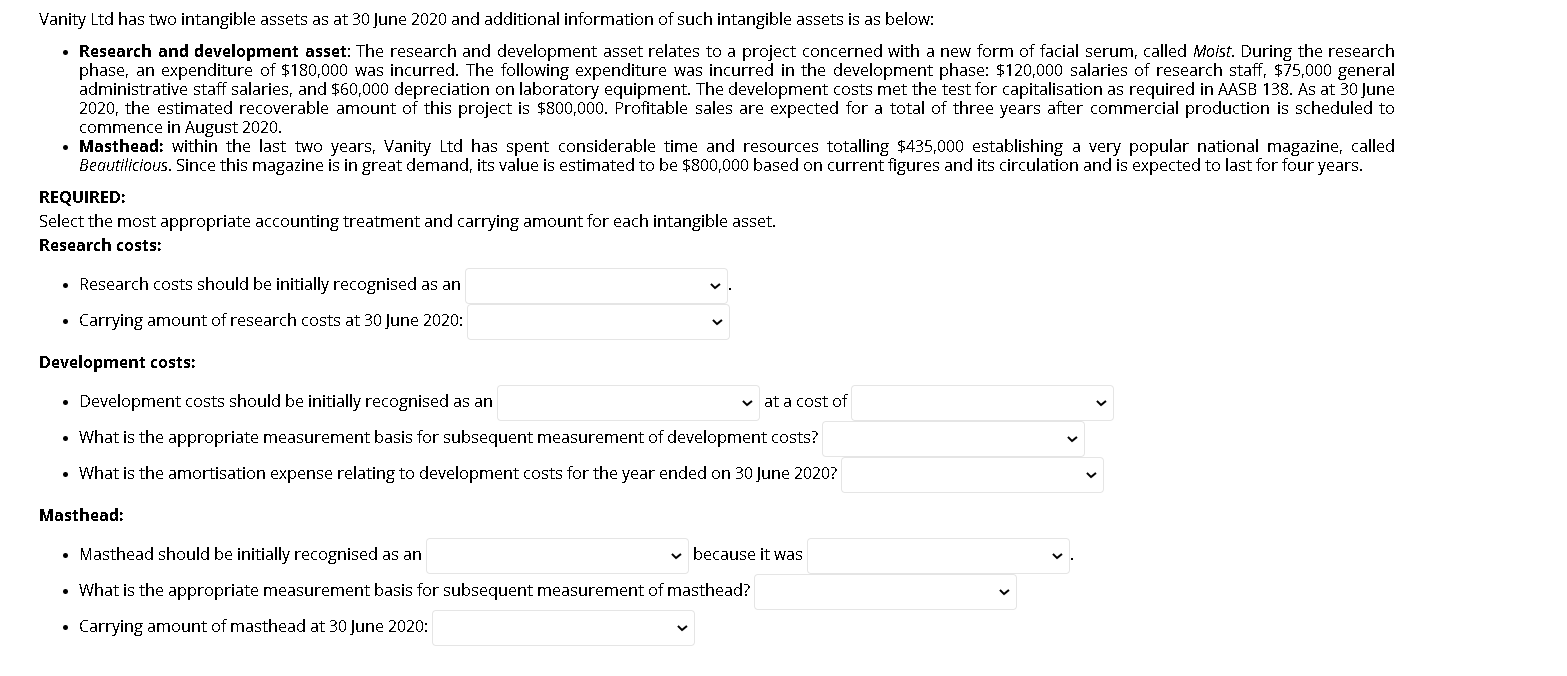

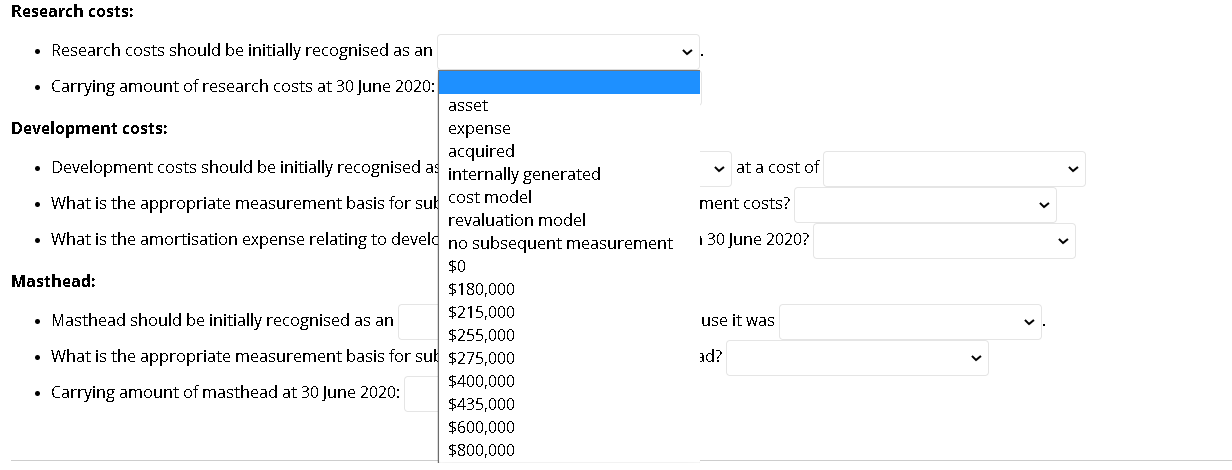

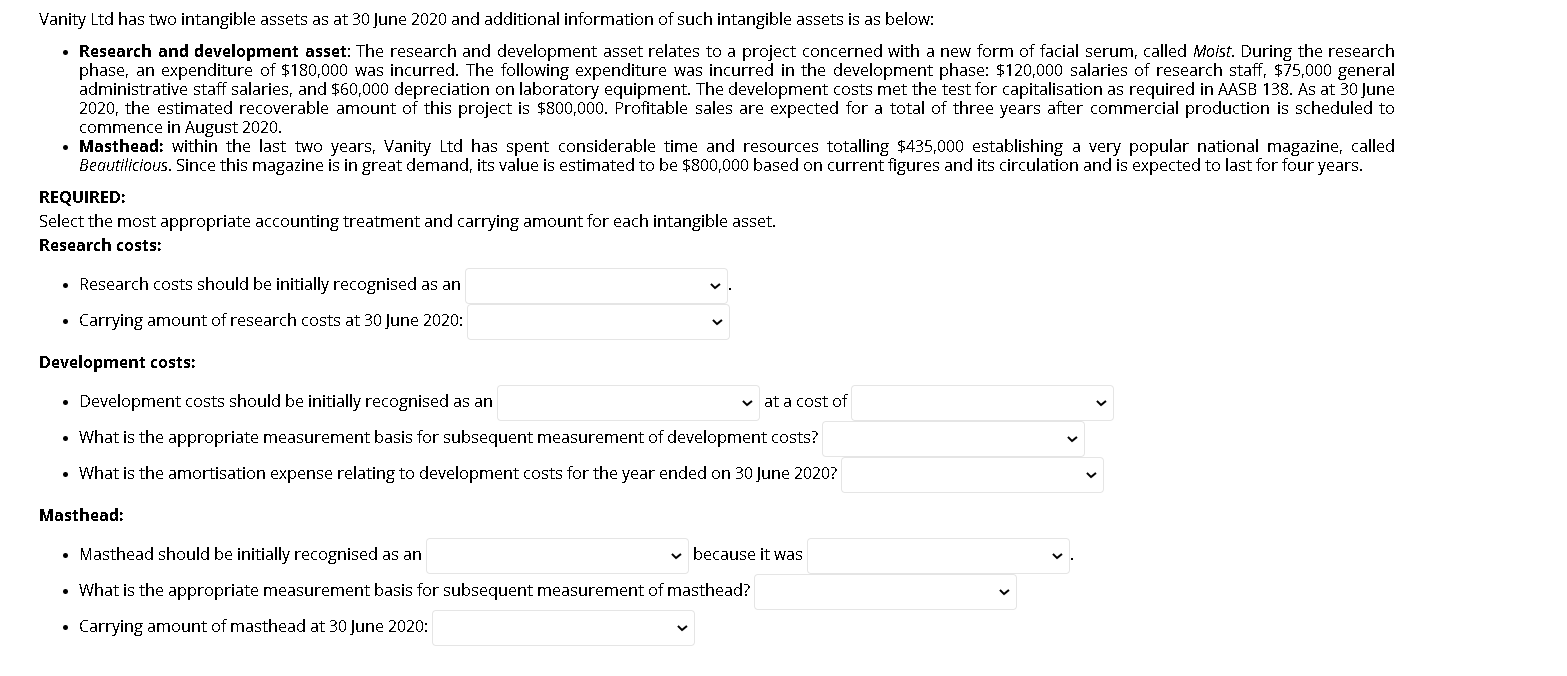

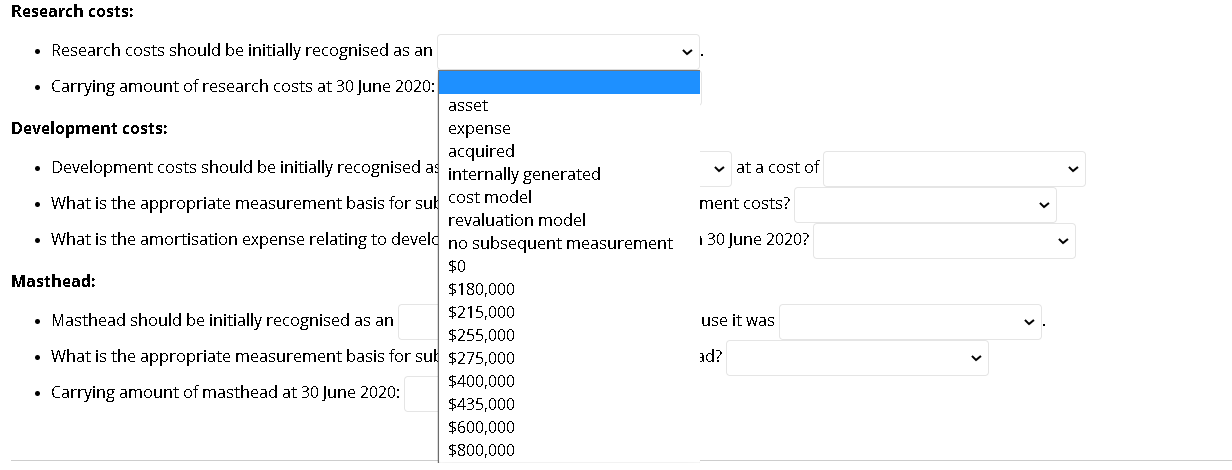

Vanity Ltd has two intangible assets as at 30 June 2020 and additional information of such intangible assets is as below: Research and development asset: The research and development asset relates to a project concerned with a new form of facial serum, called Moist. During the research phase, an expenditure of $180,000 was incurred. The following expenditure was incurred in the development phase: $120,000 salaries of research staff, $75,000 general administrative staff salaries, and $60,000 depreciation on laboratory equipment. The development costs met the test for capitalisation as required in AASB 138. As at 30 June 2020, the estimated recoverable amount of this project is $800,000. Profitable sales are expected for a total of three years after commercial production is scheduled to commence in August 2020. Masthead: within the last two years, Vanity Ltd has spent considerable time and resources totalling $435,000 establishing a very popular national magazine, called Beautilicious. Since this magazine is in great demand, its value is estimated to be $800,000 based on current figures and its circulation and is expected to last for four years. REQUIRED: Select the most appropriate accounting treatment and carrying amount for each intangible asset. Research costs: Research costs should be initially recognised as an Carrying amount of research costs at 30 June 2020: Development costs: Development costs should be initially recognised as an at a cost of What is the appropriate measurement basis for subsequent measurement of development costs? What is the amortisation expense relating to development costs for the year ended on 30 June 2020? Masthead: Masthead should be initially recognised as an because it was What is the appropriate measurement basis for subsequent measurement of masthead? Carrying amount of masthead at 30 June 2020: Research costs: at a cost of ment costs? Research costs should be initially recognised as an Carrying amount of research costs at 30 June 2020: asset Development costs: expense acquired Development costs should be initially recognised as internally generated What is the appropriate measurement basis for sul cost model revaluation model What is the amortisation expense relating to develd no subsequent measurement $0 Masthead: $180,000 Masthead should be initially recognised as an $215,000 $255,000 What is the appropriate measurement basis for sub $275,000 $400,000 Carrying amount of masthead at 30 June 2020: $435,000 $600,000 $800,000 130 June 2020? use it was ad? Vanity Ltd has two intangible assets as at 30 June 2020 and additional information of such intangible assets is as below: Research and development asset: The research and development asset relates to a project concerned with a new form of facial serum, called Moist. During the research phase, an expenditure of $180,000 was incurred. The following expenditure was incurred in the development phase: $120,000 salaries of research staff, $75,000 general administrative staff salaries, and $60,000 depreciation on laboratory equipment. The development costs met the test for capitalisation as required in AASB 138. As at 30 June 2020, the estimated recoverable amount of this project is $800,000. Profitable sales are expected for a total of three years after commercial production is scheduled to commence in August 2020. Masthead: within the last two years, Vanity Ltd has spent considerable time and resources totalling $435,000 establishing a very popular national magazine, called Beautilicious. Since this magazine is in great demand, its value is estimated to be $800,000 based on current figures and its circulation and is expected to last for four years. REQUIRED: Select the most appropriate accounting treatment and carrying amount for each intangible asset. Research costs: Research costs should be initially recognised as an Carrying amount of research costs at 30 June 2020: Development costs: Development costs should be initially recognised as an at a cost of What is the appropriate measurement basis for subsequent measurement of development costs? What is the amortisation expense relating to development costs for the year ended on 30 June 2020? Masthead: Masthead should be initially recognised as an because it was What is the appropriate measurement basis for subsequent measurement of masthead? Carrying amount of masthead at 30 June 2020: Research costs: at a cost of ment costs? Research costs should be initially recognised as an Carrying amount of research costs at 30 June 2020: asset Development costs: expense acquired Development costs should be initially recognised as internally generated What is the appropriate measurement basis for sul cost model revaluation model What is the amortisation expense relating to develd no subsequent measurement $0 Masthead: $180,000 Masthead should be initially recognised as an $215,000 $255,000 What is the appropriate measurement basis for sub $275,000 $400,000 Carrying amount of masthead at 30 June 2020: $435,000 $600,000 $800,000 130 June 2020? use it was ad