Answered step by step

Verified Expert Solution

Question

1 Approved Answer

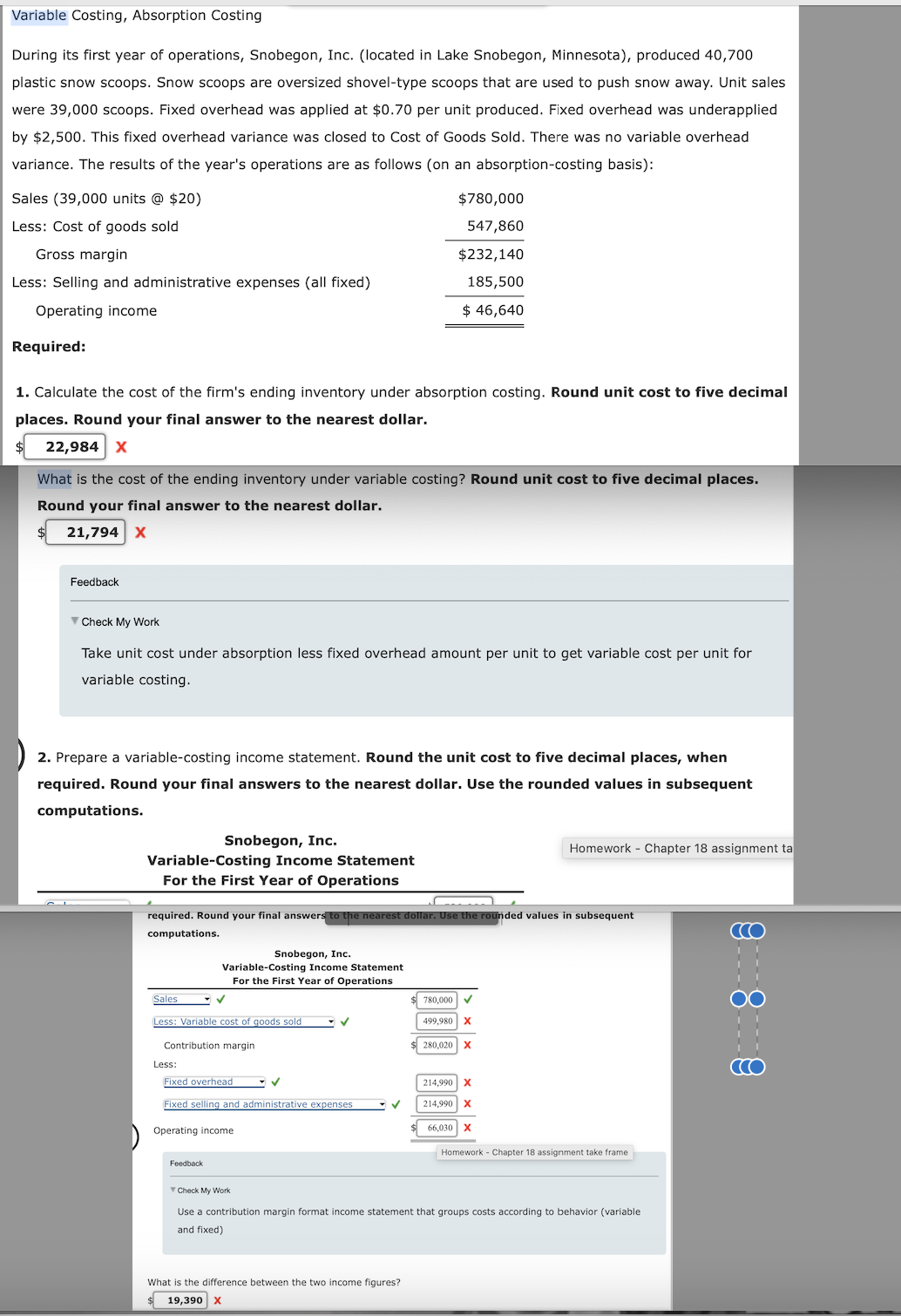

Variable Costing, Absorption Costing During its first year of operations, Snobegon, Inc. ( located in Lake Snobegon, Minnesota ) , produced 4 0 , 7

Variable Costing, Absorption Costing

During its first year of operations, Snobegon, Inc. located in Lake Snobegon, Minnesota produced

plastic snow scoops. Snow scoops are oversized shoveltype scoops that are used to push snow away. Unit sales

were scoops. Fixed overhead was applied at $ per unit produced. Fixed overhead was underapplied

by $ This fixed overhead variance was closed to Cost of Goods Sold. There was no variable overhead

variance. The results of the year's operations are as follows on an absorptioncosting basis:

Required:

Calculate the cost of the firm's ending inventory under absorption costing. Round unit cost to five decimal

places. Round your final answer to the nearest dollar.

$What is the cost of the ending inventory under variable costing? Round unit cost to five decimal places.

Round your final answer to the nearest dollar.

$

Check My Work

Take unit cost under absorption less fixed overhead amount per unit to get variable cost per unit for

variable costing.

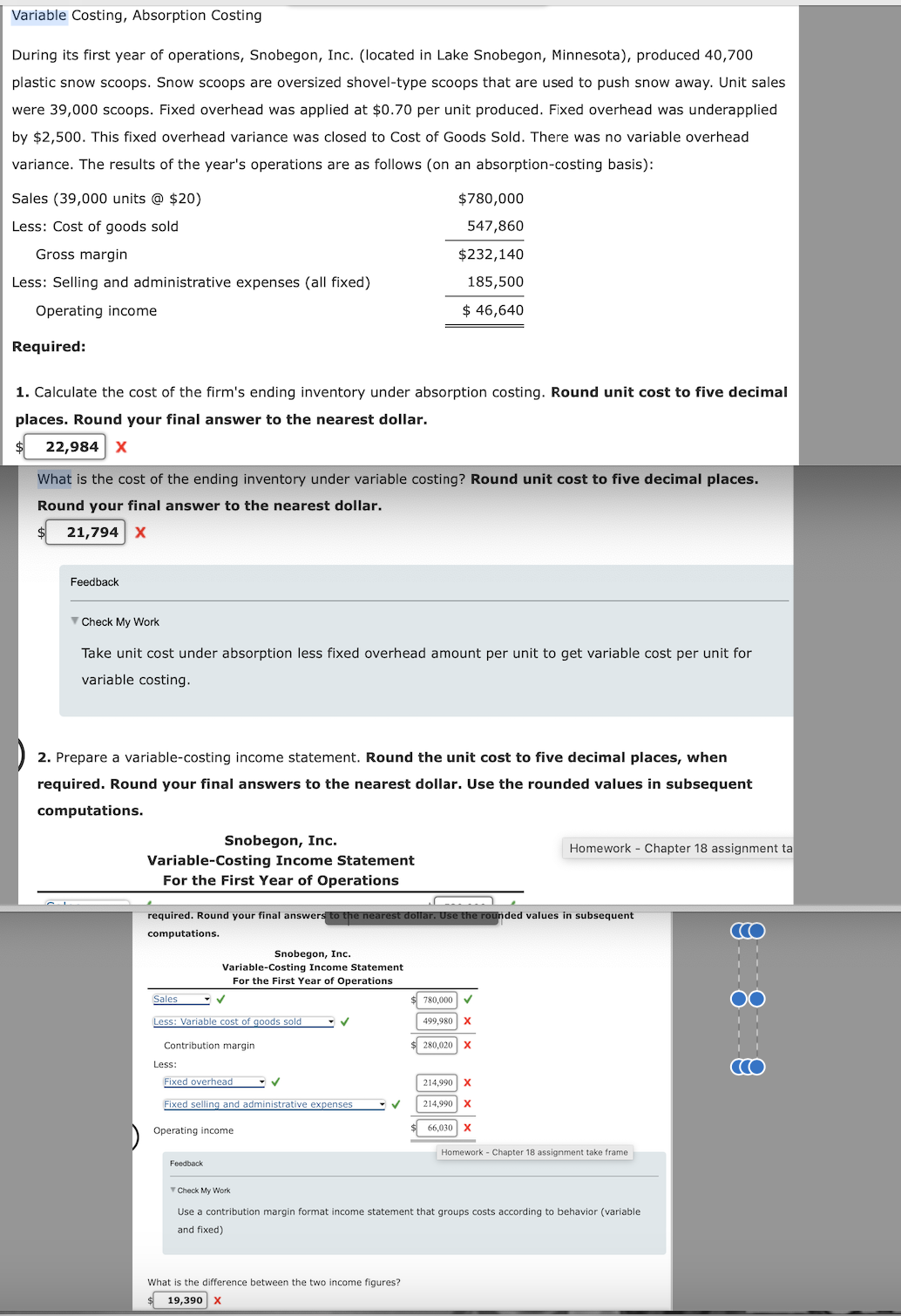

Prepare a variablecosting income statement. Round the unit cost to five decimal places, when

required. Round your final answers to the nearest dollar. Use the rounded values in subsequent

computations.

Snobegon, Inc.

VariableCosting Income Statement

For the First Year of Operations

required. Round your final answers to the nearest dollar. Use the rounded values in subsequent

computations.

Snobegon, Inc.

VariableCosting Income Statement

For the First Year of Operations

Operating income

Use a contribution margin format income statement that groups costs according to behavior variable

and fixed

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started