Question

Variable and Absorption Costing Summarized data for 2019 (the first year of operations) for Gorman Products, Inc., are as follows Sales (70,000 units) ....................................... $2,800,000

Variable and Absorption Costing Summarized data for 2019 (the first year of operations) for Gorman Products, Inc., are as follows

Sales (70,000 units) ....................................... $2,800,000

Production costs (80,000 units):

Direct materials......................................... 880,000

Direct labor ............................................ 720,000

Manufacturing overhead:

Variable ............................................... 544,000

Fixed ................................................. 320,000

Operating expenses:

Variable ............................................... 175,000

Fixed ................................................. 240,000

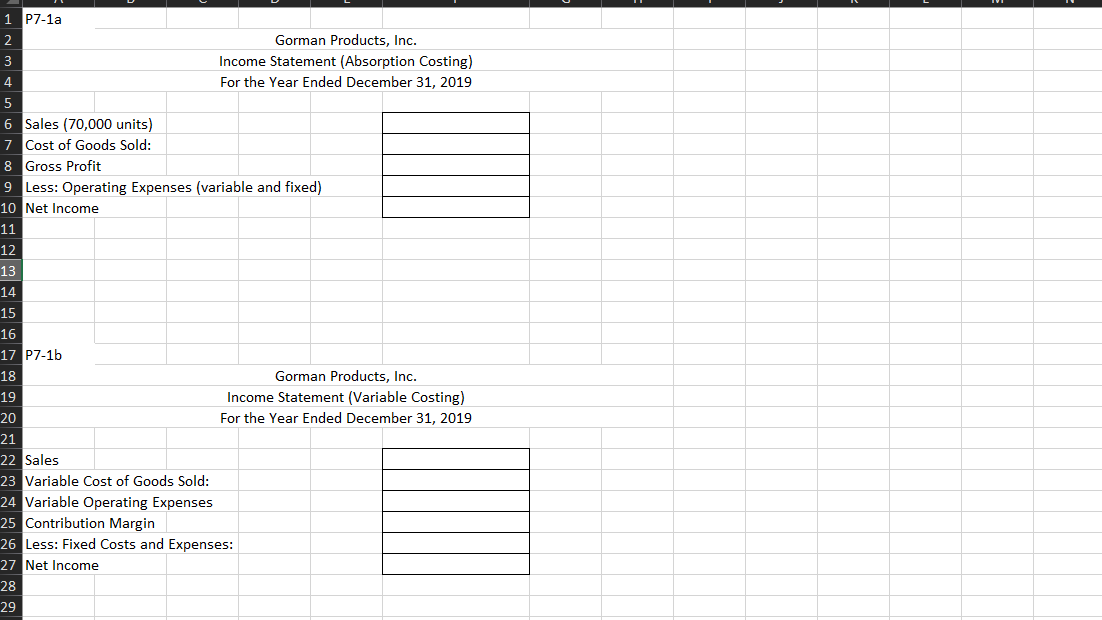

a. Prepare an income statement based on full absorption costing.

b. Prepare an income statement based on variable costing.

1 P7-1a 2 Gorman Products, Inc. 3 Income Statement (Absorption Costing) 4 For the Year Ended December 31, 2019 5 6 Sales (70,000 units) 7 Cost of Goods Sold: 8 Gross Profit 9 Less: Operating Expenses (variable and fixed) 10 Net Income 11 12 13 14 15 16 17 P7-1b 18 Gorman Products, Inc. 19 Income Statement (Variable Costing) 20 For the Year Ended December 31, 2019 21 22 Sales 23 Variable Cost of Goods Sold: 24 Variable Operating Expenses 25 Contribution Margin 26 Less: Fixed Costs and Expenses: 27 Net Income 28 29

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started