Answered step by step

Verified Expert Solution

Question

1 Approved Answer

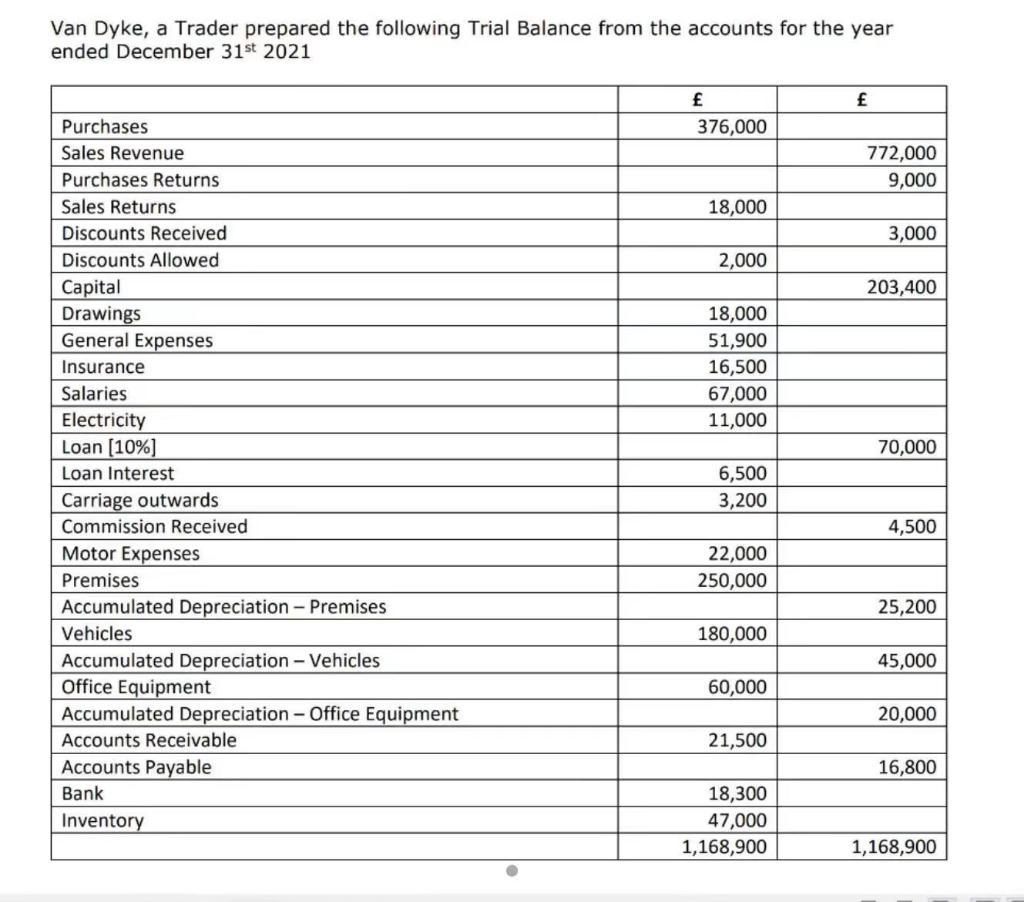

Van Dyke, a Trader prepared the following Trial Balance from the accounts for the year ended December 31st 2021 Purchases Sales Revenue Purchases Returns

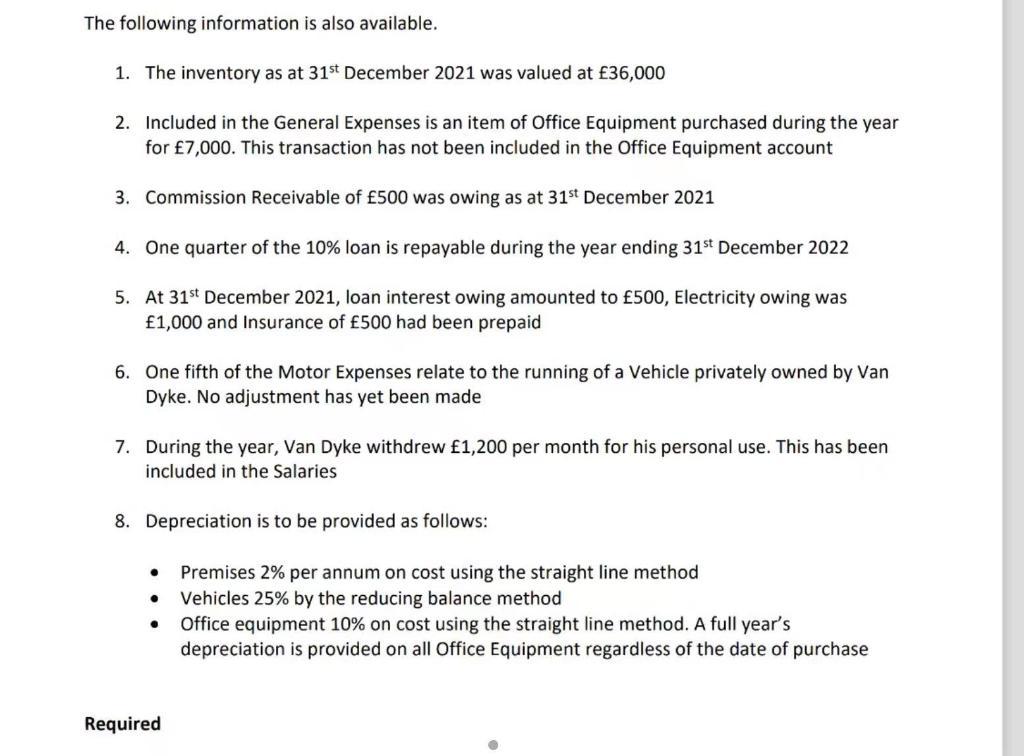

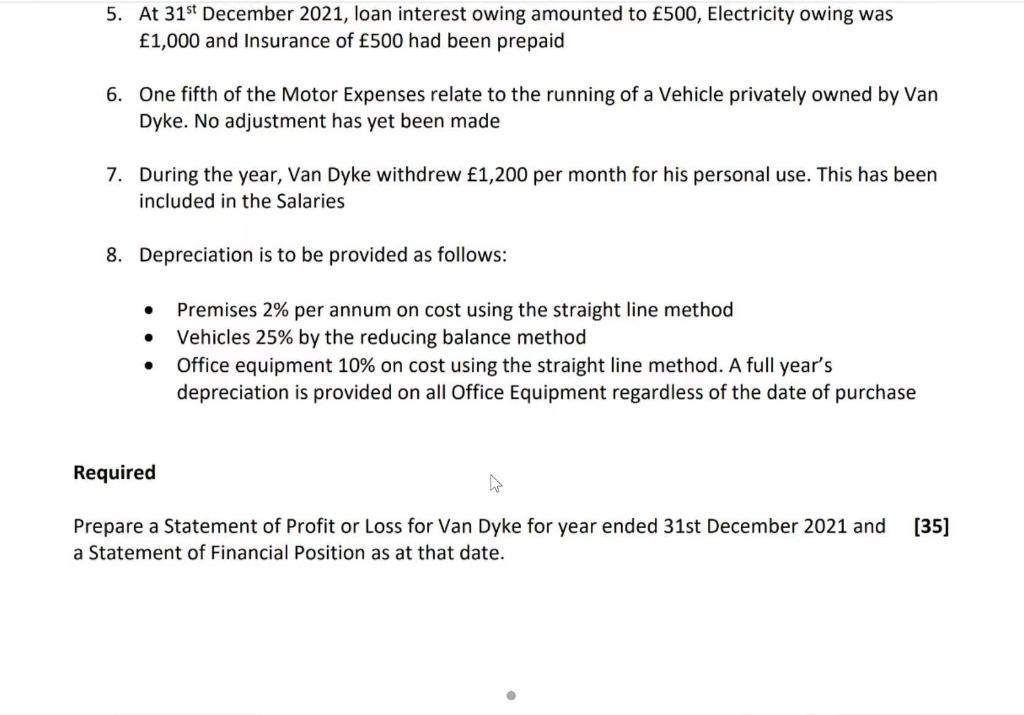

Van Dyke, a Trader prepared the following Trial Balance from the accounts for the year ended December 31st 2021 Purchases Sales Revenue Purchases Returns Sales Returns Discounts Received Discounts Allowed Capital Drawings General Expenses Insurance Salaries Electricity Loan [10% ] Loan Interest Carriage outwards Commission Received Motor Expenses Premises Accumulated Depreciation - Premises Vehicles Accumulated Depreciation - Vehicles Office Equipment Accumulated Depreciation - Office Equipment Accounts Receivable Accounts Payable Bank Inventory 376,000 18,000 2,000 18,000 51,900 16,500 67,000 11,000 6,500 3,200 22,000 250,000 180,000 60,000 21,500 18,300 47,000 1,168,900 772,000 9,000 3,000 203,400 70,000 4,500 25,200 45,000 20,000 16,800 1,168,900 The following information is also available. 1. The inventory as at 31st December 2021 was valued at 36,000 2. Included in the General Expenses is an item of Office Equipment purchased during the year for 7,000. This transaction has not been included in the Office Equipment account 3. Commission Receivable of 500 was owing as at 31st December 2021 4. One quarter of the 10% loan is repayable during the year ending 31st December 2022 5. At 31st December 2021, loan interest owing amounted to 500, Electricity owing was 1,000 and Insurance of 500 had been prepaid 6. One fifth of the Motor Expenses relate to the running of a Vehicle privately owned by Van Dyke. No adjustment has yet been made 7. During the year, Van Dyke withdrew 1,200 per month for his personal use. This has been included in the Salaries 8. Depreciation is to be provided as follows: Required Premises 2% per annum on cost using the straight line method Vehicles 25% by the reducing balance method Office equipment 10% on cost using the straight line method. A full year's depreciation is provided on all Office Equipment regardless of the date of purchase 5. At 31st December 2021, loan interest owing amounted to 500, Electricity owing was 1,000 and Insurance of 500 had been prepaid 6. One fifth of the Motor Expenses relate to the running of a Vehicle privately owned by Van Dyke. No adjustment has yet been made 7. During the year, Van Dyke withdrew 1,200 per month for his personal use. This has been included in the Salaries 8. Depreciation is to be provided as follows: Premises 2% per annum on cost using the straight line method Vehicles 25% by the reducing balance method Office equipment 10% on cost using the straight line method. A full year's depreciation is provided on all Office Equipment regardless of the date of purchase Required Prepare a Statement of Profit or Loss for Van Dyke for year ended 31st December 2021 and [35] a Statement of Financial Position as at that date.

Step by Step Solution

★★★★★

3.31 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started