Question

Van Island RecPlex (VIR) is a privately owned entertainment complex consisting of a theme park, concert venue and marina in Nanaimo, British Columbia. VIR was

Van Island RecPlex (VIR) is a privately owned entertainment complex consisting of a theme park, concert venue and marina in Nanaimo, British Columbia. VIR was founded in 1989 by a group of 10 local investors who thought a theme park would be a great way to attract visitors to the area and boost the local economy.

Over the years, VIR has developed a solid reputation as a fun place for families, boating enthusiasts, and concertgoers. However, as its facilities aged, the investors decided it was necessary to seek additional funds. In 2014, the investors sold 80 percent of VIR to Seven Flags Ltd. (SFL), a large American amusement park company. The investors no longer have any active involvement with VIR and receive a dividend based upon net income. SFL is known to have high expectations for return on its investment. To motivate VIR management to run a highly profitable operation, SFL implemented a bonus plan based upon net income. Also, to maintain firm oversight of its investment, SFL required VIR to send it the following monthly operational reports: expenditure to budget, sales, and the list of boats docked in the marina.

In 2014, VIR decided to add a 190-foot observation wheel that would give riders in climate controlled cars a panoramic view of the beautiful beaches. Because of its potential to attract tourists to the area, VIR was able to obtain a forgivable loan from the BC government. One of the conditions of the loan is that VIRmust maintains certain levels of employment for 10 years. If does not meet those requirements anytime within that 10-year period, it must repay the entire loan. Per ASPE 3800, the loan has been recorded as a credit and is being amortized over the same period of the estimated life of the observation wheel. VIRmust supply the BC government with an annual employment report as well as audited financial statements.

In 2011, when VIR completed the construction of the concert venue, it signed a 20-year lease agreement with the concert promoter Bruce Warren (BW). According to the agreement, BWwill promote and operate the VIR's concert venue and give VIR20 percent of all box office and concessionary sales revenue.

Current situation

New POS system: Prior to the 2018 theme park season, VIRpurchased and implemented a brand new point-of-sale (POS) system. Due to delays with the supplier, VIR was unable to procure the new system until late March 2018. As a result, the POS installation was completed just a day before the theme park's opening day. There was no time to perform any system tests, such as to verify the compatibility between the POS and VIR's accounting system, or to properly train employees. With no time to prepare, VIR cashiers and management were forced to learn the new POS system "on the fly."

There was also no time to install the new system throughout the entertainment complex, and the marina was left without any sales terminals. The old terminals had all been discarded. Thus, marina docking fees could be paid in cash only. Jeff is the marina's only employee and has been with VIR since its inception. Although Jeff doesn't own a boat, he is an avid sailor who is very much liked and trusted by all marina customers. Each customer must sign a formal agreement, listing the customer's name, the boat's name and dimensions, and the annual docking fee is based on an VIR pricing chart.

Overview of Revenue: For the 2019 fiscal year, VIRexperienced a considerable drop in revenue, which was attributed to an unusually cool and wet summer and a significant decline in American tourists who usually visit the area. In a typical year, the breakdown of VIR revenues is 70 percent of revenue is generated from the theme park, 20 percent from Bruce Warren, and 10 percent from the marina.

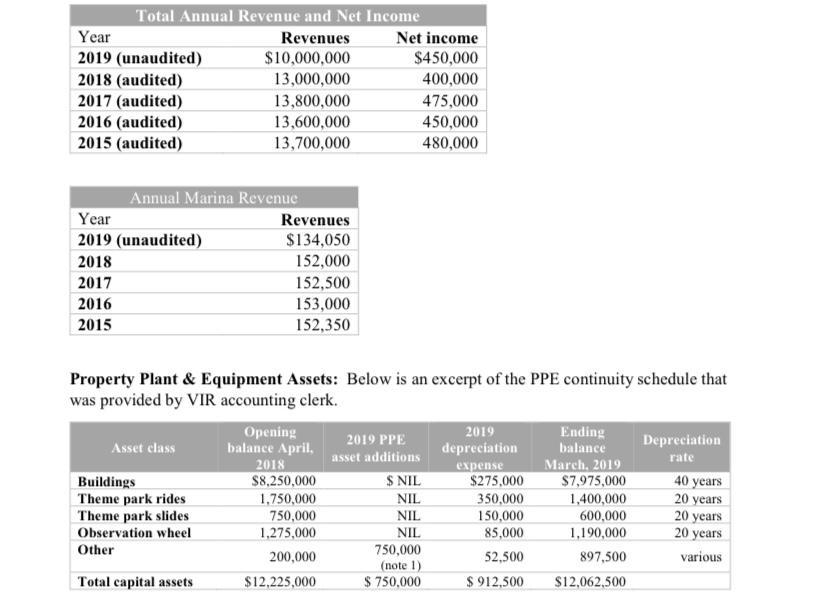

Attached screenshot above is the summary of total revenue and net income:

Note 1: per management's request, other additions consist of:

$150,000 for bird food (deprecated over 10 years, the average lifespan of the Canada Goose, which is a big attraction for kids attending the theme park)

$150,000 for promotional material with VIR logo (T-shirt, banners, tents, stickers, and pins). Depreciated over five years.

$200,000 for point of sale system, depreciated over 10 years.

$250,000 for "other" capital asset items. Management to provide support and explanation.

Restructuring and Potential Sale of VIR: In early August 2018, a rumour leaked to the press that due to problems with its US operations, SFL was no longer interested in operating in Canada. As a result, it was shutting down operations and terminating all staff. At the end of the theme park's season, in late October, SFL publicly announced that it was significantly downsizing and restructuring VIR's operations.

Coinciding with the August rumour, a two-week termination of employment notice was issued to all VIR staff and management, with the exception of Jeff, two accounting managers, and two accounting clerks, who were meant to assist with the financial statement audit. The managers and clerks were informed that their employment would end at the audit's completion, expected in June 2019. Both accounting managers are using their vacation days prior to their termination date. They are available to answer questions related to the audit on Tuesdays and Thursdays, the only days they are at work.

VIR management had intended to perform reconciliations on the VIR system's theme-park sales data and bank statements (including monthly credit card reports), but these plans were also put on hold once the termination notices were issued. Also in August 2018, VIR management did not enforce the mandatory reporting and SFL stopped receiving its monthly VIRreporting package.

As part of the management's termination agreement, SFL will pay out 50 percent of net income from VIR's 2019 operations as a severance payment. The amount will be divided and paid to all terminated managers following the audit, at which time SFLintends to bring in its own staff from the United States to temporarily take over VIR operations. SFL plans to finalize its decision about VIR's future over the next six months. Several resort developers are interested in purchasing the property and have approached SFL. SFL is considering two options:

1. Dispose of the theme park's PPE assets individually and sell theme park land to one of the resort developers. Would continue operating the observation wheel, marina, and concert venue.

2. Sell the entire VIR operation - the theme park, observation wheel, marina, and concert venue - to one of the resort developers.

Bruce Warren Lawsuit: On February 28, 2019, BW responded to the SFL's decision to shut down park operations by launching a $450,000 lawsuit against VIR and SFL, accusing the two parties of breaching the lease agreement and for the loss of potential revenue from concert tickets and concessionary sales. One of the VIR accounting managers believes that BW is just "bluffing" and that once SFL decides about VIR's future, the lawsuit will be withdrawn.

Required:

a. Recommend materiality for planning purposes (planning materiality). Be sure to use both quantitative (calculations) and qualitative analysis as support.

b. Recommend performance materiality for the VIR engagement. Provide calculations and support for recommendations.

Total Annual Revenue and Net Income Revenues $10,000,000 13,000,000 13,800,000 13,600,000 13,700,000 Year 2019 (unaudited) 2018 (audited) 2017 (audited) 2016 (audited) 2015 (audited) Annual Marina Revenue Year 2019 (unaudited) 2018 2017 2016 2015 Asset class Revenues $134,050 152,000 152,500 153,000 152,350 Property Plant & Equipment Assets: Below is an excerpt of the PPE continuity schedule that was provided by VIR accounting clerk. Buildings Theme park rides Theme park slides Observation wheel Other Total capital assets Net income $450,000 400,000 475,000 450,000 480,000 Opening balance April, 2018 $8,250,000 1,750,000 750,000 1,275,000 200,000 $12,225,000 2019 PPE asset additions S NIL NIL NIL NIL 750,000 (note 1) $750,000 2019 depreciation expense $275,000 350,000 150,000 85,000 52,500 $912,500 Ending balance March, 2019 $7,975,000 1,400,000 600,000 1,190,000 897,500 $12,062,500 Depreciation rate 40 years 20 years 20 years 20 years various

Step by Step Solution

There are 3 Steps involved in it

Step: 1

a Recommend materiality for planning purposes planning materiality Quantitative analysis To determine materiality for planning purposes I would use th...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started