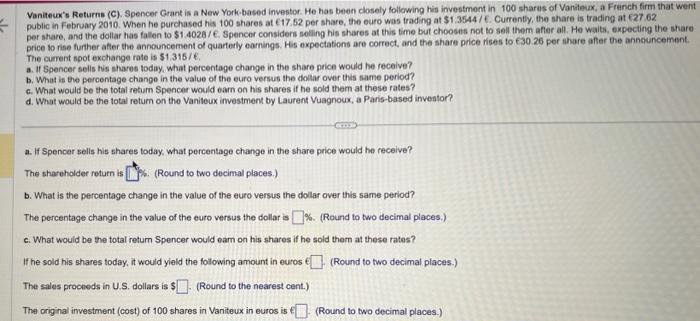

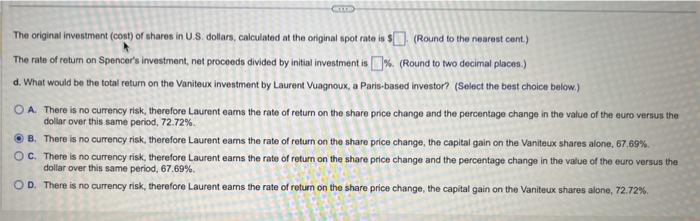

Vaniteux's Returns (C). Spencer Grant is a New York-based investor. He has been closely following his investment in 100 shares of Variteux, a Franch firm that went public in february 2010. When he purchased his 100 shares at 617.62 per share, the euro was trading at $1.3544/C. Currently, the share is trading at 627.62. per share, and the dollar has fallen to $1.4028/E, Spencer considers selling his shares at this time but chooses not to sell them after all. He waits, expecting the ohare price to rise further after the announcement of quarterly earnings. His expectations are correct, and the share price ises to 630 .26 per share after the announcement. The current spot exchange rate is $1.315/, a. If Spencer selis tis shares today, what percentage change in the share price would he receive? b. What is the percentage change in the value of the euro versus the doltar over this same period? c. What would be the total return Spencer would earn on his shares if he sold them at these rates? d. What would be the total return on the Vaniteux investment by Laurent Vuagnoux, a Paris-based inveator? a. If Spencer sells his shares today, what percentage change in the share price would he receive? The sharoholder return is (Round to two decimal places.) b. What is the percentage change in the value of the euro versus the dollar over this same period? The percentage change in the value of the euro versus the dollar is \%. (Round to two decimal places,) c. What would be the total return Spencer would earn on his shares if he sold them at these rates? If he sold his shares today, it would yleid the following amount in euros ( Round to two decimal places.) The sales procoeds in U.S. dollars is $ (Round to the nearest cent.) The original investment (cost) of 100 shares in Vaniteux in euros is f (Round to two decimal places.) The original investment (cont) of shares in U.S. dollars, calculated at the original spot rate is $ (Round to the nearest cent) The rate of return on Spencer's investment, net proceeds divided by initial investment is 1. (Round to two decimal places.) d. What would be the total return on the Vaniteux investment by Laurent Vuagnoux, a Paris-based investor? (Select the best choice below.) A. There is no currency risk, therefore Laurent eams the rate of return on the share price change and the percentage change in the value of the euro versus the dolar over this same period, 72.72%. B. There is no currency risk, therefore Laurent earns the rate of return on the share price change, the capital gain on the Vaniteux shares alone, 67,69%. C. There is no currency risk, therefore Laurent earns the rate of return on the share price change and the percentage change in the value of the euro versus the dollar over this same period, 67.69%. D. There is no currency risk, therefore Laurent earns the rate of retum on the share price change, the capital gain on the Vaniteux shares alone, 72.72%