Question

Vancouver Investments Ltd has provided you with the following information. Vancouver Investments Ltds cash flows expected at the end of each year for the next

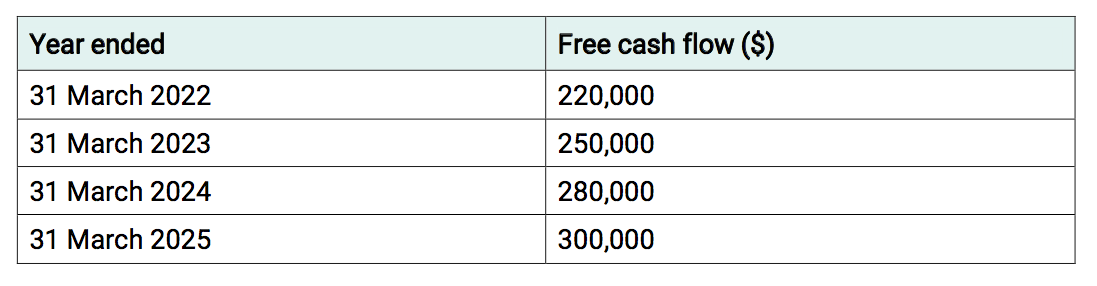

Vancouver Investments Ltd has provided you with the following information. Vancouver Investments Ltds cash flows expected at the end of each year for the next four years are shown below:

The growth rate of the free cash flows after 2025, to infinity, is expected to be 3%. The market value of Vancouver Investment Ltds debt is $905,000 and the market value of its preference shares is $150,000. Vancouver Investment Ltd has issued 500,000 shares and has a weighted average cost of capital of 8%.

a) Determine the value of the entire company using the free cash flow method. Use whole numbers when rounding.

b) Determine the value of a share in Vancouver Investment Ltd.

c) Identify two circumstances where it is appropriate to use the free cash flow method to value shares?

Year ended 31 March 2022 31 March 2023 Free cash flow ($) 220,000 250,000 280,000 300,000 31 March 2024 31 March 2025Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started