NPV of this Buy/Manage/Sell project to CT's Equity/Debt Team? Question 10 Based on CT's estimated NPV for this project, should CT go ahead with it? Answer Y,N or Can't Determine, and provide one reason. Can't Determine Because the NPV > 0 Because the NPV IRR Because we do not know the opportunity cost of capital. Because the project is too risky