Answered step by step

Verified Expert Solution

Question

1 Approved Answer

A Vancouver retailer is facing increasing competition from big shops that are opening in his area. He thinks that if he does not modernize

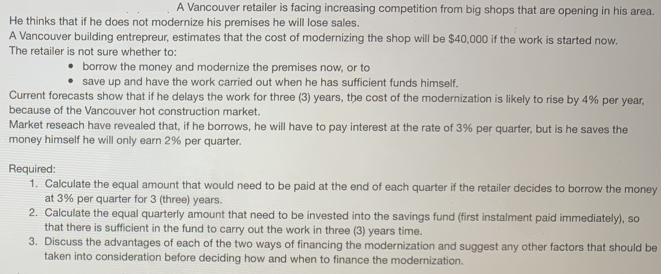

A Vancouver retailer is facing increasing competition from big shops that are opening in his area. He thinks that if he does not modernize his premises he will lose sales. A Vancouver building entrepreur, estimates that the cost of modernizing the shop will be $40,000 if the work is started now. The retailer is not sure whether to: borrow the money and modernize the premises now, or to save up and have the work carried out when he has sufficient funds himself. Current forecasts show that if he delays the work for three (3) years, the cost of the modernization is likely to rise by 4% per year, because of the Vancouver hot construction market. Market reseach have revealed that, if he borrows, he will have to pay interest at the rate of 3% per quarter, but is he saves the money himself he will only earn 2% per quarter. Required: 1. Calculate the equal amount that would need to be paid at the end of each quarter if the retailer decides to borrow the money at 3% per quarter for 3 (three) years. 2. Calculate the equal quarterly amount that need to be invested into the savings fund (first instalment paid immediately), so that there is sufficient in the fund to carry out the work in three (3) years time. 3. Discuss the advantages of each of the two ways of financing the modernization and suggest any other factors that should be taken into consideration before deciding how and when to finance the modernization.

Step by Step Solution

★★★★★

3.44 Rating (170 Votes )

There are 3 Steps involved in it

Step: 1

1 quarter if the retailer decides to borrow the money at 3 per quarter for 3 three years the ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started