Question

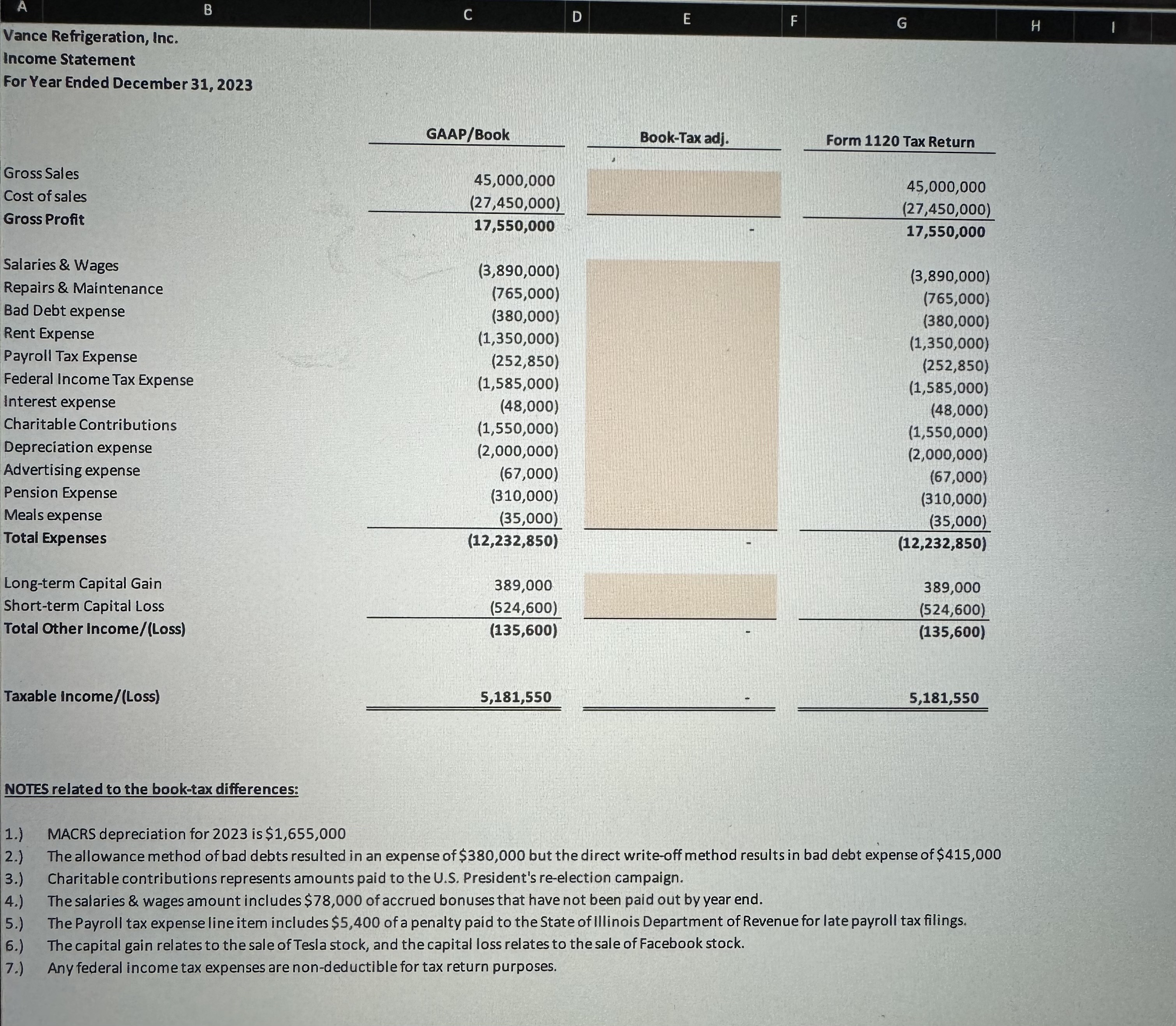

Vance Refrigeration, Inc. Income Statement For Year Ended December 3 1 , 2 0 2 3 NOTES related to the book - tax differences: 1

Vance Refrigeration, Inc.

Income Statement For Year Ended December NOTES related to the booktax differences: ?MACRS depreciation for ?is $ ?The allowance method of bad debts resulted in an expense of $ ?but the direct writeoff method results in bad debt expense of $ ?Charitable contributions represents amounts paid to the US ?President's reelection campaign.

?The salaries & wages amount includes $ ?of accrued bonuses that have not been paid out by year end.

?The Payroll tax expense line item includes $ ?of a penalty paid to the State of Illinois Department of Revenue for late payroll tax filings.

?The capital gain relates to the sale of Tesla stock, and the capital loss relates to the sale of Facebook stock.

?Any federal income tax expenses are nondeductible for tax return purposes.

Note: Can you please solve the numbers for me in BookTax Adjustment? I do not understand completely on how I am supposed to fill this out?

A Vance Refrigeration, Inc. Income Statement B For Year Ended December 31, 2023 C D E GAAP/Book LL F G H Book-Tax adj. Form 1120 Tax Return Gross Sales Cost of sales 45,000,000 (27,450,000) Gross Profit 17,550,000 Salaries & Wages Repairs & Maintenance Bad Debt expense Rent Expense (3,890,000) (765,000) 45,000,000 (27,450,000) 17,550,000 (3,890,000) (765,000) (380,000) (380,000) (1,350,000) (1,350,000) Payroll Tax Expense (252,850) (252,850) Federal Income Tax Expense (1,585,000) (1,585,000) Interest expense (48,000) (48,000) Charitable Contributions (1,550,000) (1,550,000) Depreciation expense Advertising expense Pension Expense Meals expense (2,000,000) (2,000,000) (67,000) (310,000) (67,000) (310,000) (35,000) (35,000) Total Expenses (12,232,850) Long-term Capital Gain 389,000 (12,232,850) 389,000 Short-term Capital Loss (524,600) (524,600) Total Other Income/(Loss) (135,600) (135,600) Taxable Income/(Loss) NOTES related to the book-tax differences: MACRS depreciation for 2023 is $1,655,000 5,181,550 5,181,550 1.) 2.) 3.) The allowance method of bad debts resulted in an expense of $380,000 but the direct write-off method results in bad debt expense of $415,000 Charitable contributions represents amounts paid to the U.S. President's re-election campaign. 4.) The salaries & wages amount includes $78,000 of accrued bonuses that have not been paid out by year end. 5.) The Payroll tax expense line item includes $5,400 of a penalty paid to the State of Illinois Department of Revenue for late payroll tax filings. 6.) The capital gain relates to the sale of Tesla stock, and the capital loss relates to the sale of Facebook stock. 7.) Any federal income tax expenses are non-deductible for tax return purposes.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

To adjust the book income statement for tax purposes we need to identify the differences between GAAP Generally Accepted Accounting Principles and tax ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started